Short Trade Idea

Enter your short position between 70.04 (Friday’s intra-day low) and 70.74 (Friday’s intra-day high).

Market Index Analysis

- The Coca-Cola Company (KO) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500

- All three indices are currently trading near all-time highs with rising bearish trading volumes

- The Bull Bear Power Indicator of the S&P 500 is bullish with a descending trendline, approaching a bearish crossover

Market Sentiment Analysis

Equity futures are lower this morning after US President Trump imposed additional tariffs on eight NATO allies amid his push to gain control of Greenland. This move indicates the US-EU trade war is resuming, following a similar action last week that reignited tensions with China after the announcement of a 25% tariff on all countries doing business with Iran. Gold and silver jumped, and oil prices steadied. Earnings reports from Netflix and Intel could also impact price action, along with updates on President Trump’s candidate for the next Fed Chair.

Coca-Cola Company Fundamental Analysis

The Coca-Cola Company is one of the world’s largest beverage companies, with a recent push into healthy alternatives and bottled water. It began paying dividends in 1920 and, as of 2019, has increased its dividends for 57 consecutive years. It also has high brand loyalty.

So, why am I bearish on KO following its recent advance?

I remain bearish as competition increases across the beverage sector, with Pepsi and Keurig Dr Pepper in the driver’s seat of innovation and market share expansion. I am also monitoring the quiet leadership change at Coca-Cola and how it will impact its operations. The halted sale of its Costa Coffee unit after KO failed to attract the price it sought adds a layer of concern to its overall high valuations. I am also concerned about elevated marketing expenses to defend its market position and rising input costs.

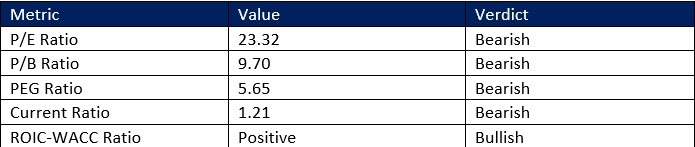

Coca-Cola Company Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 23.32 indicates KO is an expensive stock in its industry. By comparison, the P/E ratio for the S&P 500 is 31.34.

The average analyst price target for KO is 79.59, suggesting moderate upside potential with elevated downside risks.

Coca-Cola Company Technical Analysis

Today’s KO Signal

- The KO D1 chart shows price action breaking down below a horizontal resistance zone

- It also shows price action breaking down below its ascending Fibonacci Retracement Fan

- The Bull Bear Power Indicator is bullish with a descending trendline

- The average bearish trading volumes are higher than the average bullish trading volumes

- KO moved in lockstep with the S&P 500, but bearish signals are accumulating

My KO Short Stock Trading Recommendation

- KO Entry Level: Between 70.04 and 70.74

- KO Take Profit: Between 63.18 and 64.65

- KO Stop Loss: Between 73.23 and 74.38

- Risk/Reward Ratio: 2.15

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.