Short Trade Idea

Enter your short position between $211.71 (the lower band of its horizontal resistance zone) and $219.48 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Waste Management (WM) is a member of the S&P 500.

- This index trades inside a bearish chart pattern with fading bullish volumes.

- The Bull Bear Power Indicator of the S&P 500 turned bullish but remains below its descending trendline.

Market Sentiment Analysis

Equity futures are red to start the morning, after a three-day rally led by AI names. Today’s market-moving data includes a first look at the third-quarter GDP and updates on the PCE price index for July, August, and September. Geopolitical tensions continue to drive gold and silver prices higher, as tension with Venezuela mirrors a proxy fight with China. The US economy remains in an obvious cool-down period, as evidenced by a cooling labor market, and questions over last week’s weak inflation data hang over markets.

Waste Management Fundamental Analysis

Waste Management is a comprehensive waste and environmental services company. It has 337 transfer stations, 254 active landfill disposal sites, 97 recycling plants, 135 beneficial-use landfill gas projects, six independent power production plants, and 26,000 collection and transfer vehicles.

So, why am I bearish on WM after its recent advance?

Waste Management suffers from surging debt levels and rising capital expenses, some of which are related to share buybacks and dividends, which appear to be misguided attempts to please its institutional investors. Valuations are high, WM experiences a contraction in free cash flow, and the share price recovery following its latest earnings disappointment has set investors up for a repeat, as I do not see much upside potential.

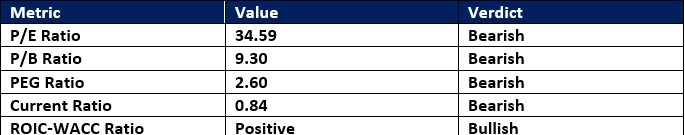

Waste Management Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 34.59 makes WM an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.01.

The average analyst price target for WM is $246.48. It suggests decent upside potential, but downside risks remain elevated.

Waste Management Technical Analysis

Today’s WM Signal

Waste Management Price Chart

- The WM D1 chart shows price action inside a horizontal resistance zone.

- It also shows price action above its descending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- WM stagnated as the S&P 500 rallied, a significant bearish trading signal.

Top Regulated Brokers

My Call on Waste Management

I am taking a short position in WM between $211.71 and $219.48. High valuations, insider selling, and a contraction in free cash flow amid rising long-term debt keep me bearish at current levels.

- WM Entry Level: Between $211.71 and $219.48

- WM Take Profit: Between $188.29 and $194.11

- WM Stop Loss: Between $222.46 and $229.50

- Risk/Reward Ratio: 2.18

Ready to trade our analysis of Waste Management? Here is our list of the best stock brokers worth checking out.