As the holiday season heats up, Bitcoin traders are buzzing with optimism about a potential "Santa Rally"— a festive surge that could propel the cryptocurrency beyond $100,000. Currently hovering around $90,000 after a period of consolidation, Bitcoin has shown resilience amid broader market volatility.

“Santa Rally” often seen in traditional markets during year-end, involves reduced liquidity, institutional rebalancing, and seasonal sentiment driving prices higher.

Data from CoinMarketCap and TradingView showed BTC/USD hitting an intra-day high of $90,530 on Tuesday, up 6.5% from a local low of $84,000.

Several technical, fundamental, and market structure factors align to suggest Bitcoin’s breakout over Christmas.

Bitcoin’s Regime Score Flips Positive

One key reason traders anticipate a Santa Rally is the bullish edge in Bitcoin's derivatives market. Recent analysis shows the structure of options and futures providing a "tactical advantage" to bulls, particularly as short positions face increasing pressure.

With a massive options expiry looming on December 26, dealers are hedging large call open interest clustered around $100,000 to $118,000, effectively pinning prices in a narrow range for now.

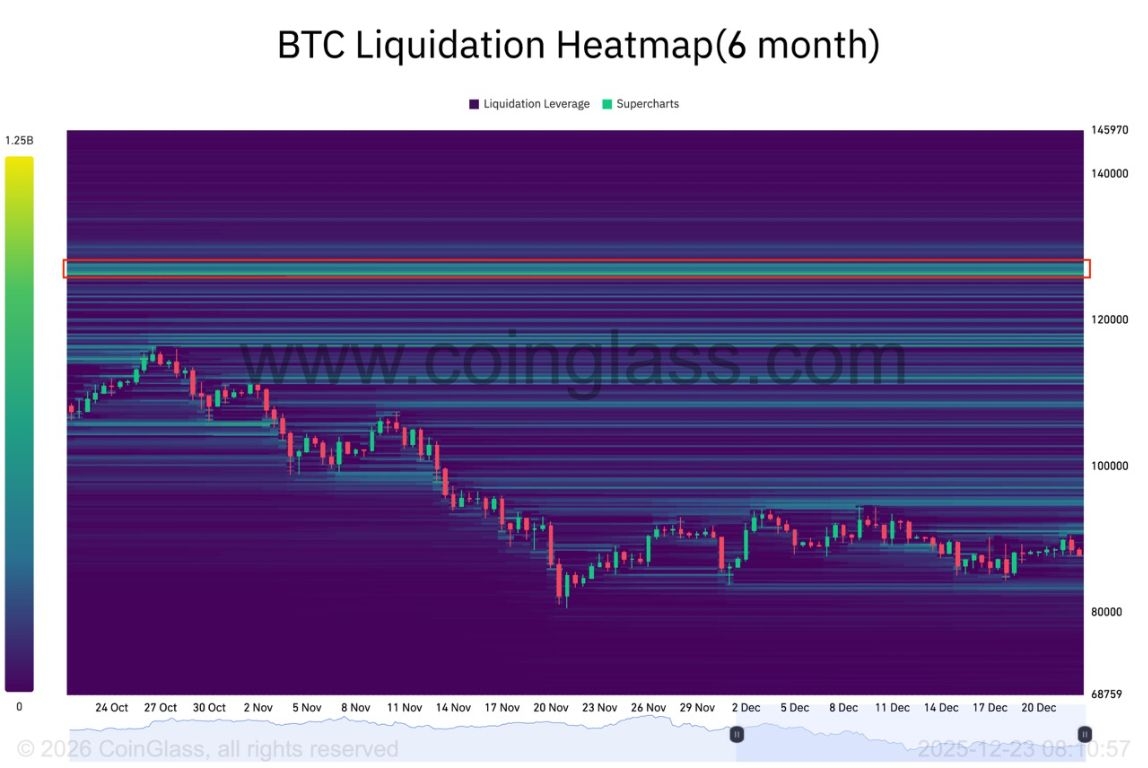

The Bitcoin liquidation heatmap from CoinGlass shows bid orders sitting all the way to $127,000, suggesting that the price could rise to collect this liquidity amid a short squeeze.

This suppression creates artificial stability, but once the expiry passes, volatility could explode upward as hedges unwind.

