Long Trade Idea

Enter your long position between $270.00 (Friday’s intra-day low) and $276.81 (Friday’s intra-day high).

Market Index Analysis

- Accenture (ACN) is a member of the S&P 100 and the S&P 500.

- Both indices trade inside bearish chart formations.

- The Bull Bear Power Indicator of the S&P 500 turned bullish with a descending trendline.

Market Sentiment Analysis

Equity futures hint at a positive open after closing Friday’s session in the green, a high-volume quadruple witching day, and the final full week of trading for 2025. Equity markets are approximately 3% below all-time highs, and investors hope for a Santa Claus rally in a low-volume trading week. Tomorrow’s consumer confidence reading could provide a volatility boost, as it could deliver more evidence of a K-shaped economic trajectory. Overall, it should be a quiet week, where existing trends and worries remain front and center.

Accenture Fundamental Analysis

Accenture is a multinational professional services company with over 770,000 employees, specializing in information technology (IT) services and management consulting. It operates five business units: Strategy and Consulting, Technology, Operations, Accenture Song, and Industry X.

So, why am I bullish on ACN after its earnings?

ACN delivered an earnings beat, growing revenues by 6% to $18.74 billion and delivering earnings per share of $3.54. I am bullish on its strategic partnership with Palantir Technologies, following a deal between Accenture and NVIDIA two months ago, to accelerate its AI strategy. ACN expects profit margin expansion in the next quarter, and I am also bullish about its signing 33 customers with a value exceeding $100 million as part of its $21 billion in new bookings.

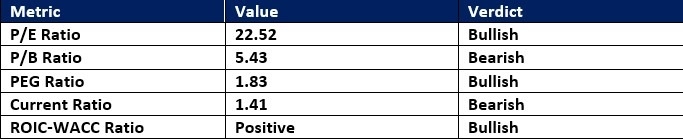

Accenture Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 22.52 makes ACN an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.01.

Top Regulated Brokers

The average analyst price target for ACN is $291.35. It suggests moderate upside potential, but I expect upward revisions above the street-high $330.00, while downside risks remain reasonable.

Accenture Technical Analysis

Today’s ACN Signal

Accenture Price Chart

- The ACN D1 chart shows price inside a bullish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish, but the descending trendline, the sole bearish signal, suggests potential volatility ahead.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- ACN advanced with the S&P 500 Index, a bullish confirmation.

My Call on Accenture

I am taking a long position in ACN between $270.00 and $276.81. I remain bullish on its accelerated AI strategy, new bookings, expanding profit margins, and strategic partnerships.

- ACN Entry Level: Between $270.00 and $276.81

- ACN Take Profit: Between $330.00 and $339.90

- ACN Stop Loss: Between $245.13 and $251.02

- Risk/Reward Ratio: 2.41

Ready to trade our analysis of Accenture? Here is our list of the best stock brokers worth checking out.