Today’s Gold Analysis Overview:

Today’s Gold Analysis Overview:

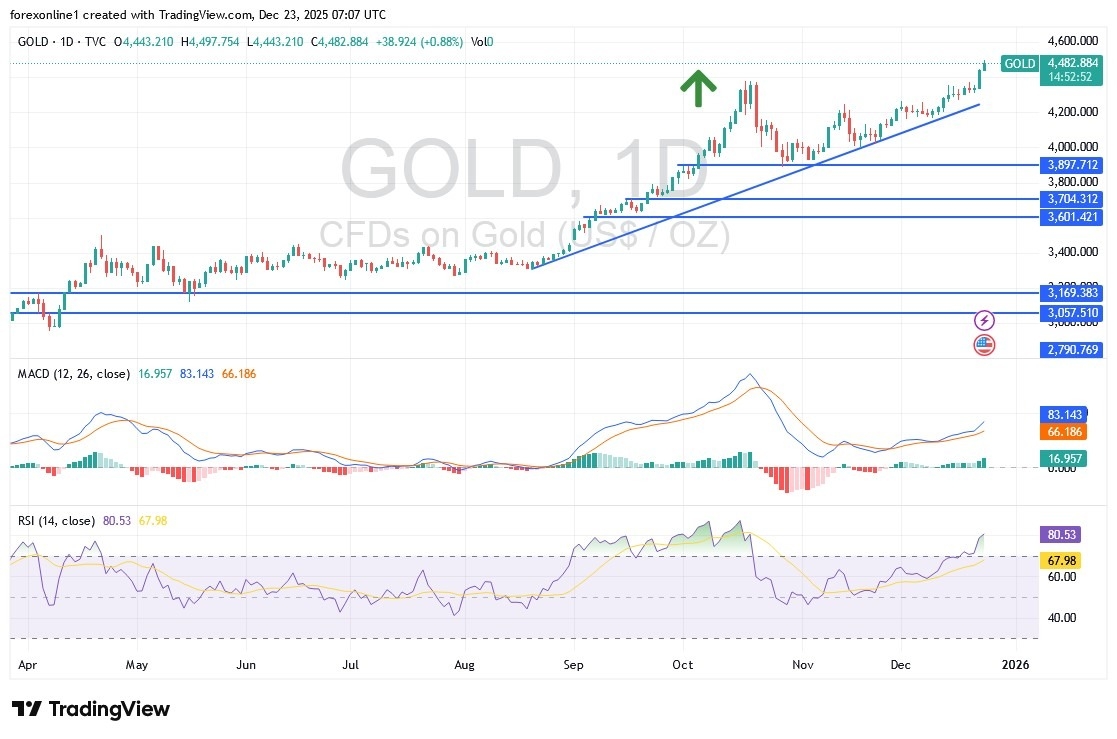

- The overall of Gold Trend: Strongly bullish.

- Today's Gold Support Points: $4430 – $4360 – $4220 per ounce

- Today's Gold Resistance Points: $4520 – $4590 – $4660 per ounce

Top Regulated Brokers

Today's Gold Trading Signals:

- Sell gold from the resistance level of $4600 with a target of $4200 and a stop-loss at $4660.

- Buy gold from the support level of $4390 with a target of $4600 and a stop-loss at $4320.

Technical Analysis of Gold Price (XAU/USD) Today:

Gold "bulls" appear to be pushing prices toward new record levels ahead of the 2025 year-end close to establish a foundation for further historic rallies in the new year. According to gold trading platforms, the gold price index jumped to a new all-time high, with the price per ounce hitting $4,497, breaking the previous record of $4,382 set in October. Overall, the gold market appears to be enjoying a period of significant upward movement, despite all technical indicators reaching strong overbought levels. For example, the 14-day Relative Strength Index (RSI) is stable above the 80 line, as is the MACD indicator.

Will Gold Gains Continue?

According to gold analysts, the answer is yes. Renewed geopolitical risks continue to support both gold and silver markets, with the pace of precious metal buying increasing amid unresolved trade tensions between the U.S. and China. Specifically, gold prices indicate a demand for long-term positioning and hedging, as prices have stabilized at these highs rather than reversing sharply.

Simultaneously, silver prices—approaching $70 per ounce—are responding to the same macroeconomic forces but with greater intensity due to specific supply-and-demand dynamics. Consequently, gold gains are expected to continue in the coming months. Today’s gains bring the target of $5,000 per ounce closer than ever.

2025 Performance Review

In 2025, gold prices have surged by 70%, while silver has climbed 135% over the same period. In the near term, both metals are expected to benefit from a weaker U.S. Dollar and expectations of interest rate cuts in 2026. A depreciating dollar is positive for dollar-denominated assets, as it makes them cheaper for foreign investors to purchase.

Treasury bond yields could influence the Federal Reserve's future monetary policy decisions in the new year, with traders anticipating at least two US interest rate cuts in the next twelve months. However, the Fed has only indicated one cut so far.

As is well known, lower interest rates are a positive factor for gold, as they reduce the opportunity cost of holding non-yielding bullion.

According to commodity market experts, investors are reassessing gold amid rising budget deficits in Western countries, including the United States and the United Kingdom. Gold's value as a potential hedge against monetary risks has resurfaced. Its price has fallen from being undervalued relative to the nominal assets recommended as a hedge to a more reasonable level. Consequently, other precious metals have also risen, with some experiencing price increases.

Meanwhile, the industrial sector continues to play a role in the anticipated metals boom in 2025. Copper is holding steady at $5.50 per pound, while platinum and palladium have surged by more than 100%, reaching $2,126 and $1,850 per ounce, respectively.

Trading advice:

Analysts advise investors to continue investing in gold and to treat any price pullbacks as buying opportunities, while cautioning against excessive risk-taking.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.

Today’s Gold Analysis Overview:

Today’s Gold Analysis Overview: