Since hitting a low near $80,400 on November 21, Bitcoin (BTC) has been consolidating, largely trading between $83,630 and $94,900. On January 1, King Crypto hit a low of $87,284 before rallying to $94,750 on Monday, a 9% surge to start the year.

BTC/USD 1-day chart. Source: TradingView

BTC has since pulled back to support at $90,000, with bears looking to stamp out any growing momentum while bulls regroup before attempting to push higher.

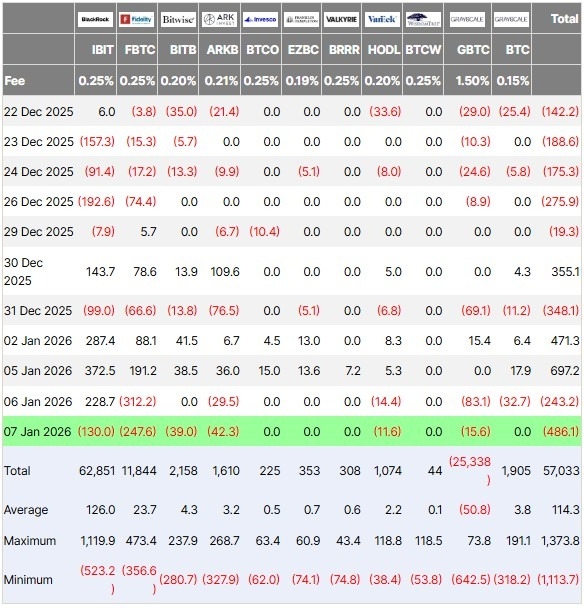

The start-of-the-year rally was fueled by a combination of institutional inflows, options positioning, and geopolitical factors that have historically driven BTC's price action. Data provided by Farside Investors shows that nearly $1.17 billion flowed into US-based spot BTC ETFs on the second and fifth of the month, coinciding with Bitcoin’s rally above $94,000.

Bitcoin ETF Flow (US$m). Source: Farside

January 5 recorded the largest single-day inflow in three months, prompting many to FOMO into the token with the hopes of an extended rally. But the inflows reversed on January 6, with nearly $730 million exiting spot BTC ETFs on Tuesday and Wednesday, coinciding with the pullback below $90,600.

Overall, the weekly flow is positive at $385.9 million over four trading days, indicating sustained institutional demand despite short-term fluctuations. Morgan Stanley's recent filing for a Bitcoin ETF further bolsters this narrative, potentially opening doors for more traditional investors. These inflows not only provide liquidity but also signal growing mainstream adoption, potentially stabilizing Bitcoin's path toward $100,000 if demand persists.

Split Outlook on Bitcoin

The current state of Bitcoin has analysts divided, with some seeing this as the start of a rally to a new record high, while others are warning of a bull trap before prices plunge back into crypto winter territory.

Fundstrat's Tom Lee predicts Bitcoin could hit a new all-time high by the end of January, potentially reversing the late-2025 slump. This optimism stems from reduced volatility compared to tech stocks like Nvidia and a shift toward an "institutional era" in crypto, as highlighted in Grayscale's 2026 crypto outlook.

Those with side bets on Bitcoin have benefited from the bullish start to the year, with U.S. crypto stocks tied to Bitcoin soaring by double digits in early January, signaling broader market confidence.

Taking the bearish position is market analyst Chiefy, who highlighted the bull trap and predicts that BTC could sink as low as $40,000.

This chart perfectly called the 2026 Bull Trap.

— Chiefy (@0xChiefy) January 6, 2026

If the 4-year cycle is still in play, $BTC will dump to $40K next month.

Are you prepared for that scenario? pic.twitter.com/7Jm0grk8d0

Traders are now looking for a breakout above $95,000, backed by consistent ETF flows, to confirm a sustainable uptrend. At the time of writing, BTC trades at $90,917, an increase of 3.92% on the 7-day chart.

XRP Surges on Institutional Interest

Another token that has gotten 2026 off to a hot start, largely thanks to ETF inflows, is XRP.

The so-called “banker’s coin” has thus far outpaced majors like Bitcoin and Ethereum with a remarkable 30% year-to-date surge to around $2.42.

XRP/USD 1-day chart. Source: TradingView

Starting from a low of $1.82 on January 1, XRP blasted higher, topping out at $2.421 on January 6, an increase of nearly 33% over five days. This rally follows a six-month downtrend, with XRP breaking key resistance at $2.15 on elevated volume, signaling a potential long-awaited breakout.

Several developments have propelled this upward trajectory. Foremost is the explosive growth in XRP ETFs, which launched in mid-November 2025 and have amassed over $1.3 billion in cumulative inflows by early January, including $483 million in December alone. These funds have locked up roughly 746 million tokens, creating a supply shock as institutional buying intensifies.

Additionally, the amount of XRP held on exchanges has plummeted to multi-year lows of about 1.6 billion tokens, down 57% since October, as whales accumulate amid retail capitulation. This tightening supply, coupled with no outflows over 54 consecutive days, has amplified price pressure.

With the capabilities of blockchain technology finally starting to get recognition from the banking world, XRP's utility in cross-border payments and upgrades like DeFi on the XRPL further enhance its appeal, drawing comparisons to gold's pre-rally patterns for potential 180% gains. Mainstream media has taken notice, with CNBC dubbing XRP the "hottest crypto trade" of 2026, highlighting its mainstream push despite mixed trader sentiment on volatility.

After dipping to October 2025 lows near $1.85, the token has rebounded strongly, holding above long-term trend support and eyeing targets from $2.50 to $5–$10 by year-end.

While short-term pullbacks are possible due to various factors, the XRP chart’s structural setup, ETF momentum, supply dynamics, and macro tailwinds support further upside. Analysts predict XRP could trade in the $2.00–$2.50 range through January, with bullish scenarios eyeing $8 by year-end if momentum sustains.

At the time of writing, XRP trades at $2.15, representing an increase of 16.65% on the 7-day chart.