EUR/USD Analysis Summary Today

- Overall Trend: : Within a technical correction upward.

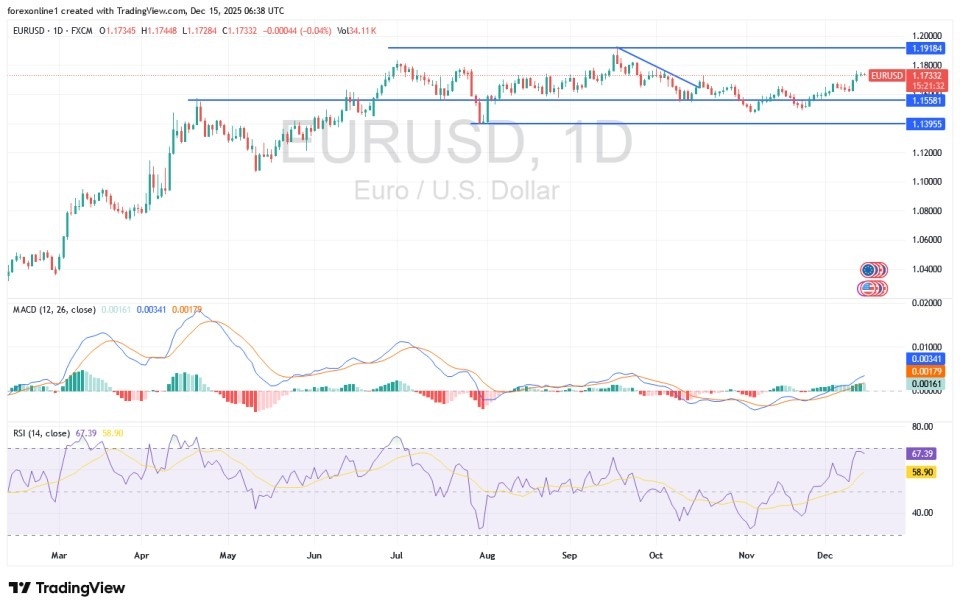

- Support Levels for EUR/USD Today: 1.1690 – 1.1620 – 1.1540

- Resistance Levels for EUR/USD Today: : 1.1790 – 1.1830 – 1.1900

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1640 with a target of 1.1850 and a stop-loss at 1.1580.

- Sell EUR/USD from the resistance level of 1.1810 with a target of 1.1500 and a stop-loss at 1.1900.

Technical Analysis of EUR/USD Today:

The EUR/USD pair continues to receive positive momentum from the divergence in the future policies of both the US Federal Reserve and the European Central Bank (ECB). Consequently, and according to reliable trading platforms, the Euro/Dollar price recently rose to the 1.1762 resistance level, the pair's highest in two months, before settling around 1.1733 at the time of writing this analysis. This stability is in anticipation of the crucial reaction this week to the ECB's policy announcement and the US jobs figures, the latter of which has been long-awaited due to the longest government shutdown in US history.

As is well known, US jobs figures and inflation levels are key factors influencing the Federal Reserve's policy decisions at upcoming meetings.

Obviously, the technical indicators confirm an upward technical correction for the EUR/USD pair. As shown on the daily chart, the 14-day Relative Strength Index (RSI) has moved towards the 67 resistance level after recent gains, with the nearest point to the overbought line being 70.

Top Regulated Brokers

Simultaneously, the MACD lines are steadily trending upwards, confirming the bulls' readiness for further gains if the factors driving the currency's price increase continue. Breaking above the psychological resistance level of 1.1800 remains crucial to confirming the overall trend shift and simultaneously supports the potential for a move towards the psychological resistance level of 1.2000, which has been identified as a target for trading in 2026.

A scenario for a EUR/USD decline on the same daily chart would require a return to the 1.1500 psychological support level. No major economic data releases are expected today, suggesting that the pair may trade within a narrow range around its current levels.

Trading Tips:

The EUR/USD pair is expected to remain within its recent range. Therefore, avoid placing trades within narrow price movements and wait for the reaction to this week's key events to determine the most suitable buy or sell opportunities.

EUR/USD Forecast Versus Central Bank Policies

According to currency trading experts' forecasts, the Euro/Dollar exchange rate will remain supported in this regard. As the new year's trades approach, currency investors will continue to monitor this divergence. Currently, they are focused on reassessing the possibility that the ECB may become one of the few G10 central banks with serious indications of monetary policy tightening in 2026. This shift would carry positive, albeit limited, implications for the single European currency.

Currency analysts believe that signs of interest rate hikes are beginning to emerge in several G10 markets, supporting currencies like the Australian Dollar, New Zealand Dollar, and Swedish Krona. They predict that, in the baseline scenario, the ECB will keep its monetary policy unchanged in 2026. However, if the market starts pricing in a more hawkish scenario, the Euro price will clearly benefit.

Experts also indicate that financial markets quickly shifted from expecting rate cuts to tentatively pricing in rate hikes in 2026 for the Australian Dollar, New Zealand Dollar, Canadian Dollar, and Swedish Krona—dynamics that have already supported these currencies. As for the Euro, a rate cut has been almost entirely ruled out.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.