Short Trade Idea

Enter your short position between $215.74 (yesterday’s intra-day low) and $223.89 (Friday’s intraday high).

Market Index Analysis

- Equifax (EFX) is a member of the S&P 500.

- This index is nearing breakdowns of its bearish chart pattern.

- The Bull Bear Power Indicator of the S&P 500 turned negative with a descending trendline.

Market Sentiment Analysis

Equity markets mostly extended their sell-off after the delayed release of the October and November NFP reports. October showed a net loss of 105,000 jobs, while November showed a gain of 64,000, and the unemployment rate rose to 4.6%. Overall, 710,000 more people are unemployed than in November 2024, and Fed Chief Powell warned about extreme overstatements in the job report, due for a revision in February. Retail sales came in flat, missing estimates for a 0.1% rise. The data was insufficient to entice the central bank to cut interest rates again at its next meeting, fueling yesterday’s sell-off.

Equifax Fundamental Analysis

Equifax is a consumer credit reporting agency and belongs to the Big Three, alongside Experian and TransUnion. It collects data on over 800 million consumers and 88 million businesses globally.

So, why am I bearish on EFX amid its recent bounce?

Ongoing margin pressures and high valuations do not support higher prices. Cyclical weakness in mortgage applications dents revenue potential, and high litigation costs will eat into free cash flow. Equifax also suffers from an average return on invested capital below the industry average, suggesting management’s inability to unlock profitable ventures. The high debt-to-equity ratio is another area of concern.

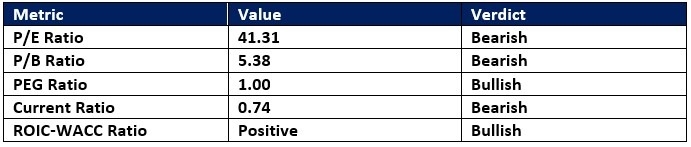

Equifax Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 41.31 makes EFX an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.09.

The average analyst price target for EFX is $267.25. It suggests good upside potential, but bearish factors continue to dominate.

Equifax Technical Analysis

Today’s EFX Signal

Equifax Price Chart

- The EFX D1 chart shows price action inside a bearish price channel.

- It also shows price action between its descending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- EFX advanced less than the S&P 500, a bearish confirmation.

My Call on Equifax

I am taking a short position in EFX between $215.74 and $223.89. Balance sheet issues, contracting profit margins with rising input costs, high litigation costs, and cyclical weakness in mortgage applications form my bearish case.

- EFX Entry Level: Between $215.74 and $223.89

- EFX Take Profit: Between $159.95 and $173.28

- EFX Stop Loss: Between $236.49 and $244.37

- Risk/Reward Ratio: 2.69

Ready to trade our analysis of Equifax? Here is our list of the best stock brokers worth checking out.