Potential signal:

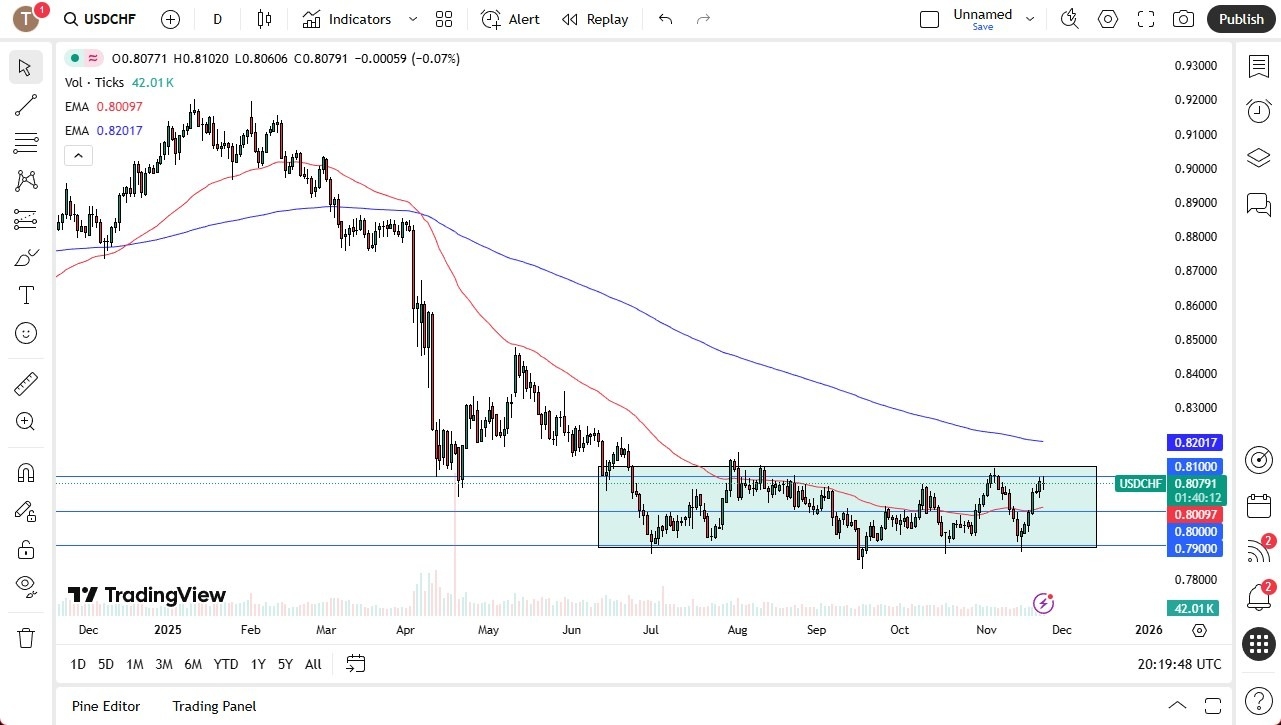

- Buying the USD/CHF pair at 0.8133 with a stop loss at 0.7990 and targeting 0.8350 above.

- The US dollar continues to test major resistance against the Swiss franc, with buyers watching the 0.81–0.8150 zone closely.

- Support levels and SNB posture suggest buyers may reenter on dips, especially if the price breaks the 200-day EMA.

The US dollar has been somewhat choppy against the Swiss franc during the trading session on Monday, which is not a huge surprise considering that we are near a significant resistance barrier that a lot of people will be watching. The 0.81 level is a barrier that I think runs to roughly 0.8150. So, I think it's going to be difficult to see whether or not we can continue to see buying pressure jump into the market and truly break out.

Top Regulated Brokers

Resistance Structure and Support Levels

If we can break out, then the 200-day EMA at the 0.82 level is a barrier. If we can break above there, then we can go much higher, perhaps to the 0.85 level. Short-term pullbacks end up being buying opportunities with the 50-day EMA sitting right around the 0.80 level, offering support.

After that, we have the 0.79 level offering a bit of a floor in the market. And you should keep in mind that this is a market that's also backed up by the Swiss National Bank, which is the biggest factor in this market. Most of the time, they have recently stated that they are watching the forex markets and the way currency markets are moving in general.

Signaling that they are, in fact, going to try to keep the Swiss franc from exploding in value, which it had been for quite some time. It's worth noting that this pair has been consolidating since the early part of July and looks like it's in what most Dow theorists would call a significant accumulation period. All things being equal, though, I still like the idea of buying dips, and I think it is probably only a matter of time before we see value hunters jumping in.

If we do kick off to the upside and break above the 200-day EMA, then it's likely that we will get a longer-term buy-and-hold type of situation. Keep in mind that the interest rate differential favors the US dollar, so you also get paid to hang on to this trade. Therefore, I have a core position that I've been sitting on for a while.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.