Short Trade Idea

Enter your short position between $78.51 (yesterday’s intra-day low) and $80.06 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Cisco Systems (CSCO) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All indices trade inside bearish chart formations with rising breakdown catalysts.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish with a descending trendline.

Market Sentiment Analysis

Equity futures waver in and out of positive territory as markets await the Fed decision, where a hawkish cut is the base case, referring to a 25-basis-point interest rate cut with a hawkish statement that future cuts will have a higher threshold. The dot-plot chart will receive heightened attention. JP Morgan experienced its most significant one-day decline in six months after warning on higher 2026 spending amid rising credit card competition and AI-related costs. Oracle will provide the next AI test, as high debt and valuation concerns linger, while silver rallied to a fresh all-time high above $60, driven by tight supply and economic woes.

Cisco Systems Fundamental Analysis

Cisco Systems is a technology company known for its networking, security, software, and cloud computing solutions. It has also faced allegations of collaborating with the NSA’s Tailored Access Operations (TAO) unit to intercept network gear.

So, why am I bearish on CSCO despite its 20%+ rally?

AI demand will drive infrastructure investments, and despite minor trust issues, Cisco Systems should capitalize on this. Still, I cannot ignore the declining operating and profit margins. Its long-term debt is also rising, and single-digit earnings-per-share growth expectations do not support the recent rally. Over the past month, the consensus earnings estimate has been decreasing, and increased competition is likely to challenge CSCO’s market position.

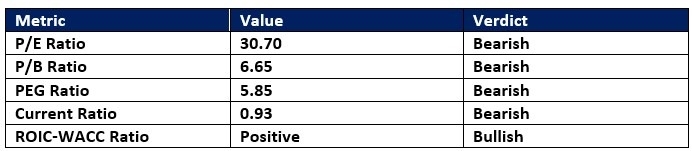

Cisco Systems Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 30.70 makes CSCO an expensive stock in its industry, but reasonably priced compared to the NASDAQ 100. By comparison, the P/E ratio for the NASDAQ 100 is 34.71.

The average analyst price target for CSCO is $84.81. It suggests limited upside potential, while downside risks are accumulating.

Top Regulated Brokers

Cisco Systems Technical Analysis

Today’s CSCO Signal

Cisco Systems Price Chart

- The CSCO D1 chart shows a price action inside its horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- Trading volumes have decreased during its recent push higher.

- CSCO advanced with the NASDAQ 100, a bullish confirmation, but bearish catalysts are rising.

My Call on Cisco Systems

I am taking a short position in CSCO between $78.51 and $80.06. The high 5-year PEG ratio, decreasing margins, and meager EPS growth projections highlight my bearish stance.

- CSCO Entry Level: Between $78.51 and $80.06

- CSCO Take Profit: Between $62.30 and $65.75

- CSCO Stop Loss: Between $84.81 and $87.35

- Risk/Reward Ratio: 2.57

Ready to trade our analysis of Cisco Systems? Here is our list of the best stock brokers worth checking out.