Long Trade Idea

Enter your long position between $576.70 (the intra-day low of its last bearish candlestick) and $587.29 (yesterday’s intra-day high).

Market Index Analysis

- Allstate (ALL) is a member of the S&P 500 Index.

- This index recorded a fresh record, but decreasing bullish trading volumes do not confirm the uptrend.

- The Bull Bear Power Indicator of the S&P 500 is bullish with a negative divergence.

Market Sentiment Analysis

The Dow Jones Industrial Average and the S&P 500 Index closed at fresh all-time highs, setting the stage for a Santa Claus rally to cap 2025 and start 2026. Major indices closed higher for a fifth consecutive session, climbing a wall of worry, as the issues that led to all 2025 selloffs remain. AI and data center spending will dominate 2026, as potential revenue shortfalls and circular financing continue to loom over equity markets. Valuations are excessive, and investors are paying high premiums for potential future growth. The low-volume uptick in equity markets is vulnerable to a sharp correction if one of the concerns materializes.

Northrop Grumman Fundamental Analysis

Northrop Grumman is an aerospace and defense company. NOC is the 5th largest US government contractor and receives over 2% of federal government spending on contractors.

So, why am I bullish on NOC after bottoming out?

I remain bullish about its order book, and NOC announced new funding for Global Hawk drones and Columbia class launch systems, a new missile contract for the Stand-in Attack Weapon SiAW and Advanced Anti-Radiation Guided Missile (AARGM-ER) systems, expanded B2 and electronic warfare work, and a fresh satellite tracking contract. Valuations remain low, and optimism about its future revenue prospects has accelerated.

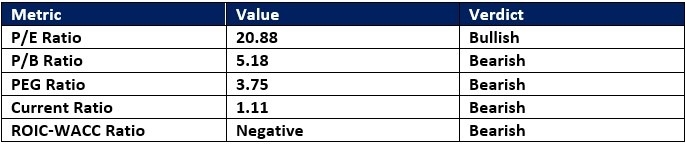

Northrop Grumman Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 20.88 makes NOC an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.38.

The average analyst price target for NOC is $662.68. This suggests an excellent upside potential with manageable downside risks.

Northrop Grumman Technical Analysis

Today’s NOC Signal

Northrop Grumman Price Chart

- The NOC D1 chart shows price action inside a bullish price channel.

- It also shows price action challenging its descending Fibonacci Retracement Fan for a breakout.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- NOC advanced with the S&P 500, a bullish trading confirmation.

My Call on Northrop Grumman

I am taking a long position in NOC between $576.70 and $587.29. Defense spending by NATO members will provide stable, future revenues, and Northrop Grumman is a buy-the-dip candidate for the rest of this decade.

- NOC Entry Level: Between $576.70 and $587.29

- NOC Take Profit: Between $640.90 and $660.13

- NOC Stop Loss: Between $546.52 and $553.37

- Risk/Reward Ratio: 2.13

Ready to trade our analysis of Northrop Grumman? Here is our list of the best stock brokers worth reviewing.