Fundamental Analysis & Market Sentiment

I wrote on the 30th November that the best trades for the week would be:

- Long of the USD/JPY currency pair following a daily close above ¥157.77. This did not set up.

- Long of the S&P 500 Index following a daily close above 6,920. This did not set up.

- Long of Silver with half the normal position size. This produced a win of 2.77%

- Long of Gold following a daily close above $4,356. This did not set up.

Overall, these trades gave a gain of 0.69%, which is per asset.

A summary of last week’s most important data:

- US Core PCE Price Index – as expected.

- US Preliminary UoM Inflation Expectations – this dropped from 4.5% to 4.1%, suggesting a decline in the long-term inflationary outlook.

- US Preliminary UoM Consumer Sentiment – this was somewhat higher than expected, suggesting a stronger consumer outlook.

- US ADP Non-Farm Employment Change – just a little bit worse than expected.

- US ISM Services PMI – just a fraction better than expected.

- US ISM Manufacturing PMI– this was somewhat lower than expected, suggesting a weaker outlook for manufacturing.

- Swiss CPI – this is showing stronger than expected deflation, at 0.2% month-on-month, which should be bullish for the Franc.

- Australian GDP – this came in lower than expected at a quarterly rate of only 0.4%, which might be some dovish pressure on the Reserve Bank of Australia, although the Bank has bigger problems.

- US Unemployment Claims – just a fraction lower than expected.

- Canadian Unemployment Rate – this unexpectedly fell from 6.9% to 6.5%, and it had been expected to rise, suggesting much stronger than expected activity in the Canadian economy.

Volatility this week is likely to be considerably higher than the volatility last week.

Last week’s data had a marginal impact, but it will likely have a dovish bearish on the Australian and US Dollars and maybe the Swiss Franc. If the Swiss National Bank takes no inflationary or otherwise dovish action, the Franc will likely have a bullish tailwind as its deflation will tend to boost its relative strength, all else being equal.

The week saw a continued modest recovery in risk-on sentiment, with most stock markets gaining a bit. The benchmark US S&P 500 Index is now within sight of its recent all-time high and is outperforming tech-focused indices.

The risk-on sentiment saw the US Dollar fall further counter to its long-term bullish trend. Key support levels in the US Dollar Index are intact, but the bullish momentum looks very questionable. This may be caused partially by a very strong expectation that the Fed will cut its interest rate on 10th December by 0.25%, with markets now pricing an 86% chance of that cut according to the CME FedWatch Tool. The poor jobs data will also have helped push the rate-cutting narrative a little.

Precious metals were the other standout assets of last week, with Silver rising very powerfully towards the end of the week to reach a new all-time high price, and Gold making a higher high following its recent bullish breakout.

Top Regulated Brokers

The Week Ahead: 8th – 12th December

The coming week will see four major central bank meetings, including the biggest of them all, the US Federal Reserve, as well as important economic data releases from the US and the UK.

This week’s most important data points, in order of likely importance, are:

- US Federal Funds Rate, Statement, and Projections – a rate cut of 0.25% is strongly expected.

- Bank of Canada Overnight Rate and Rate Statement – expected to hold rates unchanged.

- Reserve Bank of Australia Cash Rate and Rate Statement – expected to hold rates unchanged.

- Swiss National Bank Monetary Policy Rate and Monetary Policy Assessment – expected to hold rates unchanged.

- US JOLTS Job Openings

- US Employment Cost Index

- US ADP Weekly Employment Change

- UK GDP – this is expected to show a tiny increase. If the data is negative, it could stoke fears of a recession in the UK which could send the Pound lower.

- US Unemployment Claims

- Australian Unemployment Rate

Volatility this week is very likely to be higher than the volatility last week.

