Ethereum’s downturn, fuelled by macroeconomic pressures, raises questions about ETH’s near-term floor amid volatile global markets.

ETH Liquidates $140 Million Longs on Drop Below $3,000

ETH price fell as low as $2,807 on Monday, down 5.5% in the past 24 hours, amid a broader market correction.

This extended the drawdown from the Aug. 24 all-time high of $4,953 to 43% and was accompanied by massive liquidations across the derivatives market.

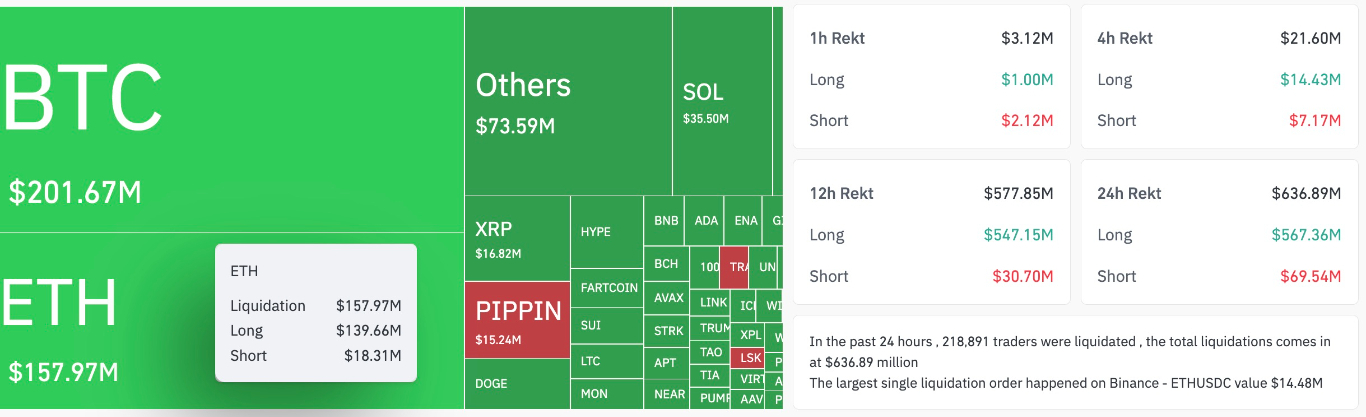

Derivatives data from CoinGlass reveals that the cryptocurrency market witnessed a brutal cascade of liquidations, with Ethereum wiping about $140 million in long positions within hours.

The drop below $3,000 triggered automated margin calls on leveraged trades across major exchanges like Binance and Bybit, where overleveraged bulls—betting on a continued rally—were forced to exit en masse.

The figure below shows that more than $564.3 million in long positions were liquidated, with Bitcoin accounting for $188.5 million of that total.

Crypto liquidations (screenshot). Source: CoinGlass

Liquidations occur when traders use borrowed funds to amplify their positions, but a sudden price drop erodes their collateral below maintenance margins, prompting exchanges to sell off assets to cover debts. In this case, ETH's slide from $3,200 to under $2,800 in a matter of hours created a feedback loop: forced sales flooded the order books, driving prices even lower and activating more stops.

The $140 million figure, while significant, pales in comparison to broader market liquidations exceeding $636 million across assets, including Bitcoin, but it underscored ETH's vulnerability.

More than 218,891 leverage traders were liquidated, with the largest single liquidation order happening on Binance involving the ETHU/SDC pair valued at $14.48 million.

Bank of Japan Rate Hike Fears Trigger a Yen Carry Trade Unwind

Today’s downside in the crypto market has been attributed to surging expectations for a BoJ rate hike at its Dec. 18-19 meeting. This has sparked fears of a Yen carry trade reversal, sending ripples through risk assets, including Ethereum.

For decades, the carry trade—borrowing cheap yen at near-zero rates to fund higher-yield investments in stocks, bonds, and cryptocurrencies—has propped up global liquidity, injecting trillions into markets.

With Japan’s 2-year bond yield hitting 1.01%, a 2-year high, and Governor Kazuo Ueda signalling tighter policy amid persistent inflation at 2.9%, traders are scrambling to unwind positions, fearing a yen surge that could make repayment costlier.

“Japanese yields are spiking with the 2-year at its highest level since 2008. The Yen is also surging,” said co-founder and CEO Coinbureau Nic in his latest post on X.

Nic said that bond investors are now placing a “76% chance of a BoJ rate hike on Dec. 19,” adding:

“An increase in Japanese base rates and strengthening of the Yen leads to an unwind of the carry trade (borrowing in Yen, buying risk assets).”

Japanese 2-year yields. Source: Nick on X

The mechanics are straightforward, yet devastating: investors borrow Yen, convert to Dollars or other currencies, and pour funds into ETH or Bitcoin for yields far exceeding Japan’s 0.5% policy rate.

A hike to 0.75% or higher would widen borrowing costs while strengthening the yen—up 0.4% to 155.49 against the USD on Dec. 1—eroding profits and triggering margin calls.

A stronger yen from higher rates makes carry trades costlier, prompting investors to unwind positions en masse. This forces the sale of risk assets, as seen in August 2024, when a surprise BOJ hike triggered a 20% BTC price crash to $49,000 and $1.7 billion in liquidations.

Ether Price Validates Bear Flag Projecting Drop to $2,150

Ethereum's chart has confirmed a bearish flag pattern, a classic continuation setup that projects potential deeper downside risks for ETH in December.

Formed since Nov. 10 in the daily time frame, the pattern emerged after ETH’s failed rally from October lows: a sharp pole down from $3,600 to $2,620, followed by a consolidating channel of higher highs and higher lows, forming the flag as shown in the chart below.

The breakdown below the flag’s lower trendline at $3,000—coupled with surging volume—signals continuation of the prior bear impulse, targeting a measured move equal to the pole’s length at $2,150. Such a move represents a 24% drop from current levels.

ETH/USD daily chart. Source: TradingView

Ether’s downside is backed by the position of the relative strength index below the midline at 34. This suggests that the current market conditions favor the downside.

This setup aligns with broader sentiment: The ETH/BTC ratio is at yearly lows (0.031), showing relative weakness, while DAA divergence per Santiment indicates low network activity to sustain rebounds.

If confirmed, the drop could unfold over 2-4 weeks, exacerbated by macroeconomic headwinds, such as the yen unwind.

Ready to trade our analysis of Ethereum? Here’s our list of the best MT4 crypto brokers worth reviewing.