EUR/USD Analysis Summary Today

- Overall Trend: In an upward technical correction.

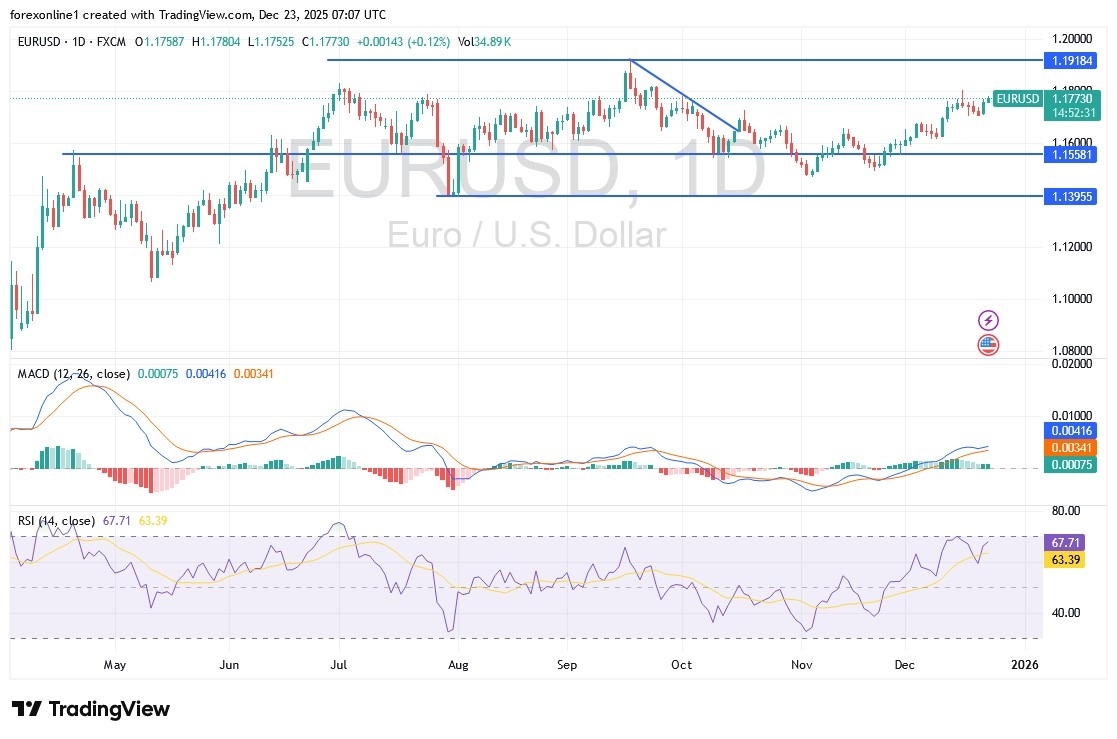

- Support Levels for EUR/USD Today: 1.1710 – 1.1650 – 1.1580

- Resistance Levels for EUR/USD Today: : 1.1800 – 1.1860 – 1.2000

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1660 with a target of 1.1820 and a stop-loss at 1.1590.

- Sell EUR/USD from the resistance level of 1.1830 with a target of 1.1500 and a stop-loss at 1.1900.

Technical Analysis of EUR/USD Today:

The EUR/USD began the penultimate trading week of 2025 on a positive note, rebounding toward the 1.1769 resistance level. Bulls are attempting to return to the 1.1800 psychological resistance area, a level critical for preparing for stronger upward breakouts. According to reliable trading platforms, the Euro is currently capitalising on the market's primary focus on Federal Reserve expectations rather than Eurozone policy.

Top Regulated Brokers

Expectations for further monetary easing by the Fed in 2026 continue to weigh on the US Dollar, even as the European Central Bank (ECB) signals no urgent need for interest rate adjustments. Risks remain tied to US economic growth, inflation, and political pressure on the Federal Reserve.

Currently, technical indicators confirm a shift in the EUR/USD trend, with the 14-day Relative Strength Index (RSI) hovering around 65, close to the overbought level, and the MACD indicator also trending upwards. The strong buying pressure from technical indicators is prompting bulls to push quickly towards the psychological resistance level of 1.2000. Today's EUR/USD trading will be influenced by the release of US economic growth figures and durable goods orders data, both at 3:30 PM Egypt time, followed by the US consumer confidence index from Michigan at 5:00 PM Egypt time.

Trading Advice:

Traders are advised to wait for market and investor reactions to the important US economic announcements, as this reaction will determine the direction of currency prices for the remainder of 2025 trading. Therefore, it is not recommended to keep positions open during the holiday season.

Expectations of Banks and Global Institutions for EUR/USD in the Coming Months:

In this context, Nordea Bank expects the EUR/USD exchange rate to rise to 1.24 by the end of 2026. HSBC expects EUR/USD to rise to 1.20 at the beginning of 2026 before retreating to 1.18 by the end of the same year.

Similarly, Société Générale commented on the short-term outlook for the EUR/USD pair, stating: “A slight pullback is currently forming; maintaining the 50-day moving average near 1.1610 will be crucial for the continuation of the upward trend. If the pair breaks above the 1.1800/1.1830 resistance levels, it is likely to experience further upward movement. The next targets could be the September high of 1.1920 and the psychological resistance at 1.2000.”

The Future of European Central Bank Policies

In this regard, the European Central Bank made no changes to interest rates at its latest meeting, keeping the deposit rate at 2.00%. Eurozone growth expectations have seen a slight improvement, while inflation is expected to remain around 2.00% over the medium term. ECB President Lagarde stated that there is no pre-determined path for interest rates.

In this regard, MUFG Bank commented on the European Central Bank's policies, stating: “We have scrapped our forecast of a final 25 basis point interest rate cut by the ECB in 2026. However, it is still too early for the Eurozone interest rate market to expect an early rate hike next year, given that inflation is still expected to remain below the ECB's target.” They added: “With the Bank of England and the Federal Reserve still expected to cut interest rates further next year, we anticipate continued strength in the euro in 2026, while the ECB maintains its current monetary policy stance.”

Future of US Federal Reserve Policy:

As for the United States, financial markets continue to expect further US interest rate cuts by the Federal Reserve in 2026 following the decline in inflation. The unemployment rate has reached a four-year high of 4.6%, while US jobs data overall has been mixed.

According to Nordea Bank; We expect the US dollar to weaken by 2026, as growth differentials and political uncertainty turn against it. We are particularly concerned about the Trump administration's focus on influencing the Federal Reserve. Rabobank also commented: “We expect the US economy to enter a cyclical recession next year. While many G10 central banks have completed their interest rate-cutting cycles, the Fed is likely to continue its monetary easing until 2026.”

The bank added in its outlook: “Additional risks to the US dollar include a new round of tariffs, persistently high inflation coupled with negative real interest rates, or a sharp correction in AI-related stocks.”

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.