Long Trade Idea

Enter your long position between $25.09 (the intraday low of its breakout) and $25.64 (Friday’s intraday high).

Market Index Analysis

- AT&T (T) is a member of the S&P 100 and the S&P 500.

- Both indices rallied close to all-time highs on low volumes and amid rising bearish pressure.

- The Bull Bear Power Indicator for the S&P 500 is bearish but shows a negative divergence and does not support the recent rally.

Market Sentiment Analysis

Equity futures point modestly higher, building on last week’s optimism that the Federal Reserve will deliver a 25-basis point interest rate cut this week. The October JOLTS report, delayed by the now-resolved government shutdown, will provide a much-anticipated snapshot of the faltering labor market. Markets will receive reports from Oracle and Adobe on Wednesday, and Broadcom and Costco on Thursday, which could inject volatility. Investors also monitor potential antitrust issues following Netflix’s announcement of plans to acquire Warner Bros. assets for $72 billion. On the macroeconomic level, China’s November trade data showed its surplus exceeded expectations.

AT&T Fundamental Analysis

AT&T is a telecommunications holding company. It is also the third-largest telecom company by revenue globally and the third-largest mobile company in the US.

So, why am I bullish on T following its breakout?

I am bullish on its recent deployment of mid-band (3.45 GHz) spectrum from EchoStar Corporation to almost 23,000 cell towers. While I understand the customer frustration over the $5 increase to their bills resulting from tariff-related cost increases, I expect the fallout to be minor and customer retention to remain high amid improving services and coverage, led by mobile download speeds.

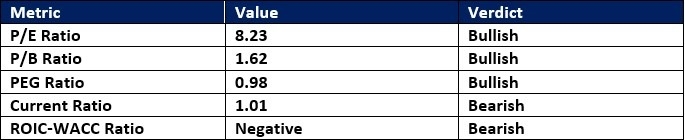

AT&T Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 8.23 makes T an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.21.

The average analyst price target for T is $30.61. This suggests good upside potential with manageable downside risks.

AT&T Technical Analysis

Today’s T Signal

AT&T Price Chart

- The T D1 chart shows price action breaking out above its horizontal support zone.

- It also shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator turned bearish but remains above its ascending trendline.

- Bullish trading volumes outpace average bearish volumes over the past three weeks.

- T advanced less than the S&P 500, a bearish development, but bullish catalysts accumulate.

My Call on AT&T

I am taking a long position in T between $25.09 and $25.64. The defensive capabilities of AT&T, the excellent dividend yield, and its acquisitions and improvements to its cell towers and bandwidth have me dialed into AT&T.

- T Entry Level: Between $25.09 and $25.64

- T Take Profit: Between $29.79 and $30.66

- T Stop Loss: Between $23.66 and $23.87

- Risk/Reward Ratio: 3.29

Ready to trade our analysis of AT&T? Here is our list of the best stock brokers worth reviewing.