Monthly Forecast December 2025

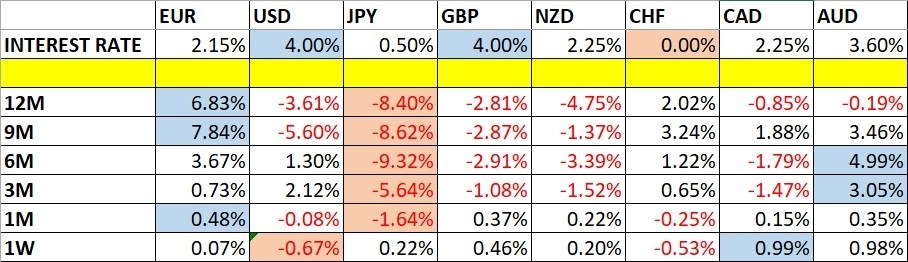

Currency Price Changes and Interest Rates

For the month of December 2025, I made no forecast.

Weekly Forecast 8th December 2025

Last week, I forecasted that the NZD/JPY currency cross was likely to fall in value over the coming week. However, it rose in value by 0.21%.

The Australian and Canadian Dollars were the strongest major currencies last week, while the US Dollar was the weakest. Directional volatility dropped very slightly last week, with 22% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility could be large as there will be four major central bank policy meetings.

You can trade these forecasts in a real or demo Forex brokerage account.

Technical Analysis

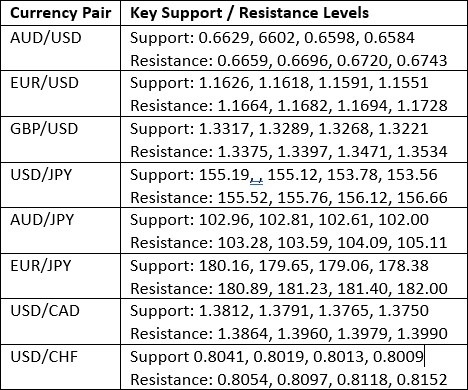

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed another bearish candlestick with only a minor lower wick. The price is still above its levels of both 13 and 26 weeks ago, so by my preferred metric, I can declare a long-term bullish trend is in force, but its continuation looks doubtful. Another bullish confirmation technically comes from the fact that the price is holding up above the nearest key support levels, with 98.55 looking crucial. This level was tested and rejected, which could be a bullish sign, but overall, the picture for the US Dollar becomes increasingly bearish. The greenback was the biggest loser last week of all the major currencies.

The Fed is strongly expected to cut its interest rate this week by 0.25%. If that does not happen, the Dollar would increase strongly.

I think being neutral on the US Dollar will be a good approach, at least until the FOMC data is release late Wednesday.

