Short Trade Idea

Enter your short position between $31.72 (the lower band of its horizontal resistance zone) and $32.80 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Carnival (CCL) is a member of the S&P 500.

- This index trades inside a bearish chart pattern with fading bullish volumes.

- The Bull Bear Power Indicator of the S&P 500 turned bullish but remains below its descending trendline.

Market Sentiment Analysis

Equity futures are red to start the morning, after a three-day rally led by AI names. Today’s market-moving data includes a first look at the third-quarter GDP and updates on the PCE price index for July, August, and September. Geopolitical tensions continue to drive gold and silver prices higher, as tension with Venezuela mirrors a proxy fight with China. The US economy remains in an obvious cool-down period, as evidenced by a cooling labor market, and questions over last week’s weak inflation data hang over markets.

Carnival Fundamental Analysis

Carnival is a cruise ship operator with over 90 vessels in its fleet and nine cruise line brands. It is one of the most recognized cruise line operators, known for organizing theme-based cruises.

So, why am I bearish on CCL after its earnings release?

While I appreciate the reinstatement of a $0.15 dividend, the upbeat outlook does not justify the recent rally. Earnings per share of $0.35 handily beat estimates of $0.24, and the adjusted revenue of $6.3 billion inched above the $6.2 billion expectation. I remain bearish on consumer weakness that appears to extend into 2026, high debt levels, and market-share concerns amid fierce competition.

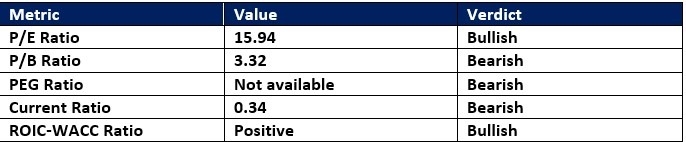

Carnival Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 15.94 makes CCL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.01.

The average analyst price target for CCL is $36.39. It suggests limited upside potential with accelerating downside risks.

Carnival Technical Analysis

Today’s CCL Signal

- The CCL D1 chart shows price action inside a horizontal resistance zone.

- It also shows price action pushing above its ascending 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bullish with an ascending trendline, which could add to short-term volatility.

- Bullish trading volumes spiked over the past two days but remain lower than bearish volume spikes during the previous earnings release.

- CCL advanced with the S&P 500, a bullish confirmation, but bearish catalysts accumulated following the two-day rally.

Top Regulated Brokers

My Call on Carnival

I am taking a short position in CCL between $31.72 and $32.80. I am bearish because the good news appears to be priced into the current share price, while debt levels are high, and competition threatens its market share.

- CCL Entry Level: Between $31.72 and $32.80

- CCL Take Profit: Between $24.60 and $25.91

- CCL Stop Loss: Between $34.44 and $36.39

- Risk/Reward Ratio: 2.62

Ready to trade our analysis of Carnival? Here is our list of the best stock brokers worth checking out.