Short Trade Idea

Enter your short position between $650.47 (last week’s intra-day low) and $660.77 (a minor horizontal resistance level).

Market Index Analysis

- Intuit (INTU) is a member of the NASDAQ 100, the S&P 100, and the S&P 500.

- All three indices trade inside bearish price channels with increasing downside momentum.

- The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

Market Sentiment Analysis

Equity futures are down this morning, building on the rotation out of extremely overvalued AI stocks, as issues from high debt levels to circular financing, and from revenue concerns to valuations, begin to materialize. Today’s focus will be on the delayed October NFP report, expected to show 40,000 job additions with an unemployment rate of 4.4%, while Thursday’s CPI report is expected to reveal an annualized inflation rate of 3.1%. Investors hope for a weak enough job market to prompt another interest rate cut, but strong enough to support economic expansion, which creates a risky investment case given stubborn inflation.

Intuit Fundamental Analysis

Intuit is a business software company best known for its small business accounting software, QuickBooks. Other leading services include TurboTax, its e-mail marketing platform Mailchimp, and its credit monitoring service Credit Karma.

So, why am I bearish on INTU following its breakdown?

First-quarter revenues clocked in at $3.89 billion with earnings-per-share of $3.34, beating expectations of $3.76 billion and $3.10, respectively. Still, profit margins are shrinking, magnified by high valuations despite a 20%+ correction from its 2025 peak. Intuit’s cautious full-year outlook suggests the good news is already priced into the current share price, and I am worried about its revenue trajectory amid a mixed small-business outlook.

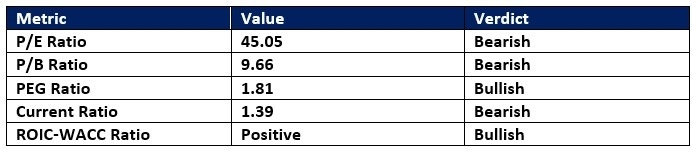

Intuit Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 45.05 makes INTU an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.13.

The average analyst price target for INTU is $803.89. This suggests excellent upside potential, but short-term risks remain.

Intuit Technical Analysis

Today’s INTU Signal

- The INTU D1 chart shows price action breaking down below a horizontal support zone.

- It also shows price action breaking down below the descending 61.8% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- The average bullish trading volumes are higher than average bearish trading volumes, a trend to monitor.

- INTU corrected in line with the NASDAQ 100 Index, which is a bearish confirmation.

My Call on Intuit

I am taking a short position in INTU between $650.47 and $660.77. Valuations remain high, while profit margins are shrinking. I am also worried about its core customer base, small businesses, where INTU noted a mixed outlook.

Top Regulated Brokers

- INTU Entry Level: Between $650.47 and $660.77

- INTU Take Profit: Between $584.84 and $599.63

- INTU Stop Loss: Between $681.20 and $689.17

- Risk/Reward Ratio: 2.14

Ready to trade our analysis of Intuit? Here is our list of the best stock brokers worth reviewing.