Monday has been very noisy for the Australian dollar with Asian and European traders running for safety, and Americans reversing the move.

AUD/USD

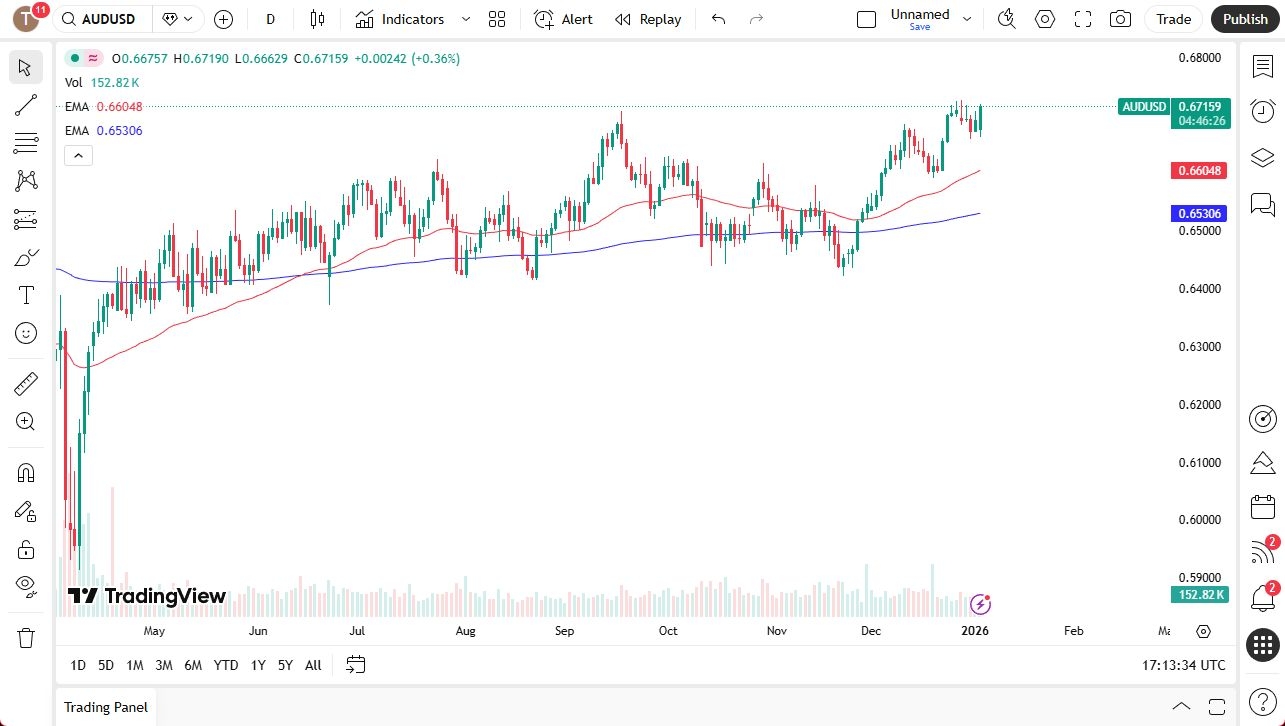

Monday has been very noisy for the Australian dollar as we initially fell after the open with traders reacting to the military action in Venezuela, going risk off. But since then, we have seen the market turn completely around. At this point, it looks like we are threatening a major breakout, and that has been somewhat of a theme here. The fundamental context for 2026 is that Australia is hawkish. The Reserve Bank of Australia is not cutting rates. In fact, some markets are starting to price in a potential rate hike in February as Aussie inflation remains sticky right around 3.8%.

RBA Policy Gap

The Fed, of course, is cutting rates, and the policy gap with US rates falling, Australian rates steady or possibly rising, is the primary reason this pair has been pushing higher. The one limiting factor in Australia is that iron ore prices are hovering near $95 a ton, which is soft by historical comparison. This presents a problem for the Australian dollar and is a little bit of a drag. Chinese demand, of course, remains a question mark for 2026, so that is also something to file in the “what if” category.

Top Regulated Brokers

All things being equal, though, if we can break cleanly above the 0.6750 level, it is likely that this pair goes much higher. Short-term pullbacks almost certainly will find support, and we have already seen that on Monday. I do not think that there is much out there to cause chaos, with maybe the exception of Friday's jobs report coming out of the United States.

The Reserve Bank of Australia is probably the biggest catalyst for this market in the short term, and that, of course, will be coming in February. But as things stand right now, I think that the market will tilt to the upside. There is an implied probability of a 36% chance of a rate hike, which could bring Australian rates to 3.85%. There is still a two-thirds roughly two-thirds chance of no change, but right now it looks like the market is starting to come around to the idea of a strengthening Australian dollar.

Ready to trade our AUD/USD Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.