Short Trade Idea

Enter your short position between $508.32 (the intra-day low of its last bearish candlestick) and $520.30 (yesterday’s intra-day high).

Market Index Analysis

- CrowdStrike (CRWD) is a member of the NASDAQ 100 and the S&P 500.

- Both indices trade in bearish chart patterns with rising bearish trading volumes.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish with a negative divergence and does not support the recent uptrend.

Market Sentiment Analysis

Equity markets closed lower yesterday after a positive start. Equity futures remain mixed this morning as NVIDIA moved higher in after-hours trading after President Trump approved the company’s sale of its H200 AI chips to approved customers in China, in return for 25% of the sales value. Investors may exercise caution today ahead of tomorrow’s FOMC announcement, where a 25-basis-point interest rate cut remains priced in, but the outlook could still inject volatility. AI and retail earnings could move price action, with earnings from Oracle, Broadcom, Costco, and Lululemon on deck.

CrowdStrike Fundamental Analysis

CrowdStrike is a cybersecurity company with a promising push into AI-based and cloud-based cybersecurity solutions.

So, why am I bearish on CRWD after its earnings report?

CrowdStrike reported revenues of $1.230 billion and earnings per share of $0.96, besting estimates of $1.214 billion and $0.94, respectively. While it delivered excellent ARR growth and net cash from operations, I turned bearish as its operating margins contracted, and its GAAP attributable net loss to shareholders more than doubled. Valuations are sky-high, even by the standards of AI-related companies, and I consider CRWD significantly overvalued.

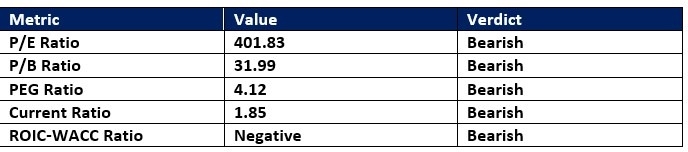

CrowdStrike Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 401.83 makes CRWD an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 34.71.

The average analyst price target for CRWD is $549.52. This suggests good upside potential with magnified downside risks.

CrowdStrike Technical Analysis

Today’s CRWD Signal

CrowdStrike Price Chart

- The CRWD D1 chart shows price action inside a bearish price channel.

- It also shows price action between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bullish with a descending trendline, approaching a bearish crossover.

- The average bearish trading volumes are higher than the average bullish trading volumes following its earnings report.

- CRWD correction as the NASDAQ 100 recovered, a significant bearish trading signal.

My Call on CrowdStrike

I am taking a short position in CRWD between $508.32 and $520.30. Valuations are excessive and disconnected from economic reality, GAAP losses have doubled, and operating margins have contracted, despite rising revenues and 20%+ ARR growth.

Top Regulated Brokers

- CRWD Entry Level: Between $508.32 and $520.30

- CRWD Take Profit: Between $402.66 and $434.34

- CRWD Stop Loss: Between $543.85 and $566.90

- Risk/Reward Ratio: 2.97

Ready to trade our analysis of CrowdStrike? Here is our list of the best stock brokers worth reviewing.