Short Trade Idea

Enter your short position between $188.16 (the intra-day high of its last bearish candlestick) and $193.76 (Friday’s intra-day high).

Market Index Analysis

- Quest Diagnostics (DGX) is a member of the S&P 500 Index.

- This index is in a bearish price channel with more bearish catalysts emerging.

- The Bull Bear Power Indicator for the S&P 500 Index is bearish with a descending trendline.

Market Sentiment Analysis

NVIDIA’s earnings reports, guidance, and outlook on the health of AI were unable to reverse rising AI bubble fears. The sole reason for a late-day market reversal was Federal Reserve Bank of New York president John Williams’ suggestion about a potential December interest rate cut, which countered numerous contrary comments. September’s delayed NFP report made monetary policy more complex, but economic indicators confirm a slowing economy, decreasing consumer strength, and stubbornly high inflation. Earnings from Alibaba Holdings, Dell Technologies, Kohl’s (KSS), and Best Buy (BBY) will provide AI and consumer spending insights this week.

Quest Diagnostics Fundamental Analysis

Quest Diagnostics is a clinical laboratory that offers diagnostic testing services for cancer, cardiovascular disease, infectious disease, neurological disorders, COVID-19, and employment and court-ordered drug testing.

So, why am I bearish on DGX following its earnings sell-off and reversal?

While Quest Diagnostics delivered a solid third-quarter earnings report, the narrowed full-year outlook took steam out of its momentum. DGX now expects 2025 revenues between $10.96-$11.00 billion, up from its previous estimate of $10.80-$10.92 billion. Still, it does not offset a multi-year contraction in profit margins and a rise in its debt-to-equity ratio. Also, the 5-year PEG ratio suggests the company remains overvalued at current levels.

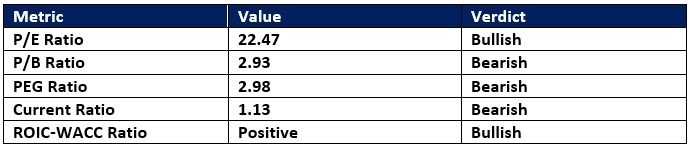

Quest Diagnostics Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 22.47 makes DGX an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.47.

The average analyst price target for DGX is $197.31. This suggests negligible upside potential with rising downside risks.

Quest Diagnostics Technical Analysis

Today’s DGX Signal

Quest Diagnostics Price Chart

- The DGX D1 chart shows price action below its horizontal resistance zone.

- It also shows price action trading between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish but shows a negative divergence.

- The average bearish trading volumes are higher than the average bullish trading volumes, and the latest three-day advance came on below average volumes.

- DGX mirrored the S&P 500 Index, but bearish catalysts have accumulated during the most recent advance.

My Call on Quest Diagnostics

I am taking a short position in DGX between $188.16 and $193.76. Quest Diagnostics delivered a solid third quarter, but DGX’s valuations remain stretched, and the current price reflects positive momentum. Profit margin contractions and rising debt levels concern me in the current economic environment.

Top Regulated Brokers

- DGX Entry Level: Between $188.16 and $193.76

- DGX Take Profit: Between $159.71 and $164.65

- DGX Stop Loss: Between $197.55 and $203.48

- Risk/Reward Ratio: 3.03

Ready to trade our analysis of Quest Diagnostics? Here is our list of the best stock brokers worth reviewing.