Long Trade Idea

Enter your long position between $40.42 (Friday’s intra-day low) and $41.61 (Friday’s intra-day high).

Market Index Analysis

- Verizon Communications (VZ) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices.

- All three indices are in bearish price channels with more bearish catalysts emerging.

- The Bull Bear Power Indicator for the S&P 500 is bearish with a descending trendline.

Market Sentiment Analysis

NVIDIA’s earnings reports, guidance, and outlook on the health of AI were unable to reverse rising AI bubble fears. The sole reason for a late-day market reversal was Federal Reserve Bank of New York president John Williams’ suggestion about a potential December interest rate cut, which countered numerous contrary comments. September’s delayed NFP report made monetary policy more complex, but economic indicators confirm a slowing economy, decreasing consumer strength, and stubbornly high inflation. Earnings from Alibaba Holdings, Dell Technologies, Kohl’s (KSS), and Best Buy (BBY) will provide AI and consumer spending insights this week.

Verizon Communications Fundamental Analysis

Verizon Communications is the largest mobile carrier in the US and the second-largest global telecommunications company based on revenue. It employs nearly 100,000 and serves over 146 million customers.

So, why am I bullish on VZ at current levels?

Valuations are a screaming buy, the dividend yield is excellent, and Verizon embarked on a cost-cutting plan that could slash billions of its annual costs. I am incredibly bullish on its Frontier Communications acquisition, and applaud its wireless leadership via the country’s first 6G working group. VZ also has excellent defensive capabilities in a volatile AI bubble environment. Operational metrics and the free cash flow generation support more upside.

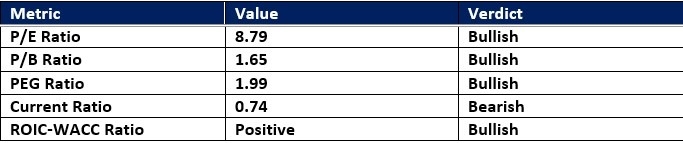

Verizon Communications Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 8.79 makes VZ an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.47.

The average analyst price target for VZ is $47.53. It suggests reasonable upside potential, with manageable downside risks.

Verizon Communications Technical Analysis

Today’s VZ Signal

Verizon Communications Price Chart

- The VZ D1 chart shows price action inside a bullish price channel.

- It also shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- VZ advanced as the S&P 500 Index struggled, a bullish trading signal.

Top Regulated Brokers

My Call on Verizon Communications

I am taking a long position in VZ between $40.42 and $41.61. Valuations are low, the dividend yield of nearly 7% compensates investors for short-term risks, and the $20 billion cash acquisition of Frontier Communications will strengthen its portfolio and revenue stream.

Top Regulated Brokers

- VZ Entry Level: Between $40.42 and $41.61

- VZ Take Profit: Between $49.33 and $50.81

- VZ Stop Loss: Between $36.45 and $37.58

- Risk/Reward Ratio: 2.24

Ready to trade our analysis of Verizon Communications? Here is our list of the best stock brokers worth reviewing.