Short Trade Idea

Enter your short position between $64.97 (Friday’s intra-day low) and $65.48 (the intra-day high of its latest bullish candlestick).

Market Index Analysis

- Alliant Energy (LNT) is a member of the S&P 500 Index.

- This index drifted to a fresh all-time high amid low bullish trading volumes.

- The Bull Bear Power Indicator of the S&P 500 Index shows a negative divergence and does not support the uptrend.

Market Sentiment Analysis

Equity markets closed marginally lower on Friday after the S&P 500 Index set a fresh intra-day all-time high, and thin trading volumes are likely to extend until next Monday. Wednesday 31st December will see the release of the December ADP employment report and the minutes from December’s FOMC meeting, during which markets will assess the likelihood of a January interest rate cut, which has slim chances for now. NVIDIA’s quiet $20 billion licensing deal with specialized chipmaker Groq, which focuses on AI inference, may reignite concerns about circular financing and quieting competitors. The debate over an AI bubble should continue for years to come, but revenue shortfalls are a bigger issue than current valuations.

Alliant Energy Fundamental Analysis

Alliant Energy is a utility company. Its subsidiaries include Interstate Power and Light Company, Wisconsin Power and Light Company, and Travero. It provides services to Iowa and Wisconsin.

So, why am I bearish on LNT after a two-month slide?

I remain bearish on Alliant Energy amid profitability concerns related to higher operating costs, while its increasing debt load to finance green energy projects is adding to medium-term balance sheet issues. Despite the two-month correction, valuations remain high, and I question its dividend sustainability, as it pays out 62.84% of its income in dividends.

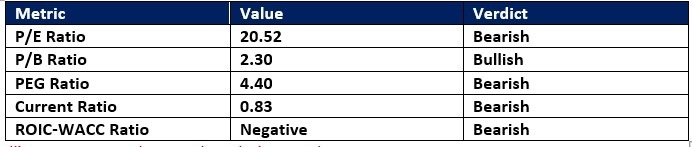

Alliant Energy Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 20.52 makes LNT an expensive stock in its industry, but inexpensive compared to the S&P 500. By comparison, the P/E ratio for the S&P 500 is 29.47.

The average analyst price target for LNT is $72.10. It suggests limited upside potential with rising downside risks.

Top Regulated Brokers

Alliant Energy Technical Analysis

Today’s LNT Signal

Alliant Energy Price Chart

- The LNT D1 chart shows a price action inside a bearish price channel.

- It also shows price action below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- LNT corrected as the S&P 500 advanced, a significant bearish trading signal.

My Call on Alliant Energy

I am taking a short position in LNT between $64.97 and $65.48. Valuations remain high, its 5-year PEG ratio confirms an overvalued utility company, and I am bearish about its profitability outlook.

- LNT Entry Level: Between $65.49 and $66.22

- LNT Take Profit: Between $58.98 and $60.84

- LNT Stop Loss: Between $67.71 and $68.79

- Risk/Reward Ratio: 2.93

Ready to trade our analysis of Alliant Energy? Here is our list of the best stock brokers worth checking out.