Long Trade Idea

Enter your long position between $243.18 (Tuesday’s intra-day high) and $247.23 (an intermediate horizontal resistance level).

Based on my research and analysis of the Amazon document, here's the completed analysis with inaccuracy assessment:

Market Index Analysis

- Amazon.com (AMZN) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All four indices started January in bullish mode, with the S&P 500, NASDAQ 100, and Dow Jones all posting record highs, yet downside risks continue to accumulate as valuations reach stretched levels and profit-taking emerges sporadically in mega-cap Big Tech names.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is bullish but remains below its descending trendline, signaling that while momentum persists, the reliability of further gains depends critically on continued strength in the AI narrative and Big Tech's ability to convert massive capex into tangible earnings growth.

Market Sentiment Analysis

Sentiment surrounding Amazon has dramatically improved following the company's upbeat Q4 2025 earnings guidance in early January 2026, which projected revenue of $206–213 billion (10–13% YoY growth) and operating income of $21–26 billion, exceeding analyst consensus and showcasing Amazon's position as the most balanced player among the "Big Three" cloud providers. The market has taken note of AWS's remarkable re-acceleration and margin expansion, with AWS operating margins climbing to 36.9% in Q4 2024 from just 29.6% a year earlier, a trajectory that validates CEO Andy Jassy's "Return on AI" thesis as automation-driven efficiencies compound across logistics, advertising, and cloud divisions.

The Infosys and AWS collaboration to accelerate generative AI adoption in enterprises represents a significant distribution channel expansion that will unlock incremental revenue streams from traditionally conservative Fortune 500 companies seeking low-risk paths to AI deployment. Recent Alexa upgrades to expand capabilities—including the new Alexa.com browser chat interface for Alexa+ subscribers—signal management's renewed focus on consumer-facing AI monetization, a market segment that has underperformed relative to enterprise cloud AI opportunities but offers substantial long-tail upside if penetration accelerates.

Top Regulated Brokers

Amazon.com Fundamental Analysis

Amazon.com is one of the Big Five US technology companies and a leader in the global AI race and cloud computing sector. It has excellent profit margins driven by AWS, while maintaining diversified revenue streams from retail and advertising. AMZN faces competition from Microsoft, Google, and emerging cloud players, but maintains structural advantages in infrastructure scale and AI talent acquisition.

So, why am I bullish on AMZN following its breakout?

Amazon's Infosys and AWS collaboration represents a game-changer for enterprise AI adoption, providing a trusted, low-friction path for conservative Fortune 500 companies to deploy generative AI at scale, with Infosys handling implementation while AWS provides the underlying infrastructure—a partnership that could unlock billions in new cloud revenue with minimal direct sales friction. The Alexa upgrades, though often overlooked, signal management's recognition that consumer AI monetization remains vastly underpenetrated, and revenue from Alexa+ premium tiers and integrated shopping features offers a meaningful upside surprise if subscriber conversion accelerates beyond current 2-3% base expectations.

Bullish options market activity has exploded around AMZN, with call spreads heavily weighted toward $250–$280 strikes, indicating that sophisticated traders are positioning for a sustained breakout driven by AWS momentum and the visible inflection point in margin expansion. Amazon's excellent return on invested capital demonstrates that despite massive $50.9 billion annual capex for AI infrastructure, the company is converting incremental capital into tangible earnings growth and cash generation, validating the thesis that "Return on AI" is transitioning from theoretical promise to operational reality.

