Short Trade Idea

Enter your short position between $58.22 (Friday’s intra-day low) and $60.38 (Friday’s intra-day high).

Market Index Analysis

- Nike (NKE) is a member of the S&P 100 and the S&P 500.

- Both indices trade inside bearish chart formations.

- The Bull Bear Power Indicator of the S&P 500 turned bullish with a descending trendline.

Market Sentiment Analysis

Equity futures hint at a positive open after closing Friday’s session in the green, a high-volume quadruple witching day, and the final full week of trading for 2025. Equity markets are approximately 3% below all-time highs, and investors hope for a Santa Claus rally in a low-volume trading week. Tomorrow’s consumer confidence reading could provide a volatility boost, as it could deliver more evidence of a K-shaped economic trajectory. Overall, it should be a quiet week, where existing trends and worries remain front and center.

Nike Fundamental Analysis

Nike is the world’s largest athletic footwear and apparel manufacturer, one of the leading sports equipment manufacturers, and the most valuable sports brand.

So, why am I bearish on NKE after its earnings report?

While Nike beat expectations of $12.22 billion in revenue and $0.38 in earnings per share, reporting $12.43 billion and $0.53, respectively, its shares plunged as Chinese sales cratered, driving my bearish stance amid the tariff impact. I am equally bearish about its ongoing direct-to-consumer (DTC) model, with a slow pivot away from it, weakness in its Converse brand, and expectations of a revenue decrease and a drop in profit margins next quarter.

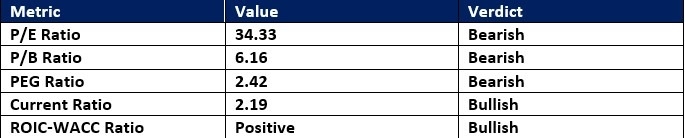

Nike Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 34.33 makes NKE an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.01.

The average analyst price target for NKE is $77.94. While this suggests there is excellent upside potential, downside risks have accelerated.

Nike Technical Analysis

Today’s NKE Signal

Nike Price Chart

- The NKE D1 chart shows price action inside a bearish price channel.

- It also shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- NKE plunged as the S&P 500 pushed higher, a significant bearish development.

Top Regulated Brokers

My Call on Nike

I am taking a short position in NKE between $58.22 and $60.38. Despite a nearly 30% correction from its 2025 high, valuations are high. I remain bullish about its shrinking profit margin, magnified by tariffs, downbeat revenue guidance, and negative non-US growth.

- NKE Entry Level: Between $58.22 and $60.38

- NKE Take Profit: Between $47.18 and $49.67

- NKE Stop Loss: Between $62.97 and $65.40

- Risk/Reward Ratio: 2.32

Ready to trade our analysis of Nike? Here is our list of the best stock brokers worth checking out.