Long Trade Idea

Enter your long position between $3,344.04 (the lower band of its horizontal support zone) and $3,492.60 (the upper band of its horizontal support zone).

Market Index Analysis

- AutoZone (AZO) is a member of the S&P 500.

- This index trades near records but fading bullish trading volumes do not support the current rally.

- The Bull Bear Power Indicator of the S&P 500 is bullish but shows a negative divergence.

Top Regulated Brokers

Market Sentiment Analysis

The S&P rallied above 6,900, with AI optimism in the driver’s seat. While the delayed GDP report showed a faster-than-expected expansion, inflation accelerated, and the chain-weighted price index, which includes consumers switching to less expensive products for pricier items, surged 3.8%. Consumer confidence slid for a fifth consecutive month, with a sour short-term outlook on current business conditions and the labor market, and debt levels are at record levels. Gold and silver prices rallied, and the disconnect between various market forces will eventually come to a breaking point.

AutoZone Fundamental Analysis

AutoZone is the largest US retailer of automotive parts. It thrives in the DIY sector and the automotive aftermarket. It operates over 7,700 locations across the US, Mexico, Brazil, Puerto Rico, and the US Virgin Islands.

So, why am I bullish on AZO following its earnings miss?

Net sales of $4.63 billion and earnings per share of $31.04 missed expectations of $4.64 billion and $32.24, respectively, but I remain bullish on AutoZone as its same-store sales increased 4.8%. Profit margins shrank but remain among the best in its industry, while the revenue and EPS outlook for the current quarter remains bullish. The post-earnings sell-off lowered valuations, and I see more upside potential ahead.

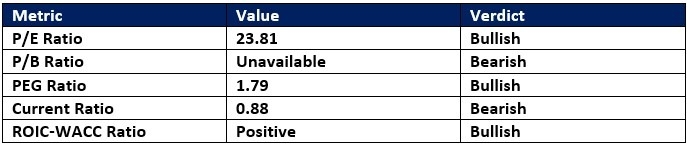

AutoZone Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 23.81 makes AZO an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 27.85.

The average analyst price target for AZO is $4,331.35. This shows excellent potential with decreasing downside risk.

AutoZone Technical Analysis

Today’s AZO Signal

AutoZone Price Chart

- The AZO D1 chart shows price action inside a horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a positive divergence.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- AZO decreased as the S&P 500 advanced, a bearish confirmation, but bullish catalysts have accumulated.

My Call on AutoZone

I am taking a long position in AZO between $3,344.04 and $3,492.60. Valuations are reasonable, the growth outlook remains solid, and I have turned bullish on its operational resilience.

- AZO Entry Level: Between $3,344.04 and $3,492.60

- AZO Take Profit: Between $3,996.25 and $4,146.42

- AZO Stop Loss: Between $3,036.40 and $3,162.00

- Risk/Reward Ratio: 2.12

Ready to trade our analysis of AutoZone? Here is our list of the best stock brokers worth checking out.