The Australian dollar has been noisy in early Wednesday trading as the ADP employment figures were somewhat firm.

The Australian dollar has been very noisy during the early part of the Wednesday session as traders react to the ADP numbers coming out a little better than anticipated. That being said, there is a whole litany of reasons why this pair could continue to rise despite the fact that the US economy itself is somewhat sticky as far as inflation is concerned.

Top Regulated Brokers

The initial thing to think about is that Chinese manufacturing is recovering, and of course, the Australian markets are heavily dominated by exports to China and places like China for manufacturing, as it is a major exporter of raw materials such as iron and copper. Gold prices continue to firm up the Australian dollar, and of course, the Reserve Bank of Australia is in a situation where it needs to keep rates fairly tight as inflation is still an issue in Australia at the moment.

Technical Outlook and Key Support Levels

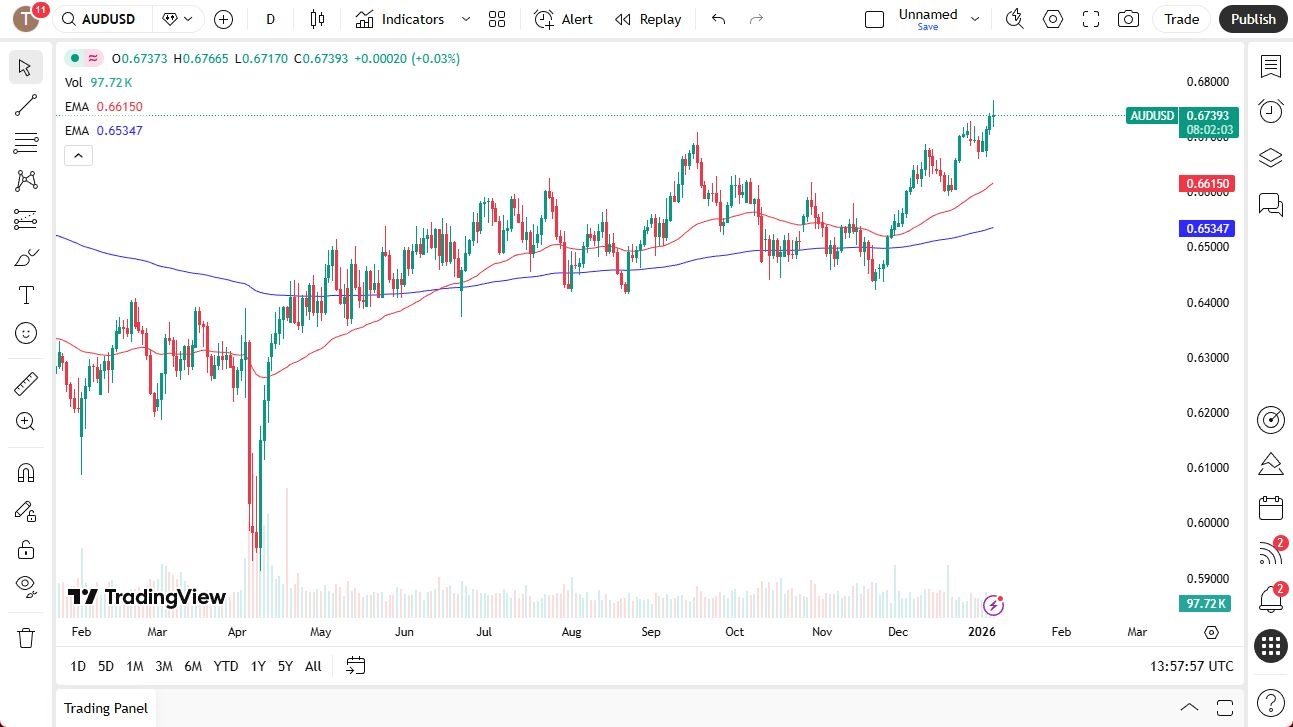

From a technical analysis perspective, we have made another swing high at the moment, and I think the next couple of days will probably feature a lot of bouncing around as we start to focus on the non-farm payroll announcement. A short-term pullback is possible, but I believe that the 0.6650 level is likely to be an area of support.

As far as targets are concerned, I suppose the short-term target is probably 0.68, but keep in mind, we could blow right through that if we get the right combination of strong Chinese manufacturing and the United States being in a situation where interest rate cuts have to be more of a cycle and less of a one-off event.

Ultimately, I do think that the market wants to go higher. We do look a little extended in the short term, but longer term I think we probably go look to the 0.68 level, followed by the 0.70 level eventually. If we were to break down below the 0.6550 level, then I think you have to consider this a false breakout. Until then, it looks bullish.

Ready to trade our AUD/USD Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.