Short Trade Idea

Enter your short position between $285.29 (a minor horizontal support level) and $291.80 (yesterday’s intra-day high).

Market Index Analysis

- Zscaler (ZS) is a member of the NASDAQ 100 Index.

- This index recovers from a massive AI-led sell-off, but bearish factors dominate.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets look poised to extend their rally, led by the AI rebound. Markets ignore the slump in consumer confidence and focus on renewed hopes for a December interest rate cut. Also, retail sales came in well below expectations, confirming a slowing consumer, and retailers flagged pressures on low and middle-income households. Valuations remain stretched, and no developments materialized to change the valuation or AI-bubble narrative this week. The third quarter earnings season is slowly winding down, as over 95% of S&P 500 companies have already reported earnings.

Zscaler Fundamental Analysis

Zscaler is a cloud-based cybersecurity company. It continues to make small but strategic acquisitions to grow its product and services portfolio, including international ones.

So, why am I bearish on ZS following its earnings report?

ZS reported revenues of $788.1 million with earnings per share of $0.96. While both figures beat estimates of $773.8 million and $0.86, on the back of strong cybersecurity demand, its operating losses swelled to $36.3 million from $30.6 million. I am bearish about its full-year EPS outlook of $3.78 to $3.82, below consensus estimates of $4.00, and on its current competitiveness. Valuations are high, Zscaler faces rising operating losses, and its debt levels are increasing.

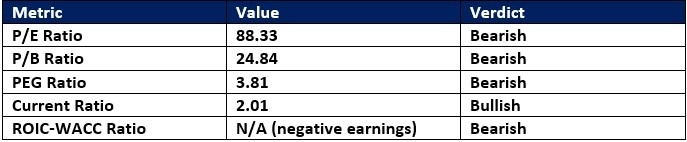

Zscaler Fundamental Analysis Snapshot

The forward price-to-earnings (P/E) ratio of 88.33 makes ZS an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 Index is 33.69.

The average analyst price target for ZS is $330.60. While it suggests moderate upside potential, downside risks are rising.

Zscaler Technical Analysis

Today’s ZS Signal

Zscaler Price Chart

- The ZS D1 chart shows price action inside a bearish price channel.

- It also shows price action below its descending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average trading volumes during the post-earnings sell-off have increased.

- ZS corrected as the NASDAQ 100 Index bounced higher, a significant bearish development.

My Call on Zscaler

I am taking a short position in ZS between $285.29 and $291.80. Excessive valuations, negative earnings over the past five years, rising operating losses, a lack of competitiveness from its product line, and a disappointing full-year EPS outlook dominate the bear case.

- ZS Entry Level: Between $285.29 and $291.80

- ZS Take Profit: Between $217.10 and $227.69

- ZS Stop Loss: Between $316.85 and $330.60

- Risk/Reward Ratio: 2.16

Top Regulated Brokers

Ready to trade our analysis of Zscaler? Here is our list of the best stock brokers worth reviewing.