Bitcoin liquidation heatmap. Source: Coinglass

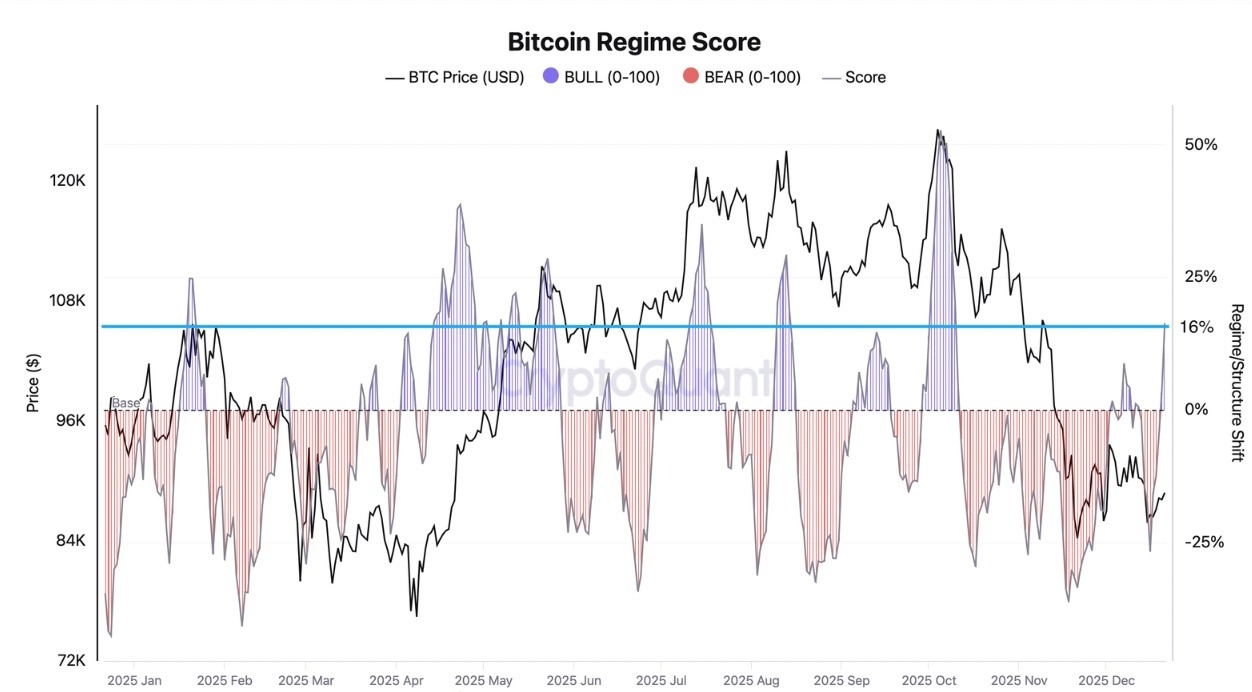

Adding fuel is Bitcoin's regime score, currently at in the positive zone, signaling "bullish neutrality" where upside momentum dominates, according to CryptoQuant analyst Axel Adler Jr, who said in a Monday X post:

“BTC is entering a window for a Santa rally: the Regime Score is bullish but not overheated.”

The chart below shows that Bitcoin’s regime score is at 16.3%, placing the BTC/USD pair in the upper neutral zone, a historically bullish signal.

Bitcoin regime score. Source: CryptoQuant

This metric reflects a market environment where short liquidations outpace longs, creating "tactical fuel" for rallies.

Over the past week, Bitcoin climbed 6.5% from lows near $84,000, driven largely by cascading short closures that amplify price gains. Market participants note that this dynamic could accelerate if spot prices hold above $90,000, forcing more shorts to cover and pushing toward six figures.

Holiday thinned liquidity exacerbates this, as fewer participants mean sharper moves when sentiment shifts. If bulls maintain control, this could mark the start of a post-Christmas surge, rewarding patient investors who avoided over-leveraged bets.

Gold and Silver Hit Record High, Bitcoin to Follow?

Bitcoin's ability to stage a holiday breakout draws from the explosive performance of traditional safe-haven assets. Gold and silver have shattered yet other records before the end of 2025, with gold reaching an all-time high of $4,497 per ounce on Tuesday and silver surging over 3% to $70 per ounce amid geopolitical tensions and US rate cuts.

Gold alone has rallied 65% this year, fueled by currency debasement fears and central bank buying, while silver has increased by 150% in 2025.

Gold vs.Silver 2025 Price Performance. Source: TradingView

Bitcoin, often dubbed "digital gold," is poised to catch up. Analysts argue that capital rotation from overbought metals into crypto could ignite the rally, especially as Bitcoin underperformed recently, down 30% from its all-time high of $126,00 reached in October.

With similar drivers—fiat erosion, inflation hedges, and institutional demand—traders see Bitcoin benefiting from the same macro tailwinds.

