EUR/USD Analysis Summary Today

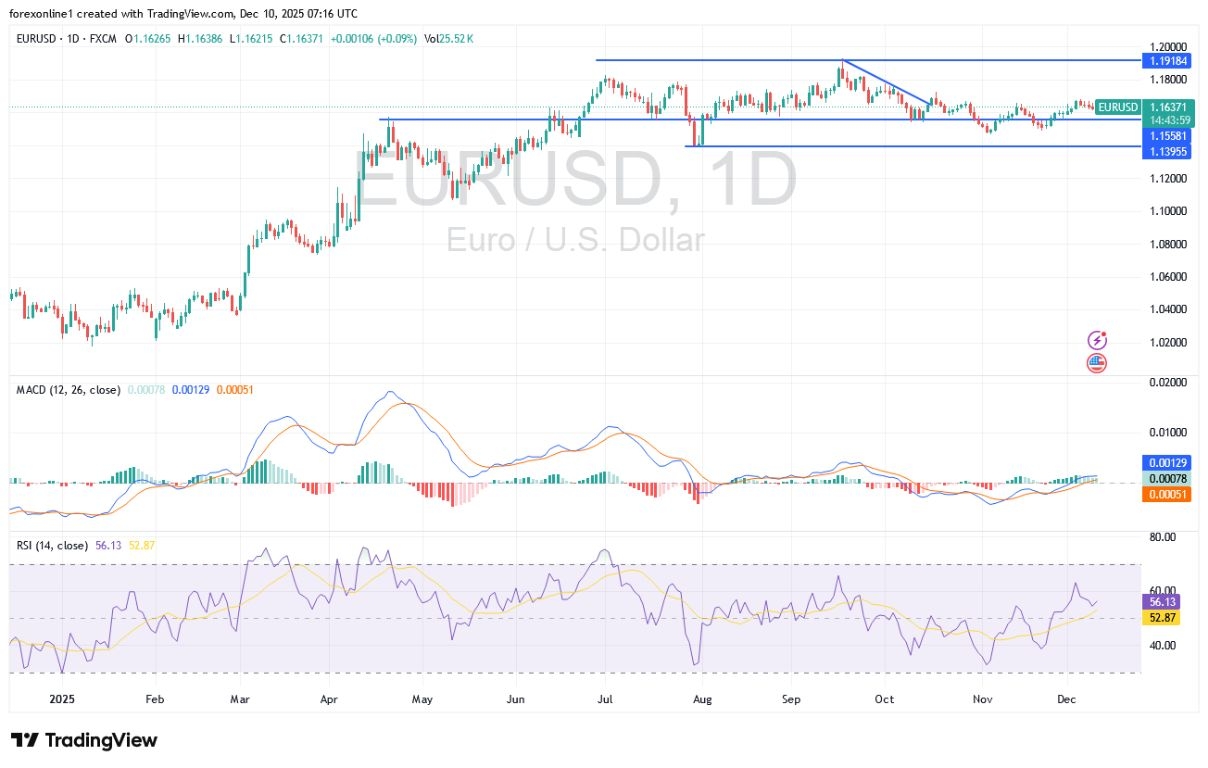

- Overall Trend: Neutral.

- Support Levels for EUR/USD Today: 1.1590 – 1.1520 – 1.1470.

- Resistance Levels for EUR/USD Today: 1.1680 – 1.1760 – 1.1820.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1540 with a target of 1.1800 and a stop-loss at 1.1480.

- Sell EUR/USD from the resistance level of 1.1740 with a target of 1.1500 and a stop-loss at 1.1800.

Top Regulated Brokers

Technical Analysis of EUR/USD Today:

Dear reader, as observed in market performance, the EUR/USD pair is showing stability within a short-term ascending triangle pattern, with the price currently testing the horizontal resistance level at the psychological mark of 1.1650. This chart pattern typically signals bullish continuation, suggesting the possibility of an upward breakout. The EUR/USD is trading around the 1.1645 level, hovering just below the resistance area that has capped gains since late November.

A decisive break above this ceiling could lead to a measured ascent equal to the height of the triangle pattern, targeting the 1.1750 level or higher. This would confirm a shift in momentum and restore buyer control over the market. However, if the resistance holds, the EUR/USD pair may retreat to test support levels within the triangle. The ascending trend line, which connects the pair's lows since mid-November, lies around the 1.15500 support level, coinciding with the dynamic support of the 100-day Simple Moving Average (SMA) and the 200-day SMA. Technically, these moving averages have recently converged and begun to flatten, reflecting market indecision.

Meanwhile, the convergence of the 100- and 200-period SMAs suggests that a breakout in either direction could determine the next move for the currency pair. A bounce off the trend line support would keep the triangle intact and pave the way for another attempt to break above the top. The Stochastic oscillator is currently hovering in the middle, showing neither strong buying nor selling pressure. The oscillator has room to rise towards overbought territory, which could support a potential upside if resistance is broken.

The Relative Strength Index (RSI) is also in neutral territory around the 50 level, allowing for movement in either direction. An upward move would indicate strengthening bullish momentum, while a decline might suggest that sellers are successfully defending the resistance zone.

Trading Tips:

Dear TradersUp trader, be cautious. The EUR/USD pair may be affected by the eagerly awaited FOMC decision today, where the Federal Reserve is expected to cut US interest rates, perhaps signaling a more cautious pace for future monetary policy easing.

Euro/Dollar Trading Influenced by the Future of ECB Policies

According to Forex currency market trades, a "hawkish" bias in Eurozone interest rate expectations is supporting the EUR/USD exchange rate. In this context, an influential European Central Bank (ECB) official stated that she is comfortable with current market bets that the Eurozone central bank's next move will be a rate hike. Isabel Schnabel, a member of the ECB Governing Council, stated in an interview earlier this week that "markets and survey participants expect the next step to be a rate hike, even if it is not soon. I am quite comfortable with this expectation."

Jana Randow, who conducted the interview with Schnabel for Bloomberg, said she was "surprised by the 'hawkish' nature of her stance." She added: "Of course, we knew she had these ideas, but hearing her be so explicit that the next move will likely be a rate hike... was certainly news we didn't expect from her."

Across reliable trading platforms, the surprise was reflected in Eurozone bond yields outperforming US and UK bond yields, mirroring the shift in expectations regarding the ECB's interest rate policy. Expectations for the ECB's rate path have risen.

Technically, the euro/dollar exchange rate reached a resistance level of 1.1672 and is maintaining its gains this December, remaining above its key 55-day moving average. The recent weakness of the US dollar is not the only factor supporting the euro against the dollar. Last week, Germany boosted the euro when German factory orders rose 1.5% in October, five times the market expectation of 0.3%, and September's reading was revised upwards from 1.1% to 2.0%.

French industrial production also surprised expectations, exceeding forecasts with a 0.2% increase compared to the anticipated 0.1% decline. Spanish output rose 0.7%, surpassing expectations of 0.5%. Overall, the strong growth trajectory and persistently high inflation reinforce Schnabel's argument for keeping interest rates unchanged.

Regarding the future of monetary policy, with the US Federal Reserve poised to cut interest rates today, the divergence in interest rate policies between the US and the Eurozone will continue to strengthen the euro against the US dollar.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.