Short Trade Idea

Enter your short position between $246.08 (the lower band of its horizontal resistance zone) and $255.69 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Lowe’s (LOW) is a member of the S&P 100 and the S&P 500.

- Both indices are nearing breakdowns of their respective bearish chart patterns.

- The Bull Bear Power Indicator of the S&P 500 turned negative with a descending trendline.

Market Sentiment Analysis

Equity markets mostly extended their sell-off after the delayed release of the October and November NFP reports. October showed a net loss of 105,000 jobs, while November showed a gain of 64,000, and the unemployment rate rose to 4.6%. Overall, 710,000 more people are unemployed than in November 2024, and Fed Chief Powell warned about extreme overstatements in the job report, due for a revision in February. Retail sales came in flat, missing estimates for a 0.1% rise. The data was insufficient to entice the central bank to cut interest rates again at its next meeting, fueling yesterday’s sell-off.

Lowe’s Fundamental Analysis

Lowe’s is a home improvement retailer with over 1,750 stores across the US. It is the second largest hardware store globally, trailing its rival Home Depot.

So, why am I bearish on LOW following its post-earnings rally?

Insider selling of $2.2 million of shares raised a red flag, magnified by a slowing EPS growth rate. Lowe’s also suffers from an average annualized contraction of 3.4% in same-store sales, as input costs continue to experience upside momentum, pressuring already weak operating margins. I am also monitoring Home Depot’s rollout of an AI-assisted tool for professionals, which gives it a competitive edge over Lowe’s.

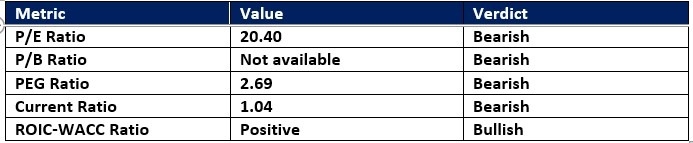

Lowe’s Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 20.40 makes LOW an expensive stock for a retailer. By comparison, the P/E ratio for the S&P 500 is 29.09.

The average analyst price target for LOW is $272.97. It offers decent upside potential, but downside risks are rising.

Lowe’s Technical Analysis

Today’s LOW Signal

Lowe’s Price Chart

- The LOW D1 chart shows price action inside a massive horizontal resistance zone.

- It also shows price action just above its ascending Fibonacci Retracement Fan level with rising bearish momentum.

- The Bull Bear Power Indicator remains bullish but shows a negative divergence.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- LOW has mirrored the rise in the S&P 500 Index, but bearish factors are mounting.

My Call on Lowe’s

I am taking a short position in LOW between $246.08 and $255.69. With consumers under pressure, I view Home Depot’s AI tool for professionals as a material threat to Lowe’s revenue, given its ongoing growth and margin challenges.

- LOW Entry Level: Between $246.08 and $255.69

- LOW Take Profit: Between $206.39 and $212.56

- LOW Stop Loss: Between $260.78 and $267.52

- Risk/Reward Ratio: 2.70

Ready to trade our analysis of Lowe’s? Here is our list of the best stock brokers worth checking out.