Long Trade Idea

Enter your long position between $109.77 (the intra-day low of its last bearish candlestick) and $110.96 (yesterday’s intra-day high).

Market Index Analysis

- Allstate (ALL) is a member of the S&P 500 Index.

- This index recorded a fresh record, but decreasing bullish trading volumes do not confirm the uptrend.

- The Bull Bear Power Indicator of the S&P 500 Index is bullish with a negative divergence.

Market Sentiment Analysis

The Dow Jones Industrial Average and the S&P 500 closed at fresh all-time highs, setting the stage for a Santa Claus rally to cap 2025 and start 2026. Major indices closed higher for a fifth consecutive session, climbing a wall of worry, as the issues that led to all 2025 selloffs remain. AI and data center spending will dominate 2026, as potential revenue shortfalls and circular financing continue to loom over equity markets. Valuations are excessive, and investors are paying high premiums for potential future growth. The low-volume uptick in equity markets is vulnerable to a sharp correction if one of the concerns materializes.

AFLAC Fundamental Analysis

AFLAC is the largest provider of supplemental insurance in the US. It is best known for its payroll deduction insurance coverage and was a pioneer in cancer insurance, introducing it in 1958. The AFLAC Duck is a well-recognized mascot.

So, why am I bullish about AFL despite a cautious sales outlook?

I turned bullish on AFLAC after it announced new partnerships as part of its digital transformation, which has changed the narrative following deals with Ethos and Ameriflex. Its Japanese Miraito cancer insurance product is its core growth driver, and I expect sluggish US sales growth to pick up. AFLAC also has industry-leading profit margins.

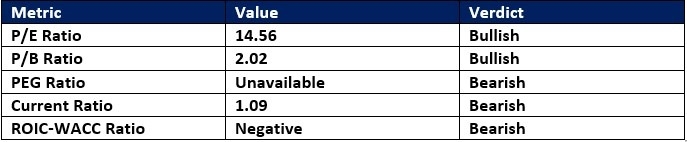

AFLAC Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 24.24 makes AFL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 Index is 29.38.

The average analyst price target for AFL is $110.85. It suggests no upside potential, but I expect it to reach the high-end estimate of $127.00 as downside risks decrease.

AFLAC Technical Analysis

Today’s AFL Signal

- The AFL D1 chart shows a price action inside a bullish price channel.

- It also shows price action between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- AFL advanced with the S&P 500 Index, a bullish confirmation.

Top Regulated Brokers

My Call on AFLAC Technical Analysis

I am taking a long position in AFL between $109.77 and $110.96. The new partnerships signed this month could revive sluggish US sales growth, while its Japanese unit continues to excel.

- AFL Entry Level: Between $109.77 and $110.96

- AFL Take Profit: Between $124.46 and $127.00

- AFL Stop Loss: Between $102.60 and $105.43

- Risk/Reward Ratio: 2.05

Ready to trade our analysis of AFLAC? Here is our list of the best stock brokers worth reviewing.