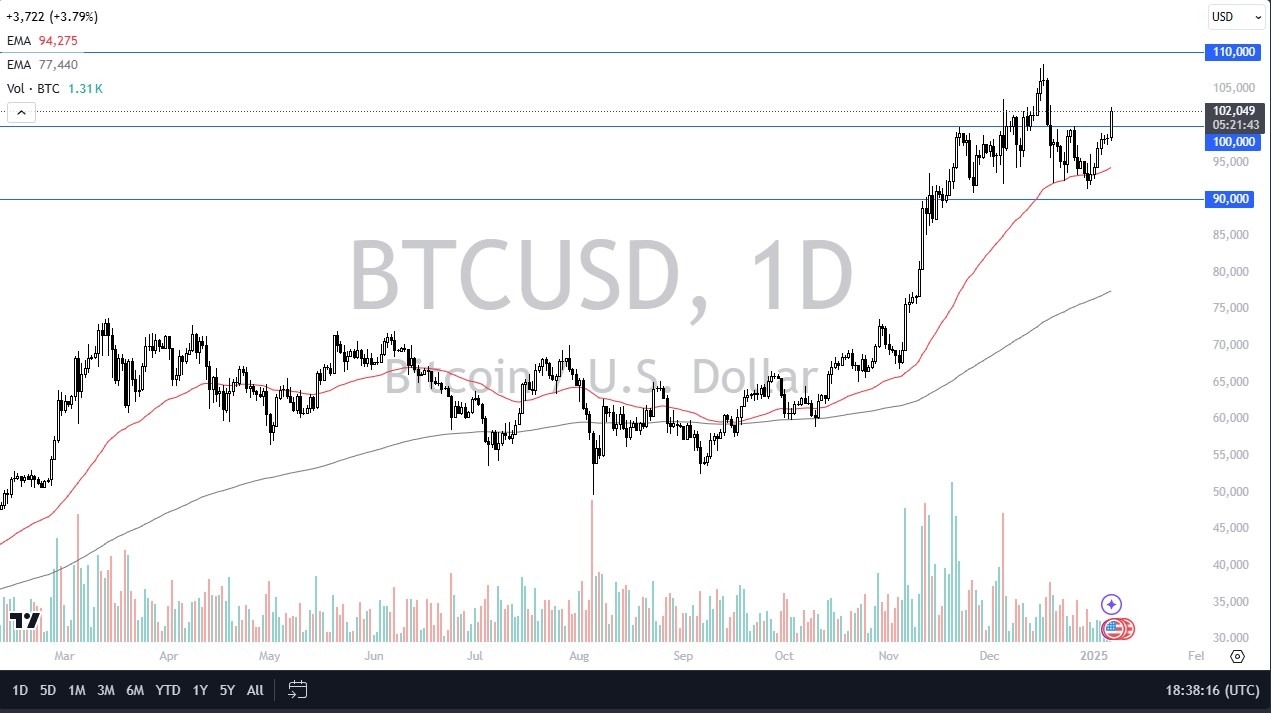

- The 95,000 level has been resistant multiple times in the recent past, and as a result, I am watching this level very closely, as many others are certainly doing as well.

- The Bitcoin market looks somewhat quiet during the trading session on Tuesday, as the 95,000 level is an area that is going to continue to be important, and I think, given enough time, may make a bigger difference than any other level that we are looking at right now.

- This is a market that will continue to try to build up a case for higher prices, and I think that a lot of longer-term traders are possibly looking for “value.”

The short-term pullbacks that have occurred in this market probably continue, but we will just have to wait and see how that plays out. Ultimately, this is a market that I think is in the midst of bottoming, and a little bit of quiet sideways action during the trading session on Tuesday probably isn't the worst thing, considering just 4 days ago we were about 6,000 lower than we are now.

Risk Sentiment and Institutional Action

We do have the jobs report coming out on Friday, and while that doesn't necessarily directly influence this market, what it does influence is risk sentiment, and that will have a lot to do with what institutions do with this market.

Top Regulated Brokers

I do think we are in the midst of a bottoming pattern, and a daily close above 95,000, maybe 96,000, I think, brings in more buyers. At that juncture, you might be looking at a move to 107,000. In the short term, if we pull back, I think it's just more of this base-building effort that we've had in the recent past as we try to turn things around in this market.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.