Fundamental Analysis & Market Sentiment

I wrote on the 7th December that the best trades for the week would be:

- Long of the S&P 500 Index following a daily close above 6,920. This did not set up.

- Long of Silver with half the normal position size. This gave a win of 2.71%.

Overall, these trades gave a gain of 1.36% per asset.

A summary of last week’s most important data:

- US Federal Funds Rate, Statement, and Projections – a rate cut of 0.25% was made, which was no surprise, although there was plenty of hidden dissent, making this widely perceived as a “hawkish cut”. However, this did not stop the US Dollar falling over the week.

- Bank of Canada Overnight Rate and Rate Statement – as expected, the Bank kept its interest rate unchanged, and this had little effect on the Loonie.

- Reserve Bank of Australia Cash Rate and Rate Statement – as expected, the Bank kept its interest rate unchanged, but signaled its discomfort with inflation, raising the prospect of rate hikes in 2026, which should give some tailwind to the Aussie going forward.

- Swiss National Bank Monetary Policy Rate and Monetary Policy Assessment – the zero interest rate was kept unchanged as expected, despite the deflation that has been seen in recent months. This might boost the Swissie, which is already very strong, as the Bank does not want negative interest rates, so it has nowhere to go.

- US JOLTS Job Openings – this was somewhat better than expected, which reduces the case for further rate cuts.

- US Employment Cost Index – this was slightly lower than expected.

- UK GDP – this unexpectedly showed a very small decrease, which is psychologically significant, as it would herald a technical recession if the decline persists over two quarters. This caused the Pound to weaken a bit.

- US Unemployment Claims – this was roughly as expected.

- Australian Unemployment Rate – this was slightly better than expected, at 4.3%, but won’t have any real effect on the interest rate outlook.

Last week’s data had a marginal impact, with the most important market outcome likely to be a continued strengthening of the Swiss Franc, which has been quietly gaining and gaining. This is a currency with a positive real rate of interest which is being allowed by its central bank to steadily strengthen. It is extremely attractive as a safe haven currency, with the Swiss National Bank’s machinations in 2015 mostly forgotten.

The other major impact was the Fed’s hawkish rate cut, with markets now pricing in only a single rate cut of 0.25% in both 2026 and 2027, even though President Trump will be appointing a new Fed Chair in May 2026 and he wants a Chair who will support aggressive rate cuts. However, Trump has now indicated that Kevin Warsh is currently favourite for the position, and he leans towards a hawkish approach.

Most stock markets ended the week slightly lower. It was generally a week of little change in the financial markets, except precious metals, which look increasingly bullish.

The US Dollar had a bearish week, breaking down below key support and invalidating its former long-term bullish trend which had recently begun.

Top Regulated Brokers

The Week Ahead: 15th – 19th December

The coming week is the last full week of open markets before the Christmas holiday gets underway. This might mean a more active market than usual, because the week is full of important central bank policy meetings (including two widely expected rate cuts) and inflation data.

We are likely to see an increase in volatility this week.

This week’s most important data points, in order of likely importance, are:

- US CPI (inflation) – expected to show a month-on-month increase of 0.3%.

- US Average Hourly Earnings – expected to show a month-on-month increase of 0.3%.

- US Non-Farm Employment Change

- European Central Bank Policy Meeting

- Bank of Japan Policy Meeting – a rate hike of 0.25% is expected.

- US Retail Sales

- Bank of England Policy Meeting – a rate cut of 0.25% is expected.

- Canadian CPI (inflation) – expected to show a month-on-month increase of 0.1%.

- UK CPI (inflation) - expected to show an annualised rate of 3.5%.

- US / UK / Germany PMI Flash Services & Manufacturing

- New Zealand GDP – expected to show fairly strong quarterly growth of 0.8%.

- US Unemployment Rate

- UK Retail Sales

- UK Claimant Count Change

Monthly Forecast December 2025

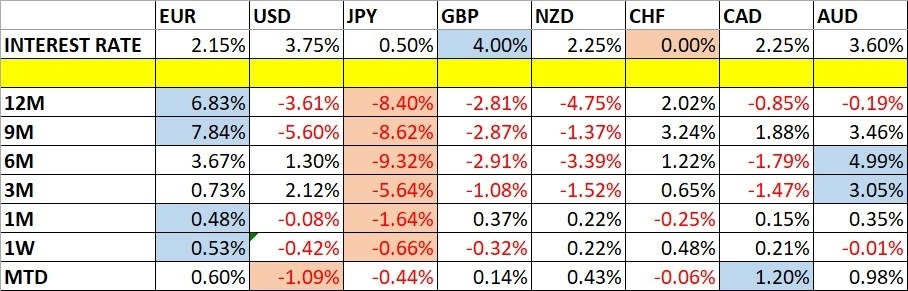

Currency Price Changes and Interest Rates

For the month of December 2025, I made no forecast.

Weekly Forecast 15th December 2025

Last week, I made no forecast, as there were no recent excessive moves in currency crosses.

The Euro was the strongest major currency last week, while the Japanese Yen was the weakest. Directional volatility fell again last week, with only 19% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility could be large as there will be three major central bank policy meetings plus key inflation data.

