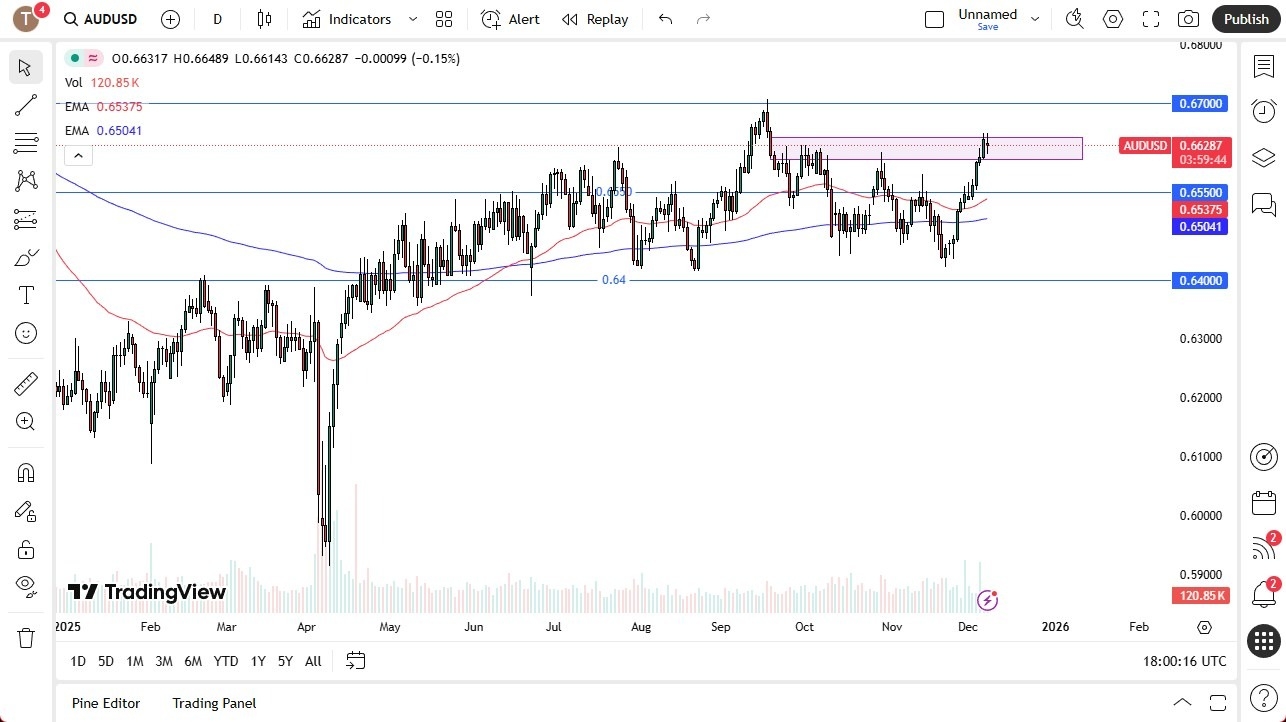

- AUD/USD churned on Monday as traders assessed whether the pair is overextended ahead of Wednesday’s FOMC decision and press conference.

- The 0.67 level remains a key ceiling, with a breakout or rejection likely dictating the next major move.

The Australian dollar has been very noisy during the Monday session as it looks like it is a little overextended. That being said, the market is also paying close attention to the FOMC this week and Wednesday, and of course, it will not only give us an interest rate decision, but it will also give us a statement and press conference. This is all about the press conference, as traders will try to figure out whether or not the United States will have a series of rate cuts, or if they will have what is known as a hawkish cut, meaning that they are in fact going to stay a little bit hesitant to cut rapidly. The Australian dollar has picked up quite a bit of momentum due to the US being expected to cut rates multiple times.

Top Regulated Brokers

Sensitivity to Global Trade Dynamics

That being said, the Australian dollar is very sensitive to the idea of global trade. And of course, US trade with China specifically, as Australia is a major exporter of raw materials to that country. Ultimately, the market is probably going to move quite violently on Wednesday, and now the question will be whether or not the 0.67 level continues to be a bit of a ceiling in the Australian dollar. Despite the fact that things have been so positive over the last two weeks, we still haven't broken out of that range, and I think that is something worth paying close attention to. If that's going to be the case, and we are going to challenge that area, a failure there could end up being a shorting opportunity.

If we were to break above there on a daily close, then I think it shows that the Australian dollar is ready to get moving again. And it probably also would signify that the US dollar is going to get weaker against most major currencies.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.