Short Trade Idea

Enter your short position between $244.82 (the intra-day high of its last bearish candlestick) and $247.91 (yesterday’s intra-day high).

Market Index Analysis

- Capital One (COF) is a member of the S&P 100 and the S&P 500.

- Both indices trade near records but fading bullish trading volumes do not support the current rally.

- The Bull Bear Power Indicator of the S&P 500 is bullish but shows a negative divergence.

Market Sentiment Analysis

The S&P rallied above 6,900, with AI optimism in the driver’s seat. While the delayed GDP report showed a faster-than-expected expansion, inflation accelerated, and the chain-weighted price index, which includes consumers switching to less expensive products for pricier items, surged 3.8%. Consumer confidence slid for a fifth consecutive month, with a sour short-term outlook on current business conditions and the labor market, and debt levels are at record levels. Gold and silver prices rallied, and the disconnect between various market forces will eventually come to a breaking point.

Capital One Fundamental Analysis

Capital One is a bank holding company, the third-largest issuer of Visa and Mastercard credit cards, and a leading US car finance company. It is also the ninth-largest US bank by total assets as of September 30, 2024.

So, why am I bearish on COF after its nearly 25% rally?

I remain bearish on Capital One, as the underlying fundamentals fail to support the share price rise, and despite EPS growth, the balance sheet remains fragile. Its return on assets and equity rank near the bottom of the industry, profit margins are dismal, and it has increased its overall share count.

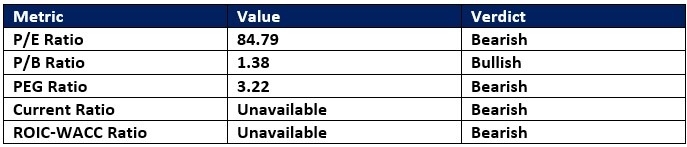

Capital One Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 84.79 makes COF an expensive stock. By comparison, the P/E ratio for the S&P 500 is 27.85.

The average analyst price target for COF is $264.48. This suggests moderate upside potential, with outsized downside risks.

Capital One Technical Analysis

Today’s COF Signal

Capital One Price Chart

- The COF D1 chart shows price action inside a rising wedge formation.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- The average bullish trading volumes have decreased as prices increased and do not confirm the rally.

- COF advanced with the S&P 500, a bullish confirmation, but breakdown catalysts have accumulated.

Top Regulated Brokers

My Call on Capital One

I am taking a short position in COF between $244.82 and $247.91. I remain bearish given dismal profit margins, a messy balance sheet, rising credit card delinquencies, subprime auto loans, and a struggling consumer in a weakening economy.

- COF Entry Level: Between $244.82 and $247.91

- COF Take Profit: Between $218.00 and $228.42

- COF Stop Loss: Between $256.55 and $264.48

- Risk/Reward Ratio: 2.29

Ready to trade our analysis of Capital One? Here is our list of the best stock brokers worth checking out.