Long Trade Idea

Enter your long position between $477.43 (a minor horizontal support level) and $484.95 (yesterday’s intra-day high).

Market Index Analysis

- Lockheed Martin (LMT) is a member of the S&P 100 and the S&P 500.

- Both indices trade near records but fading bullish trading volumes do not support the current rally.

- The Bull Bear Power Indicator of the S&P 500 is bullish but shows a negative divergence.

Market Sentiment Analysis

The S&P rallied above 6,900, with AI optimism in the driver’s seat. While the delayed GDP report showed a faster-than-expected expansion, inflation accelerated, and the chain-weighted price index, which includes consumers switching to less expensive products for pricier items, surged 3.8%. Consumer confidence slid for a fifth consecutive month, with a sour short-term outlook on current business conditions and the labor market, and debt levels are at record levels. Gold and silver prices rallied, and the disconnect between various market forces will eventually come to a breaking point.

Lockheed Martin Fundamental Analysis

Lockheed Martin (LMT) is a defense and aerospace manufacturer with four divisions: Lockheed Martin Aeronautics, Lockheed Martin Missiles and Fire Control, Lockheed Martin Rotary and Mission Systems, and Lockheed Martin Space. In 2024, LMT derived 73% of its revenues from the US government.

So, why am I bullish on LMT at current levels?

While long-term debt is an issue, Lockheed Martin has a well-diversified order book and recently saw an existing Pentagon contract raised from $15 billion to $25 billion, as well as signing a new Navy contract. The military satellite market is on track for 10% growth, adding to LMT’s revenue potential, and I am bullish about its R&D facilities, which rank among the best in the industry.

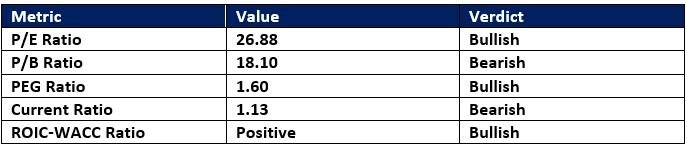

Lockheed Martin Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 26.88 makes LMT an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 27.85.

The average analyst price target for Lockheed Martin is $523.95. It suggests excellent upside potential with reasonable downside risks.

Lockheed Martin Technical Analysis

Today’s LMT Signal

Lockheed Martin Price Chart

- The LMT D1 chart shows price action inside a bullish price channel.

- It also shows price action breaking out above its descending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- LMT is moving higher with the S&P 500 Index, a bullish confirmation.

My Call on Lockheed Martin

I am taking a long position in LMT between $477.43 and $484.95. LMT is one of the largest and most diversified defense companies, and I am bullish on its R&D facilities and order backlog.

- LMT Entry Level: Between $477.43 and $484.95

- LMT Take Profit: Between $523.95 and $534.43

- LMT Stop Loss: Between $455.10 and $462.25

- Risk/Reward Ratio: 2.08

Top Regulated Brokers

Ready to trade our analysis of Lockheed Martin? Here is our list of the best stock brokers worth checking out.