Long Trade Idea

Enter your long position between $881.31 (an intermediate horizontal support level) and $903.29 (an intermediate horizontal resistance level).

Market Index Analysis

- Costco Wholesale Corporation (COST) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices.

- The NASDAQ 100 Index pushed cautiously higher to start 2026 with strong breadth in traditional consumer staples and dividend-paying names, as investors rotate out of overbought tech mega-caps into more reasonably valued, cash-generative names like Costco, even as bearish trading volumes remain elevated and suggest conviction is selective.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish but structurally below its descending trendline, yet Costco's relative strength versus the index suggests that quality, high-margin businesses are being rewarded by institutional flows despite broader market caution.

Market Sentiment Analysis

Costco has emerged as a defensive market leader in a consumer-spending slowdown scenario, with Moody's forecasting that real consumer spending growth will decelerate to just 1.5% in 2026 as higher childcare costs, property taxes, and inflation pressures weigh on household budgets. However, discount and value-focused retailers—the category where Costco's membership model naturally fits—are expected to gain market share as higher-income households trade down and seek value, positioning Costco as a prime beneficiary of this rotation.

Sentiment surrounding Costco's membership economics has turned decidedly bullish following Q4 2025 results that showed membership fee revenue growing 14% year-over-year to $1.72 billion and global renewal rates hovering around 92% in the U.S. and 90% globally, despite price increases to $65 standard and $130 executive memberships effective September 2024. New Executive membership perks like exclusive early shopping hours have reportedly lifted weekly U.S. sales by approximately 1% and encouraged upgrades into higher-margin tiers, evidence that Costco's treasure chest strategy is working to extract maximum value from its 128+ million-member base.

Costco Wholesale Corporation Fundamental Analysis

Costco Wholesale Corporation is one of the world's largest retailers and the largest retailer of beef, poultry, organic produce, and wine. Over 30% of Americans regularly shop at Costco Wholesale Corporation, which drives value through its in-house Kirkland Signature brand. It currently has 908 warehouses serving more than 130 million members globally.

So, why am I bullish on COST following its breakout?

Costco's fundamental strength rests on rising profit margins despite persistent inflationary cost pressures, with gross margin expanding 13 basis points to 11.13% in Q4 FY2025 driven by higher fresh food efficiency, expanded Kirkland Signature penetration, and supply chain optimization—demonstrating that the company can pass through tariffs and input costs while maintaining pricing power. The company's five-decade track record of uninterrupted dividend increases, with annual dividend growth averaging 12-13% over multiple time horizons, signals management's confidence in sustainable cash generation and shareholder commitment.

Health membership renewal rates near 92% in the U.S. and 90% globally remain exceptional in retail, indicating that despite price increases and a shift toward greater selectivity among consumers, Costco members continue to perceive exceptional value in their memberships, with renewal strength providing a recurring, high-margin foundation upon which merchandise sales are built. Revenue-positive shopping perks for executive members—including exclusive early shopping hours and enhanced treasure hunt offerings—drive disproportionate sales and margin contributions from the 20%+ of members who upgrade, creating an underappreciated source of incremental margin expansion.

The upbeat outlook for the current quarter, supported by 8% net sales growth in Q4 FY2025, 10% full-year net income growth, and planned expansion to 35 new warehouses in fiscal 2026, suggests that Costco's scaling advantages and international expansion will continue to drive earnings growth even as comparable-store sales moderate in response to consumer spending slowdown concerns.

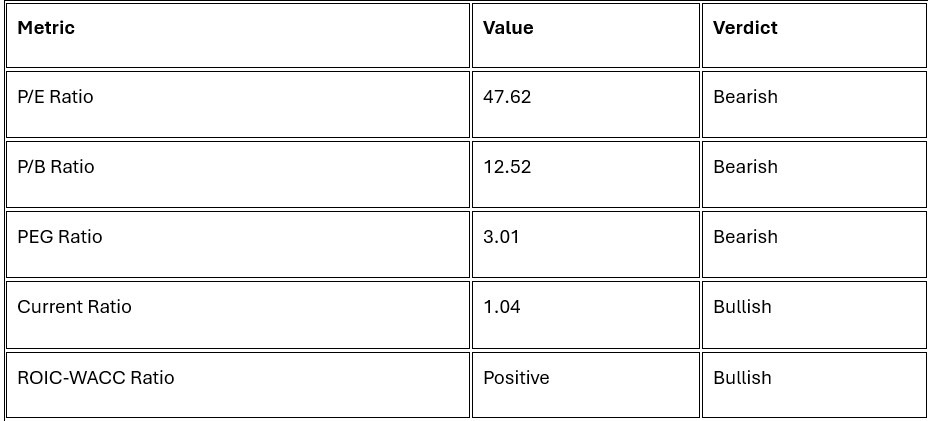

Costco Wholesale Corporation Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 47.62 makes COST an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.32.

The average analyst price target for COST is $1,033.06. It suggests good upside potential with acceptable downside risks, implying 16.2% appreciation over current levels with a reasonable margin of safety given Costco's defensive positioning.

Costco Wholesale Corporation Technical Analysis

Today's COST Signal:

- The COST D1 price chart below shows price action consolidating near $889.10 with buyers defending the $881.31 intermediate support level while resistance clusters near $903.29, indicating that the stock is entering a controlled accumulation phase where institutional investors are selectively building positions before the next leg higher.

- COST trades above its 20-day and 50-day moving averages with gradual slope higher, signalling that the stock's uptrend remains intact despite recent consolidation and that price action continues to attract steady, dip-buying demand consistent with core institutional portfolio positioning.

- The Bull Bear Power Indicator on the COST daily chart has rolled into positive territory with a rising trendline, indicating strengthening buyer dominance and suggesting that the stock's consolidation near $889 is attracting institutional accumulation rather than distribution or capitulation selling.

- Average trading volumes on the consolidation pattern near $889.00–$903.29 resistance are in line with 20-day averages, indicating that while the stock is not surging on euphoria, the steady accumulation patterns are consistent with large portfolio positions being built methodically into strength.

- COST has begun to materially outperform the broader NASDAQ 100 and S&P 500 indices on a relative strength basis, with the stock leading defensive and consumer staples sub-sectors, a constructive signal that underpins renewed investor interest in quality, dividend-paying companies as the market starts 2026 by rotating away from stretched AI valuations.

My COST Long Stock Levels and R/R

- COST Entry Level: Between $881.31 and $903.29

- COST Take Profit: Between $999.30 and $1,033.06

- COST Stop Loss: Between $844.06 and $852.50

- Risk/Reward Ratio: 3.17

Ready to trade our analysis of Costco? Here is our list of the best stock brokers worth checking out.