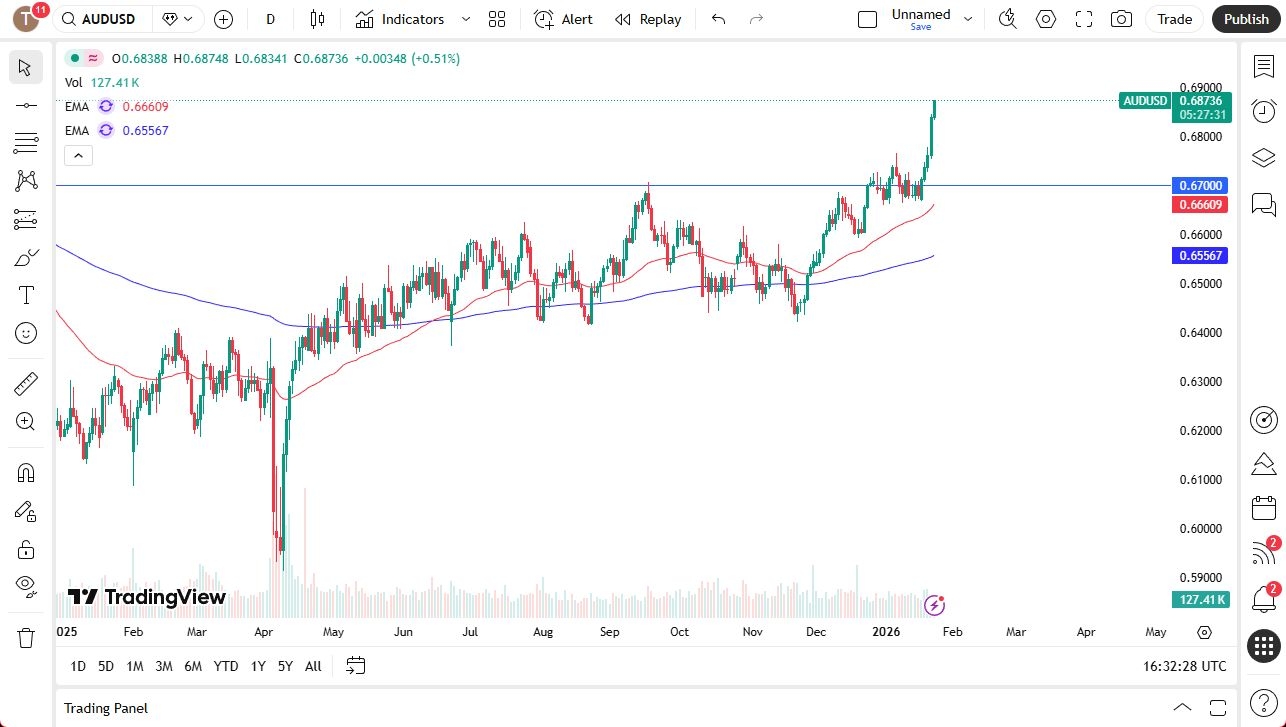

The Australian dollar continues to rocket to the upside as it looks like we are heading toward the 0.69 level, given enough time, as the Chinese economy and the RBA support it.

AUD/USD

The Australian dollar continues to rocket to the upside as it looks like we are heading toward the 0.69 level. That being said, it makes sense, but it also makes a certain amount of sense to exit this trade after this overbought condition and perhaps wait for a little bit of a pullback to offer value. After all, we are heading into the weekend, and there will be a lot of noise out there when it comes to trade; possibly, we just don't know.

Top Regulated Brokers

But the reality also is that the US dollar is a bit oversold. Not only here but in other places. So, I would anticipate a little bit of a pullback and then perhaps a continuation. The 0.67 level is an area that previously had been very difficult to break out of, and as the Reserve Bank of Australia is likely to have to raise rates, one of the few major banks in the world that does, it does make a certain amount of sense that the Australian dollar takes off, especially with Chinese manufacturing picking up.

So, it all comes together as a bullish trade, and while I don't necessarily think it's wrong to still be in the long side of this trade, I do recognize that we are getting into an area that historically has caused some problems.

Potential for a Pullback

If we were to turn around and break down below the 50-day EMA to the downside, which is currently at the 0.6661 level, then that would be a big slap across the face. I don't know that it changes the trend, but I certainly think it would give Australian dollar bulls something to think about. I don't see that happening, but a pullback? Sure, and I think it offers a nice opportunity.

Ready to trade our AUD/USD Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.