You can trade these forecasts in a real or demo Forex brokerage account.

Technical Analysis

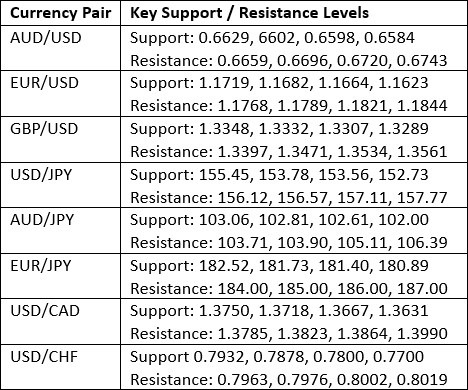

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed another bearish candlestick with only a minor lower wick. The price is still above its level of 13 weeks ago, but below its level of 26 weeks ago, so by my preferred metric, I declare the long-term bullish trend has failed. The price has also broken below a cluster of key support levels which had held for a long time, which I see as a very bearish sign for the greenback.

The Fed is cut its interest rate last week by 0.25% as was widely expected. However, the outlook for further rate cuts over the coming two years looks very slight. It is interesting that the market is shaking that off, which would normally put a bid into the Dollar, and continuing to sell it – that is a bearish sign.

I think being short of the US Dollar will be a generally good approach now, so over the coming week I will look for trades which fit that bias.

US Dollar Index Weekly Price Chart

CHF/JPY

The CHF/JPY currency cross weekly chart printed a powerful bullish candlestick that reached an all-time high price. This alone is a notably bullish sign but just look at the orderly ascending trend we have seen here since March this year, shown by the linear regression price channel study in the price chart below.

I usually ignore trends in currency crosses, but this is a powerful one. There are also good fundamental reasons why the Swiss Franc has been the strongest major currency over the long term, and the Japanese Yen has been the weakest.

The Swiss Franc has a zero interest rate but deflation, so the currency is naturally appreciating, while the Japanese Yen has been declining for a long time due to an ultra-loose monetary policy. However, that might change for the Yen soon, as the Bank of Japan is expected to hike rates this week, and might even begin a more aggressive and continuous round of hikes in 2026.

I will not be going long here myself, but it is something other trades might want to investigate and consider.

CHF/JPY Weekly Price Chart

S&P 500 Index

The weekly price chart below shows that this major US stock index fell last week, after coming very close to breaking its record high just a few weeks ago. It closed at a record high closing price on Thursday, and then opened high on Friday and then fell sharply to print a bearish near pin-bar candlestick.

This is a bearish sign, which could well be dangerous to act upon. I am not advocating going short, but bulls should be worried, although it is clearly still a bull market.

I wrote a week or two ago that I was becoming more convinced that we have already seen a medium-term high in this stock market index, and this confirms my opinion. I think we are seeing a topping out which is likely to start some kind of retracement.

The Fed seems less and likely to make significant rate cuts in the foreseeable future, and there are strong and realistic concerns about an AI bubble and a general over-valuation of the stock market, so a bearish retracement cannot be a big surprise if it happens.

However, if we get a daily close with no significant upper wick on that day’s candle above the record high at 6,930, I will enter a new long trade.

S&P 500 Index Weekly Price Chart

XAG/USD

A few weeks / months ago, Silver was in a strong bullish trend which saw the price increase by about 50% in only two months. The rise peaked in October and saw quite a strong retracement, which is usually a sign that the price is not going to make new highs soon. This bearish outlook was reinforced by what seemed to be a bearish double top formed just four weeks ago. However, the price has come up again and then made a very strong bullish breakout with an unusually large move.

We saw a further gain last week as the bullish momentum continued. Volatility is high and the moves can be messy but it’s a bullish breakout that continues to advance.

Another bullish factor is that all the major precious metals rose in value last week, although there is no doubt the Silver is leading the way.

Due to the high volatility and “second bite” breakout, as well as the significant upper wick on the weekly candlestick, I think a half-sized long position is best here, and only after we see a new record high daily close at or above $63.57.

Silver Weekly Price Chart

XAU/USD

All precious metals have been rising as an asset class, partly fueled by Fed policies and the declining Dollar, partly due to safe haven inflow.

Silver has clearly been leading the way, but this past week has seen Gold start to catch up with a minor bullish breakout beyond the $4,270 area.

The record high above $4,300 is now in sight, but Gold formed a pin bar on Friday which puts some doubt into whether it will retest or even exceed its record high which it made in October.

I will keep a close eye on Gold and enter a new long trade if we get a daily close above the record high, at or above $4,355.80.

If this long trade sets up, as the progress upwards has been steadier and more orderly than what we have seen in Silver, you might keep a normal position size. I will prefer to use half my normal position size.

Gold Weekly Price Chart

Bottom Line

I see the best trades this week as:

- Long of the S&P 500 Index following a daily close above 6,920.

- Long of Silver with half the normal position size following a daily close above $63.57.

- Long of Gold with half the normal position size following a daily close above $4,355.80.

Ready to trade our weekly Forex forecast? Check out our compilation of the top 100 Forex brokers in the world.