Short Trade Idea

Enter your short position between $208.17 (the intra-day low of its last bullish candlestick) and 210.10 (yesterday’s intra-day high).

Market Index Analysis

- Allstate (ALL) is a member of the S&P 500 Index.

- This index recorded a fresh record, but decreasing bullish trading volumes do not confirm the uptrend.

- The Bull Bear Power Indicator of the S&P 500 is bullish with a negative divergence.

Market Sentiment Analysis

The Dow Jones Industrial Average and the S&P 500 Index closed at fresh all-time highs, setting the stage for a Santa Claus rally to cap 2025 and start 2026. Major indices closed higher for a fifth consecutive session, climbing a wall of worry, as the issues that led to all 2025 selloffs remain. AI and data center spending will dominate 2026, as potential revenue shortfalls and circular financing continue to loom over equity markets. Valuations are excessive, and investors are paying high premiums for potential future growth. The low-volume uptick in equity markets is vulnerable to a sharp correction if one of the concerns materializes.

Allstate Fundamental Analysis

Allstate is an insurance company and a Fortune 500 company. It has used the same advertising slogan since the 1950s and is one of the most recognized insurance companies.

So, why am I bearish about ALL at current levels?

Allstate trails its peers in annual book value per share increases and in estimates of sales growth, while announcing total catastrophe losses of $129 million for October and November. Valuations are low, but so are profit margins, and I am bearish about its increasing share count. Its earnings are growing more slowly than its dividend, and stiff competition could decrease its overall market share.

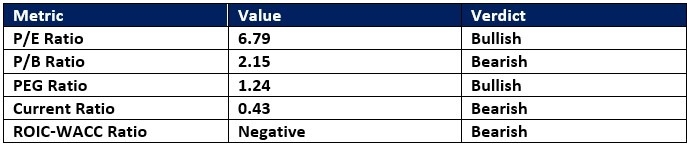

Allstate Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 6.79 makes ALL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 Index is 29.38.

The average analyst price target for ALL is $236.05. This shows decent upside potential, but downside risks are rising.

Allstate Technical Analysis

Today’s ALL Signal

Allstate Price Chart

- The ALL D1 chart shows price action inside a bearish price channel.

- It also shows price action breaking down below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bullish with a descending trendline and has spent more time in bearish territory over the past three weeks.

- The average bullish trading volumes are decreasing.

- ALL moved lower as the S&P 500 recorded fresh records, a significant bearish trading signal.

My Call on Allstate

I am taking a short position in ALL between $208.17 and $210.10. I remain bearish amid the absence of a growth strategy and declining profit margins due to cost challenges.

- ALL Entry Level: Between $208.17 and $210.10

- ALL Take Profit: Between $180.00 and $188.08

- ALL Stop Loss: Between $220.21 and $226.81

- Risk/Reward Ratio: 2.34

Ready to trade our analysis of Allstate? Here is our list of the best stock brokers worth reviewing.