Short Trade Idea

Enter your short position between $88.50 (the lower band of its horizontal resistance zone) and $91.11 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Wells Fargo (WFC) is a member of the S&P 100 and the S&P 500.

- Both indices formed a bearish chart pattern with rising downside catalysts.

- The Bull Bear Power Indicator of the S&P 500 is bullish, but shows a negative divergence, and does not support the recent uptrend.

Market Sentiment Analysis

While equity markets rallied yesterday after the Federal Reserve announced its widely expected 25-basis-point interest rate cut with a hawkish forward-looking statement, and only one expected reduction in 2026 for now, futures are plunging this morning. The central bank noted the inflationary effects of tariffs, raising the bar for future cuts. Adding to bearish sentiment is Oracle’s plunge after reporting disappointing earnings, fueling AI concerns. Earnings from Broadcom, Costco, and Lululemon are also due today.

Wells Fargo Fundamental Analysis

Wells Fargo is a banking conglomerate serving over 70 million customers in more than 35 countries. It is one of the Big Four Banks in the US and remains classified as a systemically important financial institution by the Financial Stability Board.

So, why am I bearish on WFC after hitting a 52-week high?

Announced job cuts and the rollout of AI should help Wells Fargo counter rising operational costs. Still, I remain bearish on its high debt-to-equity ratio. Its latest three-year revenue forecast of 4.9% annualized trails the 7.7% for the US banking industry. Declining dividend yields are another red flag, confirming management’s concerns about future revenues and earnings, which I share.

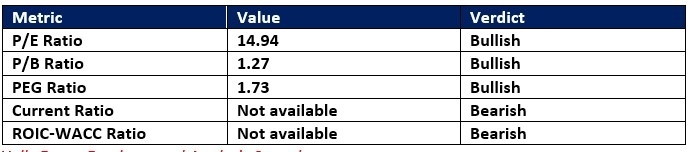

Wells Fargo Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 14.94 makes WFC an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.21.

The average analyst price target for WFC is $94.00. It suggests negligible upside potential with mounting downside risks.

Wells Fargo Technical Analysis

Today’s WFC Signal

Wells Fargo Price Chart

- The WFC D1 chart shows price action inside a horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- Bullish trading volumes have risen above their multi-month average, signaling excessive bullishness prone to sharp reversals.

- WFC advanced with the S&P 500, a bullish confirmation, but bearish catalysts have accumulated.

Top Regulated Brokers

My Call on Wells Fargo

I am taking a short position in WFC between $88.50 and $91.11. I am bearish on its operational metrics and doubt its AI implementation will solve its revenue woes, given its worrisome debt-to-equity ratio.

- WFC Entry Level: Between $88.50 and $91.11

- WFC Take Profit: Between $71.90 and $77.62

- WFC Stop Loss: Between $95.67 and $98.54

- Risk/Reward Ratio: 2.32

Ready to trade our analysis of Wells Fargo? Here is our list of the best stock brokers worth reviewing.