Fundamental Analysis & Market Sentiment

I wrote on the 21st December that the best trades for the week would be:

- Long of the USD/JPY currency pair. This gave a loss of 0.76%.

- Long of the S&P 500 Index following a daily close above 7,000. This did not set up.

- Long of Silver with half the normal position size. This gave a win of 8.84%.

- Long of Platinum with half the normal position size. This gave a win of 11.81%.

- Long of Gold with half the normal position size following a daily close above $4,355.80. This set up at Tuesday’s close and gave a win of 1.00%.

Overall, these trades gave an amazing gain of 22.41%, which comes to 4.48% per asset.

A summary of last week’s most important data:

- US Preliminary GDP – this came in much better than expected at 4.3% compared to the anticipated 3.2% and helped boost US stock markets.

- Canadian GDP – as expected, a monthly contraction by 0.3%.

- US Unemployment Claims – this was very slightly better than expected.

Last week’s data had little impact except the US GDP data. The market is still pricing in only two Fed rate cuts of 0.25% over the course of 2026.

Of course, last week saw part of the Christmas holiday and as such markets were partially closed or mostly quiet with thin liquidity.

Forex and commodities markets did little, except precious metals, which made spectacular, wild gains. Gold, Silver, and Platinum all gained strongly to make new all-time highs, while Palladium also made strong gains to reach a new 3-year high.

In the USA, the S&P 500 Index broke to a new record high for the first time in several weeks on Christmas Eve, but the gains were nothing spectacular.

Top Regulated Brokers

The Week Ahead: 29th December – 2nd January

The coming week includes the western New Year holiday, which includes public holidays in several major markets on Thursday and Wednesday or Friday in some cases. This will almost definitely mean a much less liquid and active market than usual.

We are likely to see low level of volatility this week, like last week, except perhaps in the precious metals market. There is almost no high-impact data due.

This week’s most important data points, in order of likely importance, are:

- US FOMC Meeting Minutes

- US Unemployment Claims

Monthly Forecast December 2025

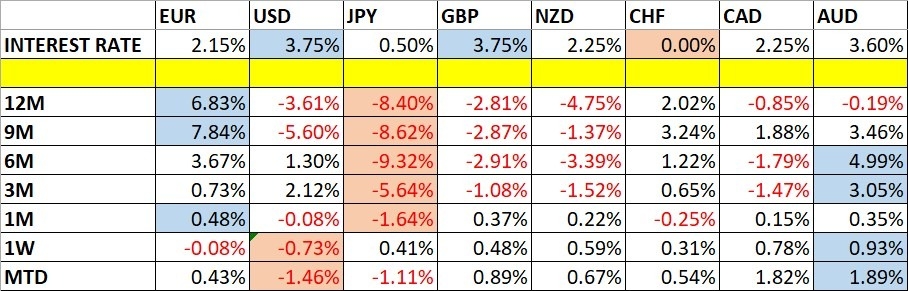

Currency Price Changes and Interest Rates

For the month of December 2025, I made no forecast.

Weekly Forecast 22nd December 2025

Last week, I made no forecast, as there were no recent excessive moves in currency crosses.

The Australian Dollar was the strongest major currency last week, while the US Dollar was the weakest. Directional volatility fell again last week, with only 7% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility will almost certainly be at a similarly low level.

You can trade these forecasts in a real or demo Forex brokerage account.

Technical Analysis

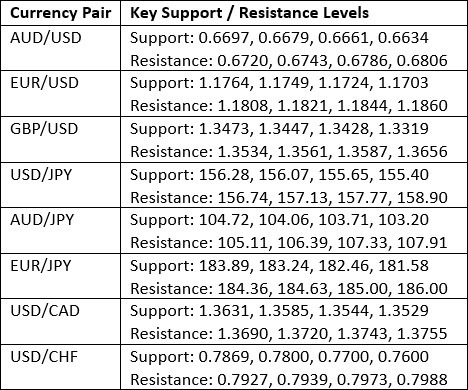

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed a bearish candlestick which engulfed the real body of the previous week’s candlestick and closed quite near the low of its range. The price action is showing no long-term trend but is showing a short-term bearish trend. Recently, the greenback has been consolidating.

The surprisingly strong US GDP data released last week might be seen to be a reason for the Fed to cut rates less in 2026, but expectations have not changed.

I take no bias on the US Dollar right now. Not much is going on here, so it will probably make sense to consider other assets on their own over the coming week.

US Dollar Index Weekly Price Chart

AUD/USD

The AUD/USD currency pair saw the largest move in the Forex market last week, although it was not very large, in relative terms. However, the Aussie is picking up some steam, although the daily price chart below shows that despite breaking a recent swing high, this bullish move may be running out of steam.

