EUR/USD Analysis Summary Today

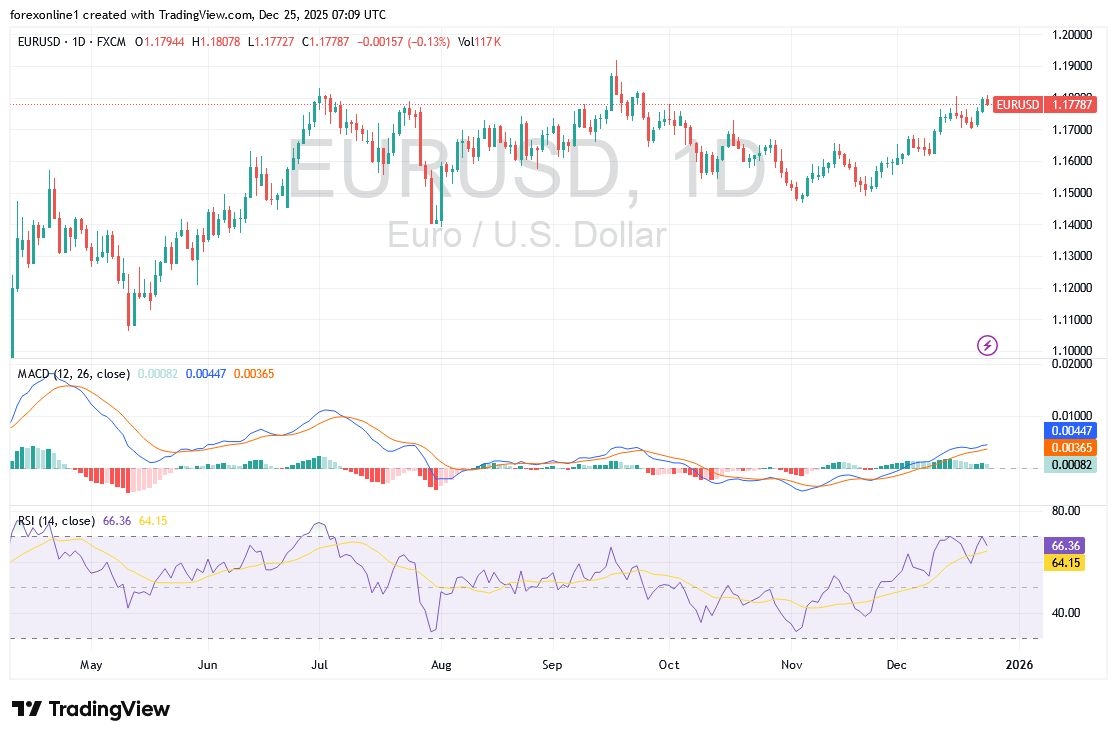

- Overall Trend: Bullish

- Support Levels for EUR/USD Today: 1.1745 – 1.1680 – 1.1600

- Resistance Levels for EUR/USD Today: : 1.1830 – 1.1880 – 1.1930

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1690 with a target of 1.1820 and a stop-loss at 1.1600.

- Sell EUR/USD from the resistance level of 1.1840 with a target of 1.1500 and a stop-loss at 1.1900.

Top Regulated Brokers

Technical Analysis of EUR/USD Today:

With the start of the Christmas holiday season, market liquidity is thinning and investor risk appetite is weakening until full market operations resume. Consequently, the EUR/USD exchange rate is expected to move within narrow ranges today, Thursday, staying close to its recent performance. According to reliable trading platforms, the Euro rose to 1.1807, breaking through a psychological level, before stabilizing around 1.1778 at the time of writing.

Bullish Scenario: The upward momentum for EUR/USD will strengthen if the price stabilizes above the 1.1800 resistance. As previously mentioned, this is the most critical level to watch for an eventual bullish breakout toward the 1.2000 resistance peak. Recent gains on the daily chart are beginning to push technical indicators into overbought territory, as seen in the 14-day Relative Strength Index (RSI) and the MACD.

Bearish Scenario: Conversely, for the "bears" to regain control of the general trend, the pair would need to return to the support vicinities of 1.1660 and 1.1500.

Today, No significant economic data releases impacting currency prices are expected.

Trading Advice:

Analysts advise caution when trading in narrow ranges during the annual holiday season to avoid sudden price gaps that could negatively impact open positions.

Will the Euro appreciate in the coming months?

According to currency trading experts, MUFG Bank anticipates strong support for the Euro. They expect increased demand for the Euro from central banks, which will be a significant driver of its appreciation. Also, the bank sees room for increased purchases of official Eurozone sovereign bonds. He noted that: “The supply of sovereign bonds will increase in Europe, and negative yields are certainly a thing of the past. The supply of EU bonds will also increase. The €90 billion loan deal concluded for Ukraine last week will contribute to improved liquidity and a gradual increase in central bank demand.”

Nordea Bank commented on its European Central Bank interest rate forecast, stating: “We remain satisfied with our current baseline forecast of stable interest rates until the second half of 2027, where we expect the ECB to raise interest rates twice by 25 basis points each time.” It added: “The risk of further interest rate cuts has diminished, although the possibility of another cut has not disappeared entirely.”

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.