EUR/USD Analysis Summary Today

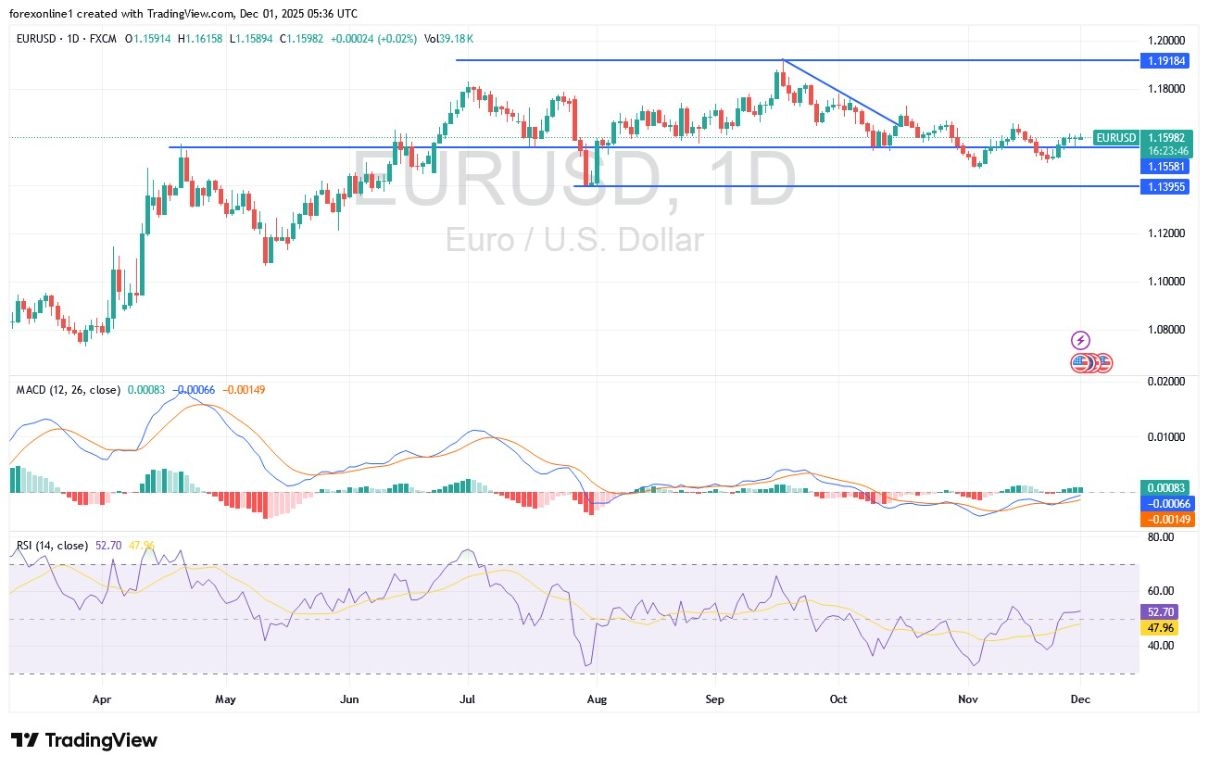

- Overall Trend: : Neutral.

- Support Levels for EUR/USD Today: 1.1555 – 1.1470 – 1.1400

- Resistance Levels for EUR/USD Today: : 1.1640 – 1.1700 – 1.1770

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1510 with a target of 1.1700 and a stop-loss at 1.1450.

- Sell EUR/USD from the resistance level of 1.1700 with a target of 1.1500 and a stop-loss at 1.1780.

Technical Analysis of EUR/USD Today:

At the end of last week's trading, the EUR/USD stabilized following the release of the latest Eurozone Consumer Price Index (CPI) data. As announced, inflation is stable across most member states, and falling energy prices may contribute to its gradual decline. Excessive disinflation could eventually prompt the European Central Bank (ECB) to consider further cuts, which would weigh on the Euro, but there is no evidence of this yet. According to licensed currency trading platforms, the Euro/Dollar price is currently stable around the 1.1600 level in the neutral zone at the start of the trading week.

Eurozone Inflation Rate Stabilization

According to the results of the economic calendar data, consumer price pressures in the Eurozone continue to show stability. National data pointed to subdued inflation expectations for November, reinforcing the ECB's position to keep interest rates unchanged at this month's meeting. As announced, the annual Consumer Price Index (CPI) in France stabilized at 0.8%. Harmonized inflation in Spain fell slightly to 3.1% from 3.0%, as falling food and transport prices offset some stickier core factors. In Germany, regional data from key states like North Rhine-Westphalia and Bavaria showed little change from the previous national reading of 2.3%.

On the other hand, selling price expectations in the services and manufacturing sectors have recently risen again, and upcoming fiscal stimulus is also expected to lead to new inflationary pressures, at least in certain sectors. In this regard, economists at Standard Chartered reported that their model suggests Eurozone core inflation is aligning with 2.5% for November. Akriti Agarwal, the bank's European economist, stated that the rising Euro and weaker Spanish data would neutralize the upward effects of producer prices in other regions.

Top Regulated Brokers

When is the euro trading bullish?

Based on the daily chart above, the current trading range for the EUR/USD is neutral. This is confirmed by the 14-day Relative Strength Index (RSI) holding around a reading of 52, slightly above the neutral line. Simultaneously, the MACD indicator lines are preparing to turn upward pending stronger positive catalysts. A bullish turn for the Euro/Dollar requires a move toward the resistance levels of 1.1685, 1.1770, and 1.1820, respectively. Conversely, the bearish scenario for the Euro/Dollar will remain the most likely as long as it stabilizes around and below the psychological support level of 1.1500.

Today's EUR/USD trading session will react to the release of the Manufacturing Purchasing Managers' Index (PMI) readings for Eurozone economies. This starts with the Spanish reading at 10:15 AM Egypt time, the German reading at 10:55 AM Egypt time, and the aggregate Eurozone reading at 11:00 AM Egypt time. Following this, the US ISM Manufacturing PMI reading will be announced at 5:00 PM Egypt time.

Meanwhile, attention will now turn to the peace negotiations between Ukraine and Russia. As is known, any breakthrough could push energy prices down and potentially support the euro until the end of the year.

Trading Advice:

The EUR/USD exchange rate remains in a convoluted range. We are waiting for a strong move to determine the most suitable trading opportunities. Ultimitally, Buying below 1.1480 may be the best option.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.