Long Trade Idea

Enter your long position between $205.47 (a minor horizontal support level) and $211.43 (yesterday’s intra-day high).

Market Index Analysis

- Garmin (GRMN) is a member of the S&P 500.

- This index has formed a bearish chart pattern with rising downside catalysts.

- The Bull Bear Power Indicator of the S&P 500 is bullish, but shows a negative divergence, and does not support the recent uptrend.

Market Sentiment Analysis

While equity markets rallied yesterday after the Federal Reserve announced its widely expected 25-basis-point interest rate cut with a hawkish forward-looking statement, and only one expected reduction in 2026 for now, futures are plunging this morning. The central bank noted the inflationary effects of tariffs, raising the bar for future cuts. Adding to bearish sentiment is Oracle’s plunge after reporting disappointing earnings, fueling AI concerns. Earnings from Broadcom, Costco, and Lululemon are also due today.

Garmin Fundamental Analysis

Garmin is a tech company known for its GPS, navigation, communication, and sensor-based products catering to the automotive, aviation, marine, and recreational markets.

So, why am I bullish on GRMN amid its bounce higher?

I turned bullish on GRMN after it scored a contract with the Brazilian Air Force to upgrade 24 UH-60L Black Hawk helicopters with its advanced G5000H integrated flight deck. I am also upbeat about Garmin’s expanding footprint in wearable and fitness technology. The launch of its nReach Mini 3 Plus, a compact satellite communicator featuring voice, text, and SOS, could boost its revenue base among tech-savvy consumers.

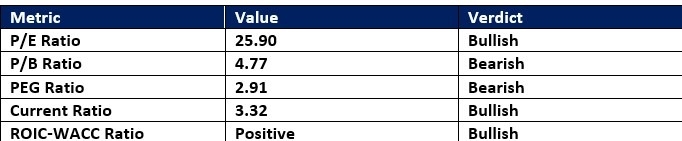

Garmin Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 25.90 makes GRMN an expensive stock in its industry but reasonably valued relative to the S&P 500. By comparison, the P/E ratio for the S&P 500 is 29.21.

The average analyst price target for GRMN is $233.50. It suggests good upside potential with fading downside risks.

Garmin Technical Analysis

Today’s GRMN Signal

Garmin Price Chart

- The GRMN D1 chart shows price action breaking out above its horizontal support zone.

- It also shows price action between the ascending 50.0% and 61.8% Fibonacci Retracement Fan levels following a double breakout.

- The Bull Bear Power Indicator turned bullish with an ascending trendline.

- Bearish trading volumes have risen during the breakout.

- GRMN advanced with the S&P 500, a bullish confirmation.

My Call on Garmin

I am taking a long position in GRMN between $205.47 and $211.43. I am bullish on its recent deal with the Brazilian Air Force, which could lead to more contracts with partner nations, while its wearable tech segment remains undervalued. Garmin also has excellent operational metrics and one of the strongest current ratios in the tech sector.

Top Regulated Brokers

- GRMN Entry Level: Between $205.47 and $211.43

- GRMN Take Profit: Between $253.94 and $261.69

- GRMN Stop Loss: Between $182.94 and $191.44

- Risk/Reward Ratio: 2.15

Ready to trade our analysis of Garmin? Here is our list of the best stock brokers worth reviewing.