The Australian dollar has rallied pretty significantly against the US dollar during trading on Tuesday as we are now breaking above a significant barrier that has been in place for a few years.

AUD/USD

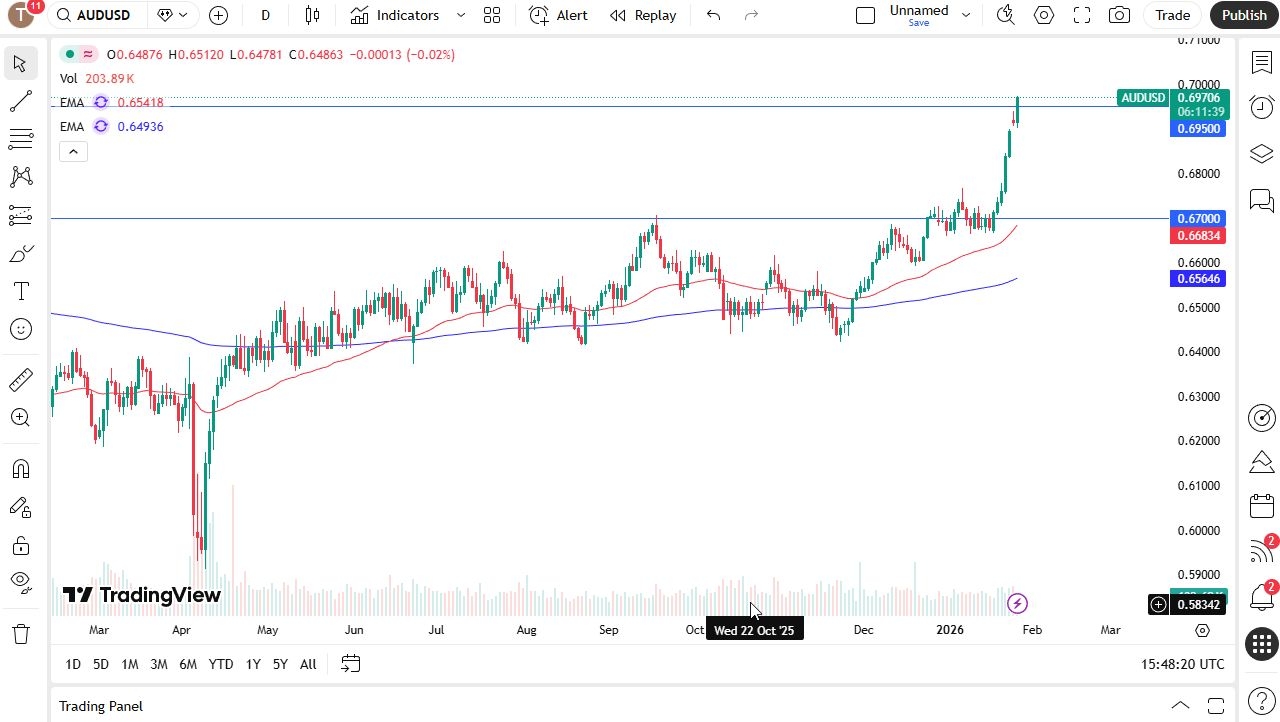

The Australian dollar has rallied pretty significantly against the US dollar during trading on Tuesday as we are now breaking above the crucial 0.6950 level. This is a momentous moment for the Australian dollar as it is an area that had previously been a brick wall.

I think at this point we are starting to see the idea of the Australian dollar rallying due to the Reserve Bank of Australia’s likelihood of having to raise rates sooner rather than later while the Federal Reserve is likely to continue to be on the dovish side.

A Technical Breakout

Furthermore, the Chinese manufacturing numbers have gotten a bit better and I think that is also being shown through the Australian dollar, so it all lines up quite nicely. We are on the precipice of reaching the 0.70 level, an area that obviously has a certain amount of psychology attached to it, but quite frankly the efficacy of this level over the last several years is one that gets violated from time to time.

If you go back 10 years you can see it has been important multiple times, but it has also been broken to both directions. A move above there opens up a move to the 0.72 level where you have your next swing high.

It is worth noting that this has been very difficult to break above since roughly February of 2023, so this is 2 years' worth of selling pressure that I think we are starting to see unwind. Whether or not that leads to something bigger remains to be seen, but it is worth noting that we are getting to levels in the US dollar over the last several years that have been somewhat supportive for the greenback when you look at the US dollar index. It does not mean that they cannot be violated; it just means that there could be a little bit of a pullback.