US Dollar Index Weekly Price Chart

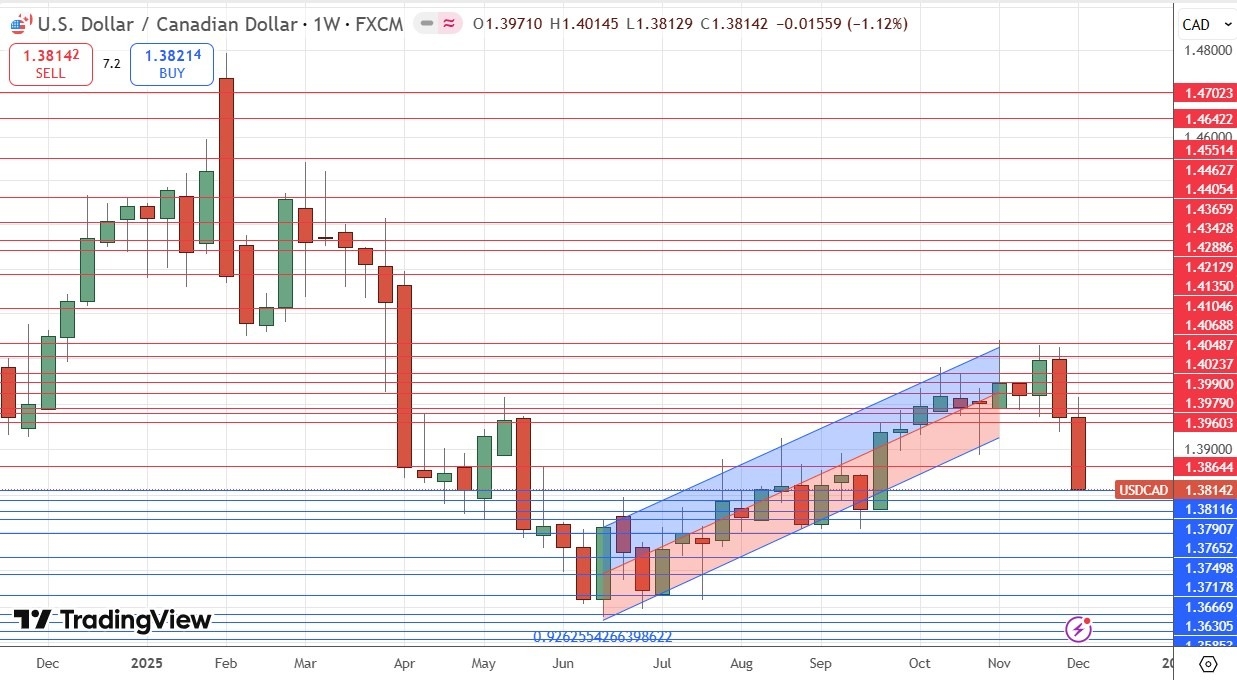

USD/CAD

The USD/CAD currency pair weekly chart printed a very large and bearish candlestick that closed right on its low. This is after the price made a powerful bearish breakdown from a long-term ascending price channel drawn by linear regression analysis within the price chart below. These are bearish signs, and we are seeing strong bullish momentum in the Canadian Dollar.

The Canadian Dollar has got stronger as much stronger than expected employment data makes the prospect of further rate cuts more unlikely. Another factor giving this currency a tailwind is the general increase in crude oil and prices and risk appetite (the two are related), which boost the CAD as an oil-producing commodity currency). The new weakness in the US Dollar is another contributing factor.

This is usually not a great currency pair for trend traders, but the momentum here is very strong, so it may be interesting day trading this currency pair on the short side, at least during the earlier part of this coming week.

USD/CAD Weekly Price Chart

USD/MXN

The USD/MXN currency pair has been in a downwards trend for a long time, even recently while the USD was gaining. The Mexican Peso has been one of the stronger currencies for a long time.

The price chart below shows the past week printed a small but significant bearish candlestick, which did not close far from its low, and reached a new near 18-month low price. These are bearish signs.

This currency pair tends to have a relatively high spread so can be hard to day trade. However, Mexico currently pays quite a high rate of interest – its central bank’s rate is currently 7.5%, so many brokers pay a positive overnight swap on short trades.

This could be an interesting carry trade short, or a swing trade for anyone thinking the Peso will remain strong and the USD is switching out of its long-term bullish trend.

USD/MXN Weekly Price Chart

S&P 500 Index

The weekly price chart below shows that this major US stock index continued to rise last week, albeit at a slower pace. The weekly closing price was a record high for a weekly close, and the all-time high made a few week ago is in sight.

We remain in a bull market, but I will feel more bullish if we get a new record high daily close above 6,920 – this is what I will want to see before entering a new long trade.

It is a bull market, so there are reasons to be bullish, backed by the recent increase in risk-on sentiment, which will welcome a rate cut by the Fed on 10th December if it happens, as seems very likely.

Another positive bullish factor is that the current rally seems to be more broad-based than some recent periods of gains, which were tech-centred.

S&P 500 Index Weekly Price Chart

XAG/USD

A few weeks / months ago, Silver was in a strong bullish trend which saw the price increase by about 50% in only two months. The rise peaked in October and saw quite a strong retracement, which is usually a sign that the price is not going to make new highs soon. This bearish outlook was reinforced by what seemed to be a bearish double top formed just three weeks ago. However, the price has come up again and then made a very strong bullish breakout with an unusually large move.

We saw a further gain last week as the bullish momentum continued. Volatility is high and the moves can be messy but it’s a bullish breakout that continues to advance.

Another bullish factor is that all the major precious metals rose in value last week, although there is no doubt the Silver is leading the way.

Due to the high volatility and “second bite” breakout, I think a half-sized long position is best here.

Silver Weekly Price Chart

Bottom Line

I see the best trades this week as:

- Long of the S&P 500 Index following a daily close above 6,920.

- Long of Silver with half the normal position size.

Ready to trade our Forex weekly forecast? Check out our list of the top 100 Forex brokers in the world.