Short Trade Idea

Enter your short position between $357.12 (Friday’s intra-day low) and $374.45 (the intra-day high of its last bullish candlestick).

Market Index Analysis

- Constellation Energy (CEG) is a member of the NASDAQ 100 and the S&P 500.

- Both indices rallied close to all-time highs on low volumes and amid rising bearish pressure.

- The Bull Bear Power Indicator for the S&P 500 is bearish but shows a negative divergence and does not support the recent rally.

Market Sentiment Analysis

Equity futures are pointing modestly higher, building on last week’s optimism that the Federal Reserve will deliver a 25-basis point interest rate cut this week. The October JOLTS report, delayed by the now-resolved government shutdown, will provide a much-anticipated snapshot of the faltering labor market. Markets will receive reports from Oracle and Adobe on Wednesday, and Broadcom and Costco on Thursday, which could inject volatility. Investors also monitor potential antitrust issues following Netflix’s announcement of plans to acquire Warner Bros. assets for $72 billion. On the macroeconomic level, China’s November trade data showed its surplus exceeded expectations.

Constellation Energy Fundamental Analysis

Constellation Energy is the largest nuclear power generator and a leading energy company in the US. It is also at the forefront of powering data centers for AI companies and is a leading player in the green energy revolution.

So, why am I bearish on CEG at current levels?

CEG confirmed my expectations of an earnings disappointment, reporting EPS of $3.04, or $2.97 adjusted, versus estimates of $3.11. While its now-cleared $16 billion acquisition of Calpine will diversify its operations, I see more medium-term downside amid industry-low margins, negative EPS growth, and cash flow issues. Also, the Return on Invested Capital (ROIC) remains below the Cost of Capital (WACC).

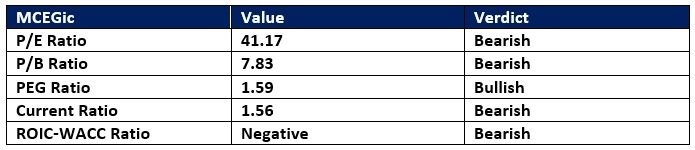

Constellation Energy Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 41.17 makes CEG an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.21.

The average analyst price target for CEG is $399.93, suggesting moderate upside potential with rising downside risks.

Constellation Energy Technical Analysis

Today’s CEG Signal

Constellation Energy Price Chart

- The CEG D1 chart shows price action inside a bearish price channel.

- It also shows price action below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bullish with a descending trendline, approaching a bearish crossover.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- CEG advanced far less than the S&P 500, a bearish confirmation.

My Call on Constellation Energy

Top Regulated Brokers

I am taking a short position in CEG between $357.12 and $374.45. CEG remains overvalued, struggles with margins, and negative EPS growth, which fuel my bearish narrative.

- CEG Entry Level: Between $357.12 and $374.45

- CEG Take Profit: Between $293.15 and $316.18

- CEG Stop Loss: Between $388.47 and $400.98

- Risk/Reward Ratio: 2.04

Ready to trade our analysis of Constellation Energy? Here is our list of the best stock brokers worth reviewing.