For instance, as equities rally pre-holiday, risk-on flows might spill into BTC, mirroring gold's path. Community sentiment on platforms like Reddit echoes this, predicting Bitcoin's turn after metals' frenzy. If holiday rebalancing by institutions amplifies this shift, $100,000 could be just the beginning, aligning Bitcoin with the debasement trade that propelled gold's dominance in 2025.

Bitcoin’s Symmetrical Triangle Targets $105,000 BTC Price

From a technical perspective, Bitcoin's chart patterns bolster the Santa Rally narrative. The BTC/USD pair have formed a symmetrical triangle on the daily chart, a chart pattern characterized by converging trendlines with lower highs and higher lows. This consolidation pattern, often a continuation signal in bull markets, suggests a breakout could target $105,000 if resistance near $90,500 gives way.

BTC/USD Daily Chart. Source: TradingView

Traders anticipate reduced holiday volume compressing the triangle further, leading to a volatile resolution post-Christmas.

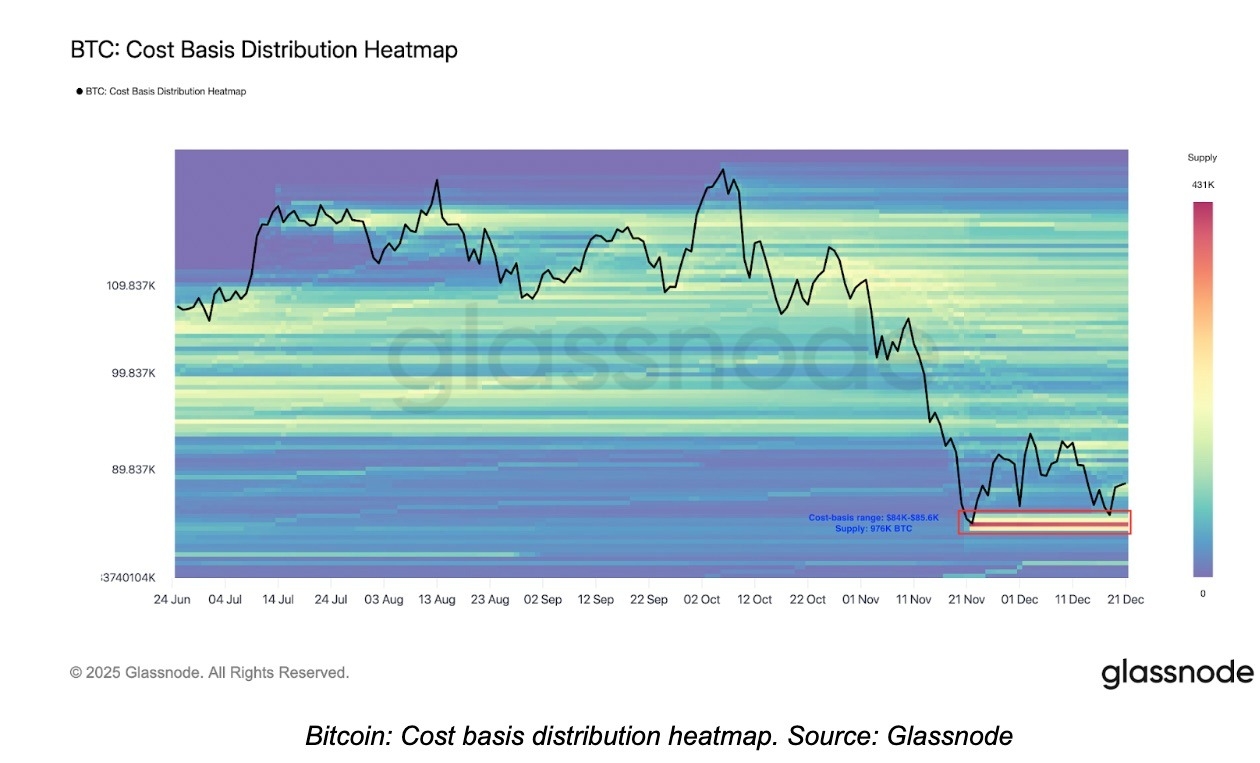

Current support at $85,000 aligns with a strong demand zone, providing a floor. Glassnode’s cost basis distribution heatmap reinforces the importance of this level, where investors acquired about 976,000 BTC.

Holding above this level is a key prerequisite for regaining momentum toward $100,000 or higher.

Bitcoin: Cost Basis Distribution Heatmap. Source: Glassnode

If the relative strength index (RSI) climbs into the positive region, the move could extend to $110,000–$120,000, as seen in recent bounces. This setup, combined with bullish on-chain metrics, has analysts warning bears of a potential short squeeze.

Ready to trade our analysis of Bitcoin? Here’s our list of the best MT4 crypto brokers worth reviewing.