Short Trade Idea

Enter your short position between $180.39 (the intra-day low of its current correction) and $186.36 (the lower band of its horizontal resistance zone).

Market Index Analysis

- Cintas Corporation (CTAS) is a member of the NASDAQ 100 and the S&P 500.

- Both indices advance inside bearish chart patterns with rising bearish trading volumes.

- The Bull Bear Power Indicator of the S&P 500 is positive but below its descending trendline.

Market Sentiment Analysis

Equity markets have continued their reversal from November’s lows, driven by hopes that the US central bank will deliver a Christmas gift in the form of a 25-basis point interest rate cut. Still, conditions from November’s sell-off persist, and lower interest rates will not address them. While the holiday shopping season started at a record-setting pace, it masked the weakening consumer. Adding to consumer worries is the weakening labor market, while inflation remains stubborn. The AI bubble conversation began to shift into air-pocket talk. Still, uncertainty continues to accompany the AI trade, with Snowflake’s earnings miss being the latest reminder of an overvalued sector.

Cintas Corporation Fundamental Analysis

Cintas Corporation provides corporate uniforms via rental and sales programs. It also sells a range of office equipment from janitorial to safety products. It is one of the largest companies in its sector with over 44,000 employees.

So, why am I bearish on CTAS despite its 20%+ correction?

The latest earnings report and outlook failed to impress investors, and valuations are higher than those of some AI behemoths. The weakening labor market softens demand for CTAS’s core products, while US interest rate cuts amplify the negative impact of foreign exchange on earnings. At the same time, other central banks stay put, which puts pressure on Cintas Corporation’s revenue and margins.

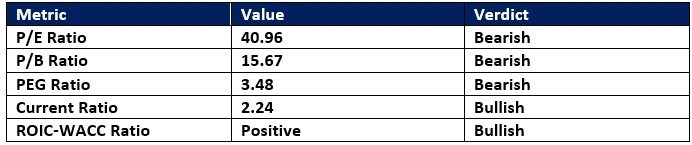

Cintas Corporation Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 40.96 makes CTAS an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.73.

The average analyst price target for CTAS is $214.88. This suggests strong upside potential, but there are notable downside risks.

Cintas Corporation Technical Analysis

Today’s CTAS Signal

Cintas Corporation Price Chart

- The CTAS D1 chart shows price action breaking down below its horizontal resistance zone.

- It also shows price action between the descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bearish trading volumes.

- CTAS flatlined as the S&P 500 Index advanced, a significant bearish trading signal.

My Call on Cintas Corporation

I am taking a short position in CTAS between $180.39 and $186.36. Valuations are excessive, the 5-year PEG ratio confirms an overvalued company, and the outlook is dim.

- CTAS Entry Level: Between $180.39 and $186.36

- CTAS Take Profit: Between $151.95 and $156.54

- CTAS Stop Loss: Between $192.50 and $199.39

- Risk/Reward Ratio: 2.35

Ready to trade our analysis of Cintas? Here is our list of the best stock brokers worth reviewing.