Short Trade Idea

Enter your short position between $52.30 (yesterday’s intra-day low) and $53.73 (a minor horizontal resistance level).

Market Index Analysis

- Tractor Supply (TSCO) is a member of the S&P 500.

- This index is nearing breakdowns of its bearish chart pattern.

- The Bull Bear Power Indicator of the S&P 500 turned negative with a descending trendline.

Market Sentiment Analysis

Equity markets mostly extended their sell-off after the delayed release of the October and November NFP reports. October showed a net loss of 105,000 jobs, while November showed a gain of 64,000, and the unemployment rate rose to 4.6%. Overall, 710,000 more people are unemployed than in November 2024, and Fed Chief Powell warned about extreme overstatements in the job report, due for a revision in February. Retail sales came in flat, missing estimates for a 0.1% rise. The data was insufficient to entice the central bank to cut interest rates again at its next meeting, fueling yesterday’s sell-off.

Tractor Supply Fundamental Analysis

Tractor Supply is an agriculture, lawn and garden maintenance, livestock, equine, and pet retailer with over 2,200 stores and expansion plans to reach 3,000 store locations. It is also a Fortune 500 company.

So, why am I bearish on TSCO after its post-earnings sell-off?

I remain bearish amid ongoing cost pressures combined with sub-standard revenues, driven by lagging same-store sales. Competition is rising, eating into Tractor Supply’s market share, which is also hampered by commoditized inventory and poor unit economics. I also expect the weakening economic environment to pressure its urban customer base, while its rising debt levels are another concern.

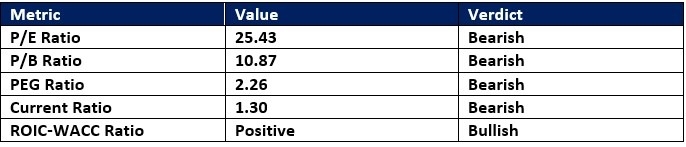

Tractor Supply Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 25.43 indicates TSCO is fairly valued. By comparison, the P/E ratio for the S&P 500 is 29.09.

The average analyst price target for TSCO is $63.74. It suggests good upside potential, but downside risks are rising.

Tractor Supply Technical Analysis

Today’s TSCO Signal

Tractor Supply Price Chart

- The TSCO D1 chart shows price action inside a bearish price channel.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- TSCO corrected as the S&P 500 advanced, a significant bearish trading signal.

Top Regulated Brokers

My Call on Tractor Supply

I am taking a short position in TSCO between $52.30 and $53.73. With rising competition eroding Tractor Supply’s customer base, ongoing cost pressures adding to margin contractions, and a weakening economy, I see more downside ahead.

- TSCO Entry Level: Between $52.30 and $53.73

- TSCO Take Profit: Between $44.35 and $46.85

- TSCO Stop Loss: Between $55.75 and $56.94

- Risk/Reward Ratio: 2.30

Ready to trade our analysis of Tractor Supply? Here is our list of the best stock brokers worth checking out.