My previous AUD/USD signal on 3rd December was not triggered.

Today’s AUD/USD Signals

Risk 0.25%

Trades may only be taken prior to 5pm Tokyo time Friday.

Short Trade Ideas

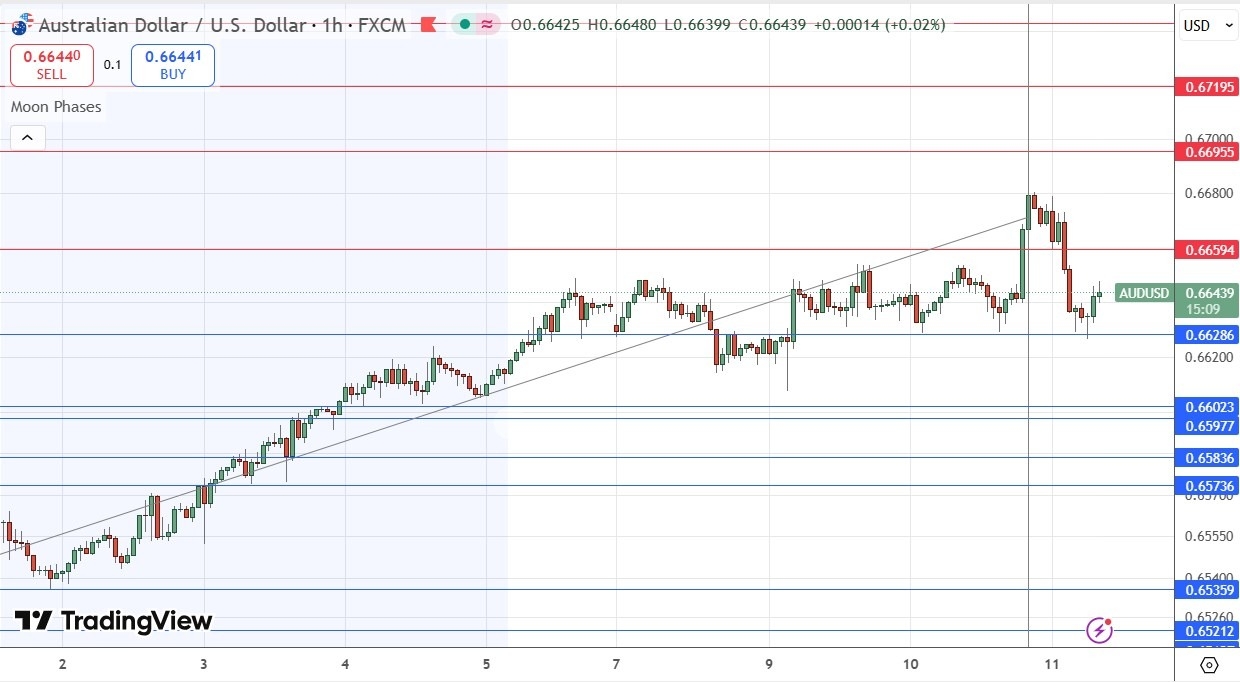

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of $0.6659 or $0.6696.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of $0.6629, $0.6602, or $0.6598.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Top Regulated Brokers

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

In my previous AUD/USD forecast just over a week ago, I wrote that we would see the price continue to advance, and that the price area around the half-number at $0.6550 would be a natural place to expect a bullish bounce.

I was correct about the direction, but the price never made it back to $0.6550.

The price has continued to advance over the past week, mostly respecting the linear regression analysis which can be seen within the price chart below. However, the last day or so is an anomaly, suggesting that we might be about to see a change to this pattern. The price rose strongly then came back down quickly to where it was, although this was not a spike. The trigger was yesterday’s rate cut by the Fed, which boosted risky assets and hit the USD, but markets have quickly reversed most of these movements.

What is most interesting is the way the old support level at $0.6629 has continued to hold strongly. I see this as likely to be today’s pivotal point.

I will remain at least weakly bullish as long as this level continues to hold up, and it could even be used to trigger a new long trade entry.

However, if this level breaks down, we could see a sharper fall, which is being signalled by the recent increase in volatility.

We have just had the third bounce of the triple bottom here, so if we are going to see a further rise, it should happen quickly.

There is nothing of high importance scheduled today concerning the AUD. Regarding the USD, there will be a release of Unemployment Claims at 1:30pm.

Ready to trade our free Forex signals? Check out our top 100 Forex brokers list.