- Ultimately, I think we continue to see a lot of choppiness, but I still favor the upside because maybe we see a little bit of a pullback, but that should be short-lived at best.

- The Nasdaq 100 has pulled back slightly in pre-market trading on Tuesday as it looks like we are trying to do everything we can to shake out a lot of positions at the end of the year.

- This does make a certain amount of sense, considering that a lot of traders will be trying to square out their positions heading into the holidays, as volume will start to really drift lower.

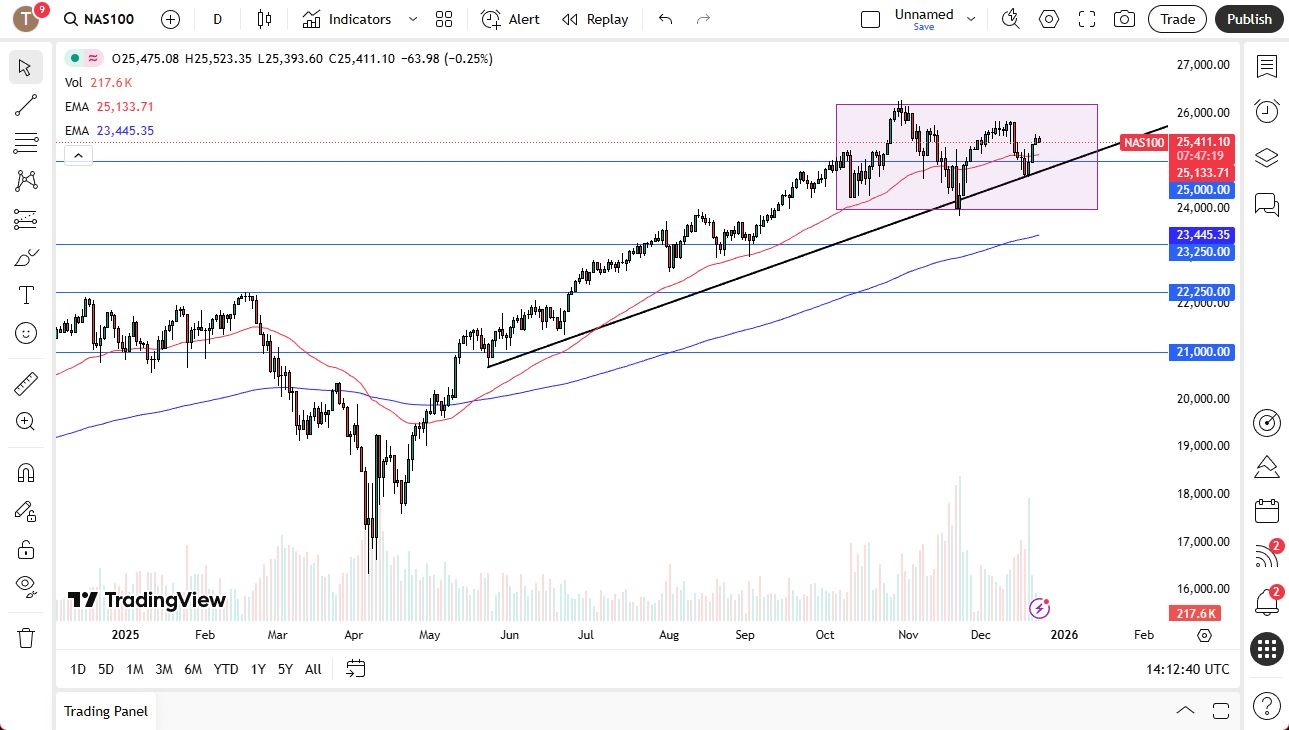

That being said, this is still a very positive market, and we have had three very strong days in a row, so I think a short-term pullback makes sense as a potential buying opportunity. The 50-day EMA is sitting right around the 25,130 level, and then of course, we have the 25,000 level offering support. The uptrend line underneath offers a bit of a floor as well.

Top Regulated Brokers

Santa Claus Rally

To the upside, if we were to break out to the upside and clear the 26,000 level, then it opens up the possibility of a much bigger move, but I think ultimately this is a market that may not see that until after the holidays. There is such a thing as the Santa Claus rally, and maybe that's what we are about to see, or maybe that's what we just saw over the last couple of days.

Ultimately, I think we continue to see a lot of choppiness, but I still favor the upside because maybe we see a little bit of a pullback, but that should be short-lived at best. Keep in mind that the Nasdaq 100 is not equally weighted, and the Nasdaq 100 hosts some of the favorite stocks around the world, such as Nvidia and Tesla. So as long as that's the case, there will be a certain amount of an underlying bid to this market. Once we get into next year, the volume will pick up quite significantly, and then that opens up the possibility of a much more sustainable rally. We have been more or less sideways for a couple of months now after a massive move higher. That makes sense because traders want to collect their profit, but I still think you're looking at dips as value.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.