What impresses me the most about this currency pair is that its medium and long-term moving averages are starting to point up and gain on a daily chart, meaning this pair is probably a good candidate for a swing trade on the long side followed by a pullback and bounce at a medium moving average on a shorter-term price chart.

There isn’t a lot to say about the US or Australian Dollars in fundamental terms right now, except it is the most interesting thing in an otherwise dull Forex market.

AUD/USD Daily Price Chart

S&P 500 Index

The weekly price chart below shows that this major US stock index gained last week, breaking to a new all-time high, although the move and breakout were not large or strong.

However, the price closed quite near the high, and it makes sense to be long of this index when it is making new record highs and showing even moderately bullish price action. Historically, the odds are in your favour going long here, as new record highs tend to lead to rising prices.

Bears can argue that the market is heavily overvalued and rising due to an AI bubble which will soon burst. Both these arguments are plausible, which is why anyone going long should use a volatility-based trailing stop and proper risk management.

I see technical but not fundamental reasons to be long, along the high US GDP data released last week might be encouraging bullish sentiment.

S&P 500 Index Weekly Price Chart

XAG/USD

Silver’s wild, meteoric rise continues. It gained more than 10% just on Friday, more than 17% over the past week (the largest in over 5 years), and almost 60% in the last five weeks alone. The price action is extremely bullish, closing right on the high.

Other precious metals, such as Platinum, are also seeing explosive gains.

It is fair to say that Silver and Platinum are behaving like meme stocks rather than precious metals, although Silver and Platinum, like Palladium, are also industrial metals.

Some analysts argue that Silver is facing supply issues which cannot meet demand. I find this unconvincing as there is always plenty of Silver underground that can be mined if it becomes economical to do so.

Other analysts think some precious metals are gaining dramatically because markets are wary of all fiat currency. However, if this were so, you might expect Gold to be gaining much more dramatically, and Bitcoin might have a bid too – neither are true, Gold rose in an orderly way to a new record high last week.

I think what we are seeing is an end-of-year institutional and retail FOMO (fear of missing out) bubble. Silver may continue to rise, maybe even to $100, and then the bubble will burst, and it will come crashing down.

I think the correct way to approach Silver is to use a volatility-based trailing stop, maybe ATR (100) X3, and a very small position size (say, a quarter of the normal risk by account equity percentage).

Silver Weekly Price Chart

XPT/USD

Platinum had its best week last week of all time, rising by more than 23% to exceed its previous record high set in 2008, gaining even more strongly than Silver did.

Everything I have to say about Silver in the section above also applies to Platinum. There is a stronger case that Platinum’s supply disruptions are meaningful and a real factor in pushing the price higher (70% of the world’s Platinum is mined in South Africa). Yet ultimately, it’s essentially a speculative bubble, just like Silver.

Platinum Weekly Price Chart

XAU/USD

Gold has made a firm bullish breakout beyond its ascending price channel of recent weeks, closing very near its high and at a record high price too. These are all bullish signs, and precious metals are obviously gaining tremendously as an asset class.

These are all good reasons to be long of Gold and I am. What is most interesting though, is why Gold is gaining so much more slowly than other precious metals like Silver and Platinum?

The only fundamental answer I can think of is that Gold is purely a precious metal, while Silver and Platinum and Palladium are also industrial metal (although Gold does have a few other uses).

I suspect that speculators are just finding it easier to go after other markets than Gold, because so much Gold is held by central banks, who have an interest in calming and slowing the market.

I am long Gold. I have no idea how high it will go but I am happy to use a trailing stop and take the risk of coming along for part of the ride.

Gold Weekly Price Chart

XPD/USD

Palladium rose strongly for a second consecutive week, gaining by 13% over the past five days to reach a new 3-year high price.

These are bullish signs, but it is worth noting that the price could not reach the big round number at $2,000 and retreated from that area once it got close to it.

Palladium is a precious and industrial metal and is a much more squeezable market than other precious metals, as it is a far rarer substance than Gold. Most Palladium is mined in South Africa and Russia, and there are legitimate supply issues and fears that are playing a role in driving the price higher.

Everything I have to say about Silver and Platinum in the sections above also applies to Palladium. I think we might see further strong gains here, but I will be long with a small position size and a hard trailing stop.

Paladium Weekly Price Chart

Bottom Line

I see the best trades this week as:

- Long of the S&P 500 Index.

- Long of Silver with a quarter of the normal position size.

- Long of Platinum with a quarter of the normal position size.

- Long of Gold with half the normal position size.

- Long of Palladium with a quarter of the normal position size.

Ready to trade our Forex weekly forecast? Check out our list of the top 10 Forex brokers in the world.