Short Trade Idea

Enter your short position between $137.64 (the intra-day low of its most recent bullish candlestick sequence) and $141.10 (Friday’s intra-day high).

Market Index Analysis

- Generac Holdings (GNRC) is a member of the S&P 500 Index.

- This index drifted to a fresh all-time high amid low bullish trading volumes.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence and does not support the uptrend.

Market Sentiment Analysis

Equity markets closed marginally lower on Friday after the S&P 500 set a fresh intra-day all-time high, and thin trading volumes are likely to extend until next Monday. Wednesday will see the release of the December ADP employment report and the minutes from December’s FOMC meeting, during which markets will assess the likelihood of a January interest rate cut, which has slim chances for now. NVIDIA’s quiet $20 billion licensing deal with specialized chipmaker Groq, which focuses on AI inference, may reignite concerns about circular financing and quieting competitors. The debate over an AI bubble should continue for years to come, but revenue shortfalls are a bigger issue than current valuations.

Generac Holdings Fundamental Analysis

Generac Holdings is a Fortune 1000 American manufacturer of residential, light commercial, and industrial power systems with outputs ranging from 800 watts to 9 megawatts.

So, why am I bearish on GNRC after its 30%+ correction?

Its sub-standard annual revenue growth confirms that its role in data center backup generators is overly optimistic. Its day-to-day operating expenses have surged, while profit margins continue to shrink, further eroding its capital returns. I reiterate my bearish stance on its latest product line, its market positions, and its decreased 2025 outlook.

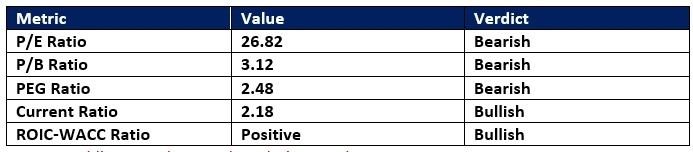

Generac Holdings Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 26.82 indicates GNRC is fairly valued. By comparison, the P/E ratio for the S&P 500 is 29.47.

The average analyst price target for GNRC is $206.53. While this suggests an excellent upside potential, downside risks are higher.

Generac Holdings Technical Analysis

Today’s GNRC Signal

- The GNRC D1 chart shows a price action inside a bearish price channel.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- GNRC corrected as the S&P 500 rallied, a significant bearish trading signal.

My Call on Generac Holdings

I am taking a short position in GNRC between $137.64 and $141.10. I remain bearish on its decreased 2025 outlook, rising costs, shrinking profit margins, and its overly optimistic outlook as a data center backup generator player.

- GNRC Entry Level: Between $137.64 and $141.10

- GNRC Take Profit: Between $94.53 and $99.50

- GNRC Stop Loss: Between $156.15 and $160.02

- Risk/Reward Ratio: 2.33

Ready to trade our analysis of Generac Holdings? Here is our list of the best stock brokers worth checking out.