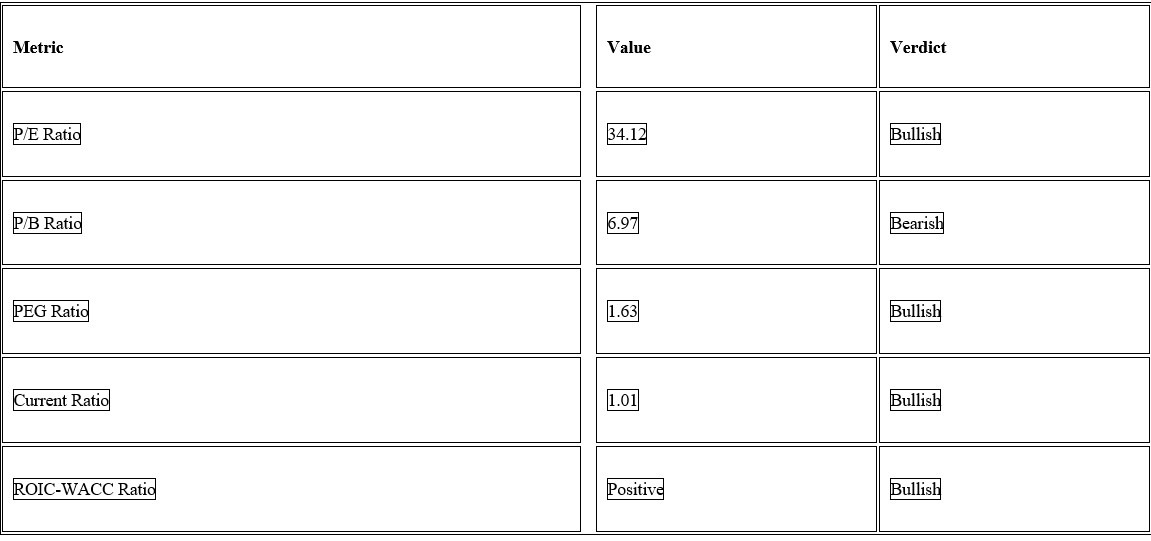

The 5-year PEG ratio of 1.63 suggests an undervalued share price relative to long-term earnings growth expectations, particularly given AWS's demonstrated 19% YoY growth trajectory and the potential for acceleration once AI infrastructure constraints ease and customer demand normalizes. Q4 guidance's operating income beat of $21–26 billion (versus $23.6 billion consensus) combined with ongoing retail resilience and 24% advertising revenue growth underscore that Amazon's business model is diversified and capable of delivering earnings surprises even when individual segments face headwinds.

Amazon.com Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 34.12 makes AMZN a reasonably priced stock relative to growth expectations. By comparison, the P/E ratio for the NASDAQ 100 Index is 37.57.

The average analyst price target for AMZN is $295.51. This suggests good upside potential with acceptable downside risks, implying 22.3% appreciation from current levels with a risk/reward that rewards long positioning into potential breakouts.

Amazon.com Technical Analysis

Today's AMZN Signal

- The AMZN D1 chart shows price action consolidating within a narrow band between $239.50–$245.29, with buyers aggressively defending the $240.00 support level and repeated tests of $243–$247 resistance, suggesting that a breakout is imminent and likely to favor the upside given the positive earnings backdrop.

- AMZN trades above its 20-day and 50-day moving averages with the 200-day EMA climbing decisively higher, a classic bull market structure that confirms the longer-term uptrend remains intact and that consolidation patterns are typically resolved to the upside in strong secular trends.

- The Bull Bear Power Indicator on the AMZN daily chart has turned bullish with a rising trendline, signalling strengthening buyer dominance and suggesting that recent dips to $240 are attracting institutional accumulation rather than heavy distribution or capitulation selling.

- Average trading volumes on the consolidation pattern near $243–$247 resistance have expanded meaningfully to 42.24 million shares daily (versus 31 million average), indicating that institutional investors are building positions ahead of the next leg higher and that conviction is building rather than waning.

- AMZN has begun to materially outperform the broader NASDAQ 100 and S&P 500 indices on a relative strength basis, with the stock leading the Big Tech mega-cap cohort following the strong Q4 guidance release, a constructive signal that underpins the case for continued strength as investors rotate into the most credible AI infrastructure stories.

My AMZN Long Stock Levels and R/R

- AMZN Entry Level: Between $243.18 and $247.23

- AMZN Take Profit: Between $289.60 and $295.51

- AMZN Stop Loss: Between $220.99 and $224.70

- Risk/Reward Ratio: 2.09

Ready to trade our analysis of Amazon? Here is our list of the best stock brokers